Governments are not merely regulating digital assets. A more precise understanding is that they are redefining what forms of money are politically permissible. With stablecoins increasingly absorbed into state-aligned frameworks to reinforce U.S. Treasury demand, and crypto markets reshaped under regimes like the EU’s MiCA, the space for financial anonymity is shrinking fast.

But does that mean demand for privacy protocols is on the way out, or set to take some other form?

Uphill Battle for Financial Privacy

Financial privacy is inherently incompatible with governmental systems. Governments derive legitimacy from taxation. When this financial pool is extracted, their standing is akin to secular gods – regulating every aspect of life with both financial and physical threat behind every policy.

More importantly, as much as governments need to extract wealth to secure their secular god status and fund projects, which may or may not be popular, they also need to spot “rival castles”, as articulated by elite theorists De Jouevenel, Mosca, Pareto and Michels.

Historical evolution mocks all the prophylactic measures that have been adopted for the prevention of oligarchy. If laws are passed to control the dominion of the leaders, it is the laws which gradually weaken, and not the leaders.

For governments, it is a top priority to intercept independent centers of power capable of challenging state authority. This was on full display during Elon Musk’s DOGE reveals, showing in no uncertain terms that much of public life is engineered from top down specifically to prevent rival castles from arising.

Consequently, governmental power is inherently accumulative, always seeking to absorb or dismantle rival castles. On the global stage, we see this in play between the U.S. and China, to name just one example. Therefore, we have a situation in which:

- Governments must be against financial privacy to intercept rival castles, given that unchecked financial flows facilitate their rise.

- Governments must be against financial privacy to intercept erosion of funding, especially if these projects are largely unpopular, as is the case with conflicts in Ukraine and Israel.

In short, there is always a tension moving against financial privacy.

Across the West’s financial architecture, the prevailing system is of regulated transparency. From banks and fintech firms to crypto exchanges, the accepted framework is Know Your Customer (KYC), so that financial access is conditioned by identity verification. If a technology arises to counterveil this model, it challenges the philosophical foundation of statehood itself.

This is why the EU’s MiCA (Markets in Crypto-Assets) effectively restricted trading platforms from accepting crypto-assets with an “inbuilt anonymisation function”. Moreover, to ensure people keep funding unpopular projects such as net zero, AML (Anti-Money Laundering) regulation ensures that platforms reveal participation information with the “Travel Rule”.

Australia effectively banned privacy coins on all regulated exchanges, lest they face debanking. The coming struggle over privacy coins, then, is not about technology, but about sovereignty itself.

Privacy Protocols’ Landscape

In retrospect, it was a wise decision to make Bitcoin (BTC) pseudonymous. Bitcoin’s ledger itself is completely transparent, but BTC ownership is linked to addresses as pseudonyms rather than to real-world identities.

Yet, if ever that address is linked to a real identity, every single transaction tied to the address can be traced. And that is not very difficult, given that exchanges enforce KYC/AML compliance whenever there is Bitcoin deposit/withdrawal.

Case in point, Chainalysis built its entire business model around tools to track crypto transactions, enabling law enforcement and financial institutions to trace BTC flows. Most recently, Chainalysis revealed that up to $75 billion worth of crypto assets are eligible for governmental seizure.

Over time, however, this has made pseudonymous Bitcoin more attractive to invest in because it would inherently suffer the least governmental friction. Accordingly, against the two top privacy coins, Monero (XMR) and Zcash (ZEC), Bitcoin is clearly the winner in return on investment (ROI). Accordingly, against the two top privacy coins, Monero (XMR) and Zcash (ZEC), Bitcoin is clearly the winner in return on investment (ROI). In traditional markets, such performance would be weighed against fundamentals like the payout ratio — but in crypto, value flows instead through network activity, liquidity incentives, and narrative momentum.

Yet, with the amount of delisting pressure on privacy coins, XMR and ZEC have performed remarkably well. It turns out, the demand for financial privacy offsets such pressures, under the condition there are still platforms that allow their trading. Case in point, when Kraken delisted Monero (XMR) in October 2024, this was limited to the European Economic Area (EEA).

Offering default privacy, XMR has still risen 120% in value since then. On the other hand, Zcash, using advanced but optional zk-SNARKs privacy, has skyrocketed 622% in the same period. The most recent driver for that rise is Grayscale’s launch of a Grayscale Zcash Trust (ZCSH), triggering speculation of a future ZEC ETF.

