In finance, ‘primitives’ function the essential constructing blocks for constructing decentralized functions (dApps). As an example, a USDC stablecoin primitive would possibly mix with a lending protocol Aave to function an anchored collateral. This stablecoin can’t be decomposed into additional monetary constructs. Fairly, it’s used as a constructing element, making it a primitive.

However what if the identical logic utilized to memes themselves? May the jokes, photos, and viral traits of the web be the brand new primitives of finance?

With this in thoughts, let’s look at the most recent entry into the memecoin market – Little Pepe (LILPEPE) – after we discern what memes are actually about.

Memes as Items of Cultural Transmission

Befitting the character of monetary markets, the time period “meme” originated from Richard Dawkins’ 1976 e-book The Egocentric Gene. Particularly, genes create tradition, because the sum complete of what genes are able to expressing, which then creates memes as models of expression. And identical to genes, memes mutate and bear a Darwinian choice course of.

The fittest memes get to unfold quickly and extensively, whereas unfit ones die off. In different phrases, that doesn’t imply there’s such a factor because the ‘finest meme’ however one that’s finest fitted to a particular setting. That setting is usually outlined by the in-group/out-group dynamic.

For instance, the latest meme virality got here from the “No Kings” rally by which an elementary faculty trainer Lucy Martinez pointed to her neck in an aggressive method, referring to the gushing wound of the assassinated conservative activist Charlie Kirk.

Such a gesture is a typical meme within the making:

- Energized from in-group/out-group cleavage.

- Transmits the sign of who belongs, who defies and who bleeds.

- Compact, simply understood and replicable, leveraging prior viral assassination.

This meme, particularly, operates because the emotional neurotransmitter of collective ideology. It compresses energy, standing and exclusion right into a single, reproducible gesture.

Relying on what occurs to the originator – Lucy Martinez – that gesture might obtain memetic escape velocity. If Martinez is in some way sanctioned, this itself might increase the act because the go-to sign towards the opposite.

Memes in Monetary Markets

Now that we perceive the memetic potential from a recent instance, it’s simple to see how monetary markets function in a lot the identical approach however on an much more fertile floor. As a result of sheer complexity of the crypto market, knowledge compression is inherent to it.

That is why it’s so widespread to see memes reminiscent of “diamond fingers”, “HODL”, or “purchase the dip”. Consequently, memecoins are engineered from the underside as much as change into memes themselves. Their function is to compress a market narrative right into a tradable token.

Though some memecoins boast utility or fundamentals, the majority of them successfully focus collective vibes into value motion.

In distinction, some buyers desire asset courses constructed on fundamentals relatively than sentiment – reminiscent of dividend investing, which focuses on corporations with constant earnings and dependable money flows.

Due to this fact, though memecoins operate like derivatives of sentiment, they’re structurally monetary primitives as a result of their worth is self-referential, pushed by narrative, communal consideration and liquidity.

Let’s look at how Little Pepe (LILPEPE) performs on that intangible social power.

Diving Into Pepe Memetics

Of all of the memes, one of the vital enduring ones is Pepe the Frog, originating from Matt Furie’s comedian sequence “Boy’s Membership” in 2005. Nonetheless, as a laid-back anthropomorphic frog, Pepe quