- Bitwise CIO, Matt Hougan, believes Bitcoin’s latest sluggish value motion is reflective of it at present present process a “silent IPO” by which early traders promote and institutional patrons enter the market.

- Hougan argued that Bitcoin is behaving equally to how tech shares equivalent to Fb and Google did following their IPOs, suggesting it’s possible Bitcoin will see robust progress following a interval of sideways value motion.

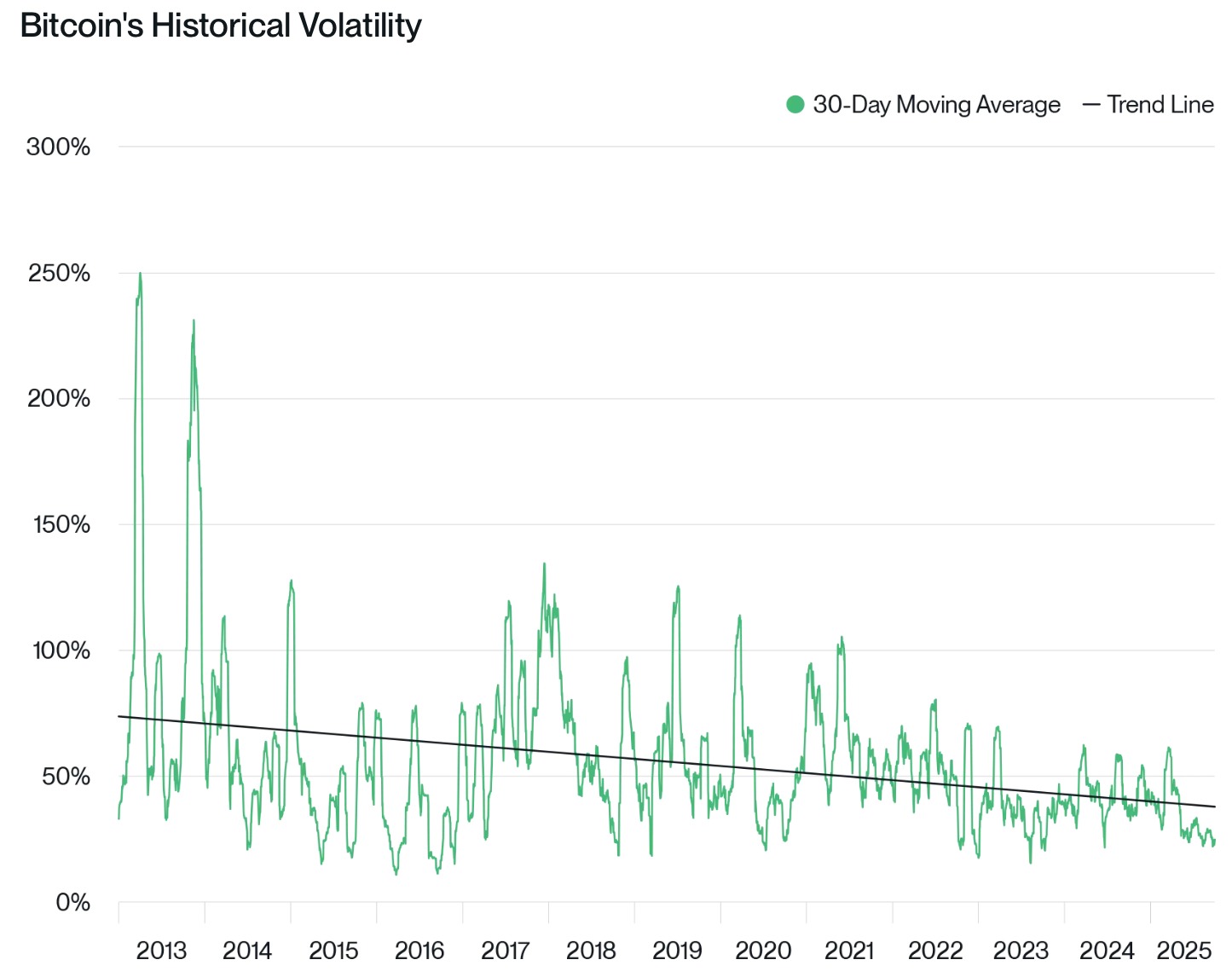

- Hougan additionally thinks establishments are prone to begin making bigger Bitcoin allocations as its volatility continues to say no.

Bitcoin’s latest sluggish value motion doesn’t sign the top of the highway for the OG cryptocurrency, however as a substitute displays its transition from “loopy thought to mainstream success,” based on Matt Hougan, CIO at asset supervisor Bitwise.

Constructing on concepts from a piece written by fellow crypto analyst and President of Weiss Multi-Technique Advisers, Jordi Visser, Hougan wrote in a latest weblog that Bitcoin is at present present process a “silent IPO.” He believes Bitcoin is behaving equally to different tech IPOs, together with Fb and Google, each of which additionally skilled sideways value motion after they went public, as early traders took earnings and institutional traders stepped in.

The method of insiders promoting and establishments shopping for takes time. Solely after that transition has hit a sure stability can the inventory resume its upward march.

Hougan offers the instance of Fb, which went public in 2012 at a value of US$38 per share. For the following 15 months, Fb’s share value didn’t break above US$38 (AU$58) as early traders took earnings, holding the worth down. Now although, Fb is buying and selling at US$637 (AU$981), a rise of 1576%.

Hougan believes an identical re-distribution of Bitcoin is at present occurring.

“Early believers who purchased bitcoin when it was $1, $10, $100, and even $1,000 are sitting on generational wealth. Now that bitcoin has graduated to the massive leagues—with ETFs buying and selling on the NYSE, main companies constructing reserves, and sovereign wealth funds shopping for in—these traders can now harvest their rewards,” he mentioned.

Nevertheless, Hougan does hedge his bets barely. He admits that onchain knowledge “paints a blended image of who’s promoting,” though he maintains that the re-allocation from early traders to institutional traders is a crucial a part of what’s happening.

Associated: Bitcoin Slips Below $105k as Analysts Warn of Further Downside — and a Whale Buys the Dip

Bitcoin Re-allocation Is “Extraordinarily Bullish” Says Hougan

Hougan believes the exit of early traders and entry of institutional traders is a bullish signal, suggesting Bitcoin’s future might mirror Fb’s post-IPO efficiency — a chronic interval of sideways motion adopted by sustained progress.

Going ahead, we’re unlikely to see 100x returns in a single yr. However there’s nonetheless large upside as soon as the distribution section is full.

Matt Hougan, Bitwise CIO

Matt Hougan, Bitwise CIO Hougan added that Bitwise believes “bitcoin will attain $1.3 million by 2035.” He famous that his private view is that this value prediction is conservative.

The Bitwise CIO additionally argued that, in contrast to an everyday firm that requires fixed progress and new sources of income to maintain share value will increase, Bitcoin doesn’t want any of that.

“As soon as the OGs are carried out promoting, bitcoin doesn’t want something. The one factor crucial for bitcoin to go from a $2.5 trillion market cap to $25 trillion—gold’s measurement—is broad acceptance,” Hougan wrote.

“For those who take the lengthy view, bitcoin chopping sideways is a present. I see it as a chance to purchase extra bitcoin earlier than it resumes its ascent.”

Bitcoin’s Diminished Volatility Is Making It a Safer Funding

Hougan additionally highlighted Bitcoin’s long-term pattern of changing into much less risky, suggesting this decrease volatility makes it a safer funding and due to this fact giant institutional traders are prone to make bigger allocations.

Sooner or later, bitcoin is prone to have considerably decrease returns and considerably decrease volatility than prior to now.

Matt Hougan, Bitwise CIO

Matt Hougan, Bitwise CIO “As an allocator, my response to this dynamic wouldn’t be to promote the asset—in any case, we forecast bitcoin to be the best-performing giant asset on the earth over the following decade—however reasonably, to purchase extra of it. Put in another way, decrease volatility means it’s safer to personal extra of one thing.”

Associated: JPMorgan to Let Institutions Use Bitcoin and Ether as Loan Collateral, Marking Major Wall Street Shift

Hougan mentioned bigger institutional Bitcoin allocations are very a lot on the playing cards as Bitcoin strikes out of its extremely risky early period and transitions to a interval of behaving extra like a standard tech inventory.

“The times of a 1% allocation to bitcoin are over. More and more, traders must be pondering of 5% as a place to begin.”

The submit Bitcoin’s “Silent IPO” Moment: Why Sideways Trading Could Signal Bigger Things Ahead appeared first on Crypto News Australia.