- Markets flash red after US policy makers fail to reduce interest rates overnight, casting doubt in the minds of inventors.

- President Trump’s working committee delivers long-awaited report, promising to make America the ‘crypto capital of the world’.

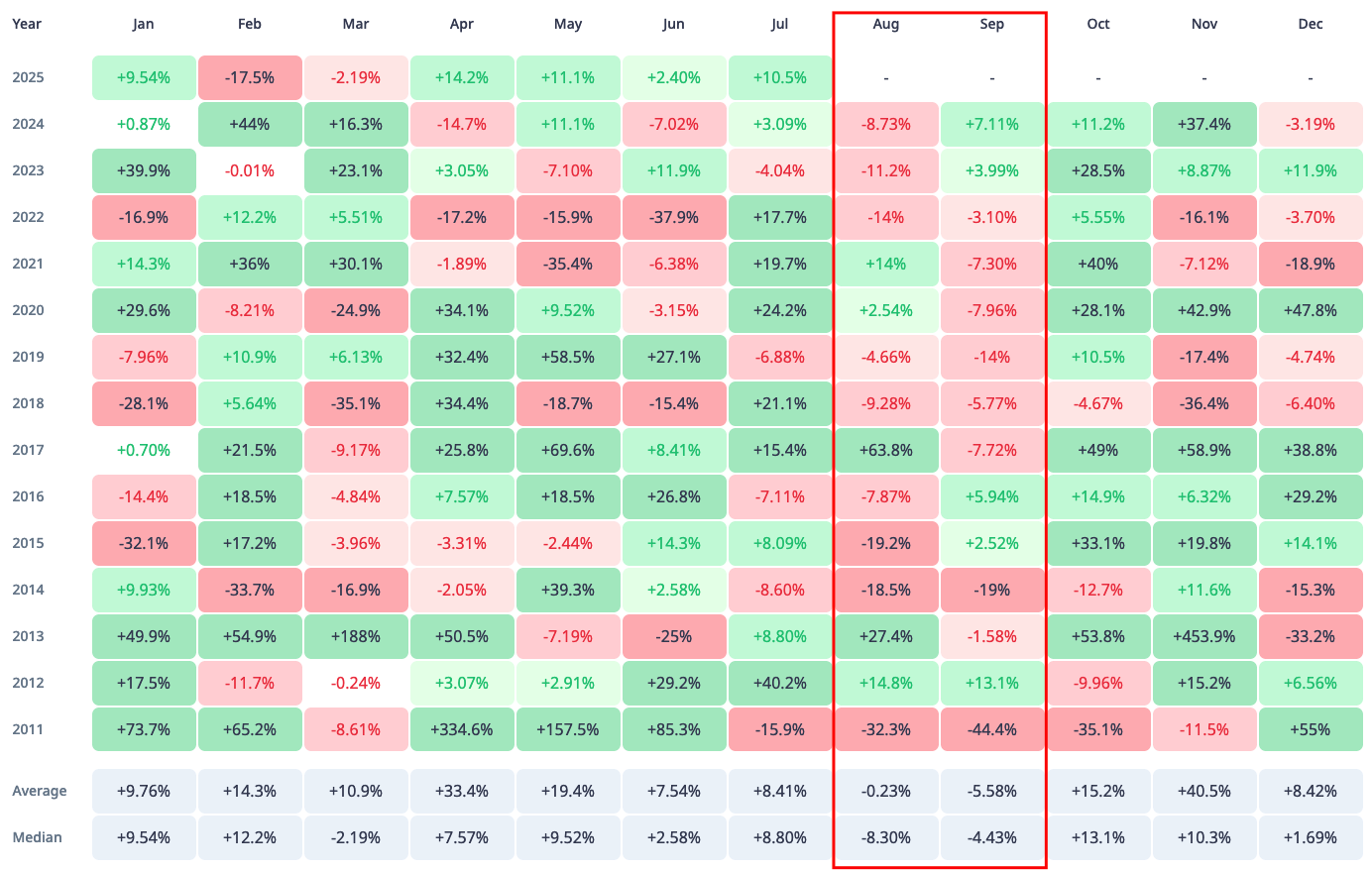

- Charts I’m watching: Bitcoin: Stuck in a range & historical performance in Q3.

Follow me on X to keep up to date as market news lands or my instagram.

If you’re wondering what just happened to crypto markets this week – you’re not alone.

After July saw weeks of double-digit gains across altcoins and Bitcoin hitting new all-time highs, the sudden pullback to close out the month has left many with a bitter aftertaste.

But let’s not lose sight of the bigger picture.

July has been a landmark month for crypto. We’ve seen a surge in corporate adoption, major progress on US crypto legislation and the release of long-awaited recommendations to President Trump from the national crypto working group – a blueprint for making the US the global hub for digital assets. More on that shortly.

But first let’s dive into what happened this week that caused the sudden de-risking.

I recommend also checking out our latest episode of the Tapping into Crypto poddy to hear more about what’s pulling and pushing crypto markets at the moment.

US policy makers deliver caution

Wednesday night we saw the US Federal Open Markets Committee (FOMC) deliver the latest guidance on interest rates. The results came as expected – no change. However, it was Fed. Chair Jerome Powell’s remarks during the proceedings that really caught the market off-guard.

This FOMC meeting comes during an interesting period where President Trump has been heaping pressure onto Jerome Powell. The president has been vocalising the inaction of policy makers to reduce interest rates will have negative consequences for growth in the US.

The key call outs from me through all the noise is that:

- Powell is firm that the economy isn’t being held back from growth under the current level of restrictive policy.

- Members from the committee are showing misalignment in their views.

- They are not citing or pointing to any specific data (e.g. inflation, growth targets, job data) to either reduce rates or ease monetary policy conditions.

What will be fascinating to watch is how the market reshapes its own expectations, knowing that the Feds might not be willing to drop rates. As we’ve seen in the latest rounds of data, both jobs and growth are looking optimistic – giving no real urgency for quantitative easing.

While we wait to see how the market feels in the near term, the longer-term outlook for crypto has arguably never looked better.

Crypto report delivered to white house overnight

Since January, Trump’s assigned crypto Working Group has been tasked with bringing the President’s vision of making America the ‘crypto capital of the world’ to life. The nation intends to do this by embracing a forward-thinking, innovation-first approach to digital assets and blockchain technology.

While the report doesn’t offer a clear short-term roadmap for crypto use, it does present a comprehensive framework for long-term adoption. You can read it here.

Some key takeaways from the document recommend how to:

- Establishing Clear Legal Rights for Users and Developers

- This lays foundational legal clarity for future innovation and usage, rather than pushing for a narrow short-term implementation.

- Decentralized Finance (DeFi) Integration into Regulatory Frameworks

- This recognizes DeFi as a long-term pillar of the crypto ecosystem, laying groundwork for safe integration rather than prescribing short-term financial product rollouts.

- Stablecoin Policy and Dollar Dominance

- This positions stablecoins not as a quick-fix payment method, but as a strategic long-term tool in global financial influence.

This is all about integrating crypto technologies and solutions into the long-term strategic direction of the US. And there is a good chance this report lays the groundwork for other countries to follow suit.

So, now that we’ve had a bumper July and experienced the market tapping the brakes – what can we expect for the months ahead? That’s where seasonality data may provide some insights.

Bitcoin is stuck in a range

We’re nearing day 20 of this tight range – Bitcoin bouncing between roughly $115K and $120K like a game of ping-pong.

Overnight price action didn’t inspire much confidence. A failed breakout below the black channel suggests we may need to go lower before any meaningful push higher.

So what now? Rejection inside the range again raises the odds we sweep the lower levels before attempting another leg up.

Right now, I’m keeping an eye on $113k for two key reasons…

- Daily imbalance level @ $113.6k

- 0.382 Fib retracement level @ 113.6k

There’s some noticeable confluences around that level – it’s not about it being convenient or astrological – I want to simply find a level that many others in the market are eyeing too.

Ultimately, for prices to push higher again, we need to see real buying interest at these key zones. That’s the signal the market sees value and is willing to step in at those prices.

It’s important to remember as well that, even when we do see accumulation in these areas, it can take some time before the price action follows suit. So I’m also becoming comfortable with the idea that if/when we do hit levels lower, the market is patient when trying for new highs again.

And seasonal data might also give weight to this way of thinking, as I’ll discuss next.

Historical trends in Q3

Seasonality describes the historical trends Bitcoin has shown us over the course of the calendar year. Unfortunately, it doesn’t favour the bulls heading into the back end of the third quarter. Average returns for Bitcoin during these periods are -0.2% in August and -5.5% in September respectively.

While this doesn’t predict future performance, it does show that historically the wind isn’t blowing in the sails of investors over this period.

When we strip it all back – it’s encouraging to see crypto asserting itself more confidently on the global stage. There’s growing consensus among policymakers that this ecosystem holds real value.

For many of us who’ve backed this space early, this moment reflects the vision we’ve believed in all along. And even if we do experience a quieter

phase – the long-term blueprint for the industry remains unchanged.

Follow me on X to keep up to date as market news lands! Or My instagram.

Keep up to date.

Stay informed and connected! Subscribe to Crypto with Pav on YouTube, where I dive into the latest trends. You can also follow me on Substack for my weekly newsletter.

You can also follow me on X.

Cheers!

The post On The Radar – What to Watch This Week in Crypto appeared first on Crypto News Australia.