- Bitcoin has stabilised above US$100k, with most main cryptocurrencies together with XRP, Solana and Ethereum recording each day positive factors exceeding 5%.

- The Concern and Greed Index moved to 27, indicating market warning, and analysts recommend the rally can proceed if it stays pushed by institutional accumulation moderately than retail euphoria.

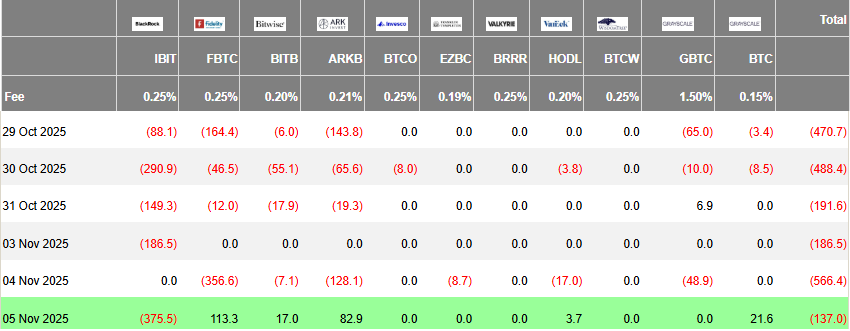

- Some US spot Bitcoin and Ethereum ETFs have reversed current outflows, whereas BlackRock funds proceed with giant outflows.

The crypto market appears to have circled for now, with Bitcoin stabilising over US$100k (AU$153.5k). Most main cryptocurrencies are within the inexperienced, with XRP, Solana and Ethereum all making positive factors above 5% on the each day chart. BTC, in the meantime, gained 2.2%, buying and selling at US$103,573 (AU$159,074) on the time of writing.

The Concern and Greed Index has moved to 27 – into Fear – up 4 factors from yesterday’s Excessive Concern.

Analysts at Santiment said the “rally can proceed if FOMO stays low, and retail stays on the sidelines,” including that “markets transfer in the wrong way of the group’s expectations.”

The thought – a minimum of in line with these analysts – is that so long as sentiment stays cautious and the rally is pushed by institutional or regular accumulation moderately than euphoric retail shopping for, it’s extra more likely to be sustainable. Retail enthusiasm arriving too early can, in reality, sign {that a} correction is close to.

Information from Glassnode broadly aligns with that view, although it highlights a market nonetheless in delicate stability. “Merchants are nonetheless hedging, not shopping for the dip,” the agency noted, including that the market stays in “a fragile equilibrium, with weak demand, managed losses, and excessive warning.”

Of their most up-to-date report, they added:

A sustained restoration requires renewed inflows and reclaiming the $112K–$113K area as help.

Glassnode

Glassnode ETF Flows Get better

The analysts additionally famous the current outflows of US spot exchange-traded funds (ETFs), although the most recent knowledge exhibits some combined outcomes.

Associated: BlackRock Expands Bitcoin Bet with Australia’s First iShares Bitcoin ETF

After 5 consecutive days of outflows, most US spot Bitcoin ETFs noticed a rebound yesterday, posting US$238.5 million (AU$365.9 million) in mixed inflows. Nonetheless, BlackRock’s IBIT recorded a considerable US$375.5 million (AU$576.9 million) outflow, which greater than offset these positive factors – leaving the group with a web lack of about US$137 million (AU$210.4 million) for the day.

On Tuesday, IBIT reported net-zero flows, whereas most different ETFs misplaced US$566.4 million (AU$869.2 million).

US spot Ethereum ETFs mirrored Bitcoin’s pattern to some extent. Excluding BlackRock’s fund, they recorded US$28.1 million (AU$43.1 million) in web inflows yesterday. Together with BlackRock’s US$146.6 million (AU$225.2 million) outflow, the group completed with a mixed web outflow of US$118.5 million (AU$182 million).

The a lot youthful Bitwise US spot Solana ETF, BSOL, then again, hasn’t missed a beat. Since inception, it has had a seven-day streak, amassing US$282.9 million (AU$434.2 million).

This comes as XRP is predicted to get its own ETF soon.

Associated: Bitcoin’s “Silent IPO” Moment: Why Sideways Trading Could Signal Bigger Things Ahead

The put up Crypto Market Recovers as Bitcoin Stabilises Above $100K, ETFs See Mixed Picture appeared first on Crypto News Australia.