Although the number of exchanges delisting privacy coins has gone up, from 51 in 2023 to 73 in 2025, there has been a steady rise in their usage. According to CoinLaw, privacy coins have been used 11.4% more in Q1 2025 across blockchains, compared to 9.7% in 2024.

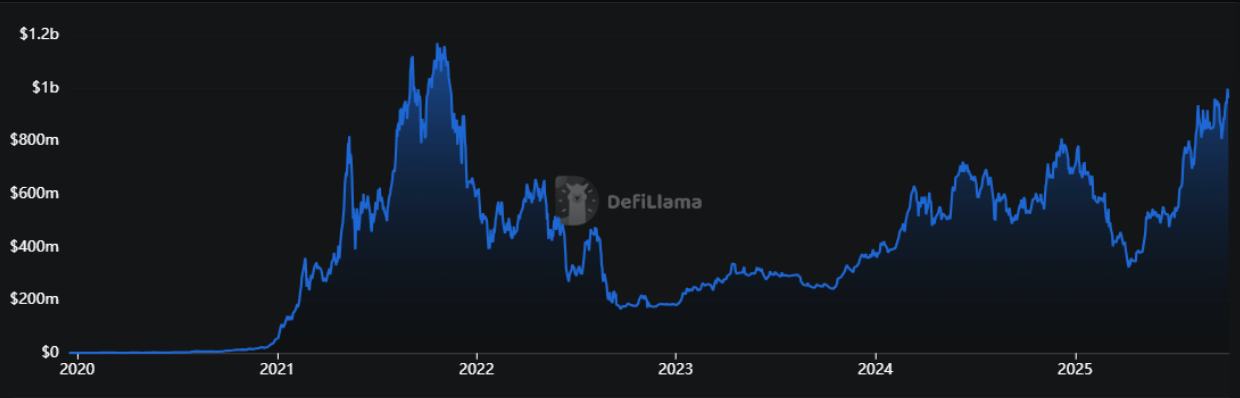

In highly regulated Europe, privacy coins saw a 22% surge across DeFi protocols. This aligns with DeFiLlama data on privacy protocols traffic, showing steady return to peak total value locked (TVL) of $1.17 billion in October 2021.

dApps like Tornado Cash break the on-chain tracking between deposit and withdrawal addresses by mixing assets into shared pools. Under the Trump administration, the U.S. Treasury Secretary Scott Bessent lifted sanctions against Tornado Cash in March 2025, because “digital assets present enormous opportunities for innovation and value creation for the American people.”

This strong signal was the main driver of recovery for the privacy protocols market, as seen on the above chart. In addition to aforementioned privacy coins and protocols, Zano (ZANO) has attracted investors with its hybrid proof-of-work/proof-of-stake consensus ready for mobile wallet integration. Over the last three months, ZANO outperformed both Bitcoin and Monero at 40% gains.

The Bottom Line

As of July 2027, the EU will completely ban privacy coins like Monero under the new anti-money laundering regulation. This is nothing new from Europe as it continues to abandon innovation in favour of bureaucratic parasitism. On the other side of the pond, the Trump administration has been demonstrating crypto-friendliness.

A major aspect of that friendliness is the abandonment of the controversial central bank digital currency (CBDC) in favour of diversified, market-driven stablecoins. After all, without the CBDC taint, stablecoins are likely to increase the net demand for US Treasuries, boosting the USG capacity to monetise debt in the process.

J.P.Morgan recently projected the stablecoin market to reach $500 billion by 2028, while Standard Chartered estimated $2 trillion by 2028 and Bernstein $4 trillion by 2035 (Singh 2025).”

It is likely that privacy coins and protocols are viewed as peripheral instruments in that pursuit, merely serving to boost stablecoin flows. Therefore, privacy protocols can complement stablecoins, making users more comfortable holding and moving digital dollars.

To put it differently, privacy assets are acting as pressure valves for a variety of purposes, from cross-border settlements to corporate treasury management. In this light, EU’s bans notwithstanding, privacy rails are not undermining U.S. influence but quietly expanding it, by encouraging capital to flow through dollar-denominated networks rather than offshore alternatives.

In the end, by necessity or by design, financial privacy will remain the quiet counterweight to state power.

The post Is There Space for Privacy Coins? appeared first on Crypto News Australia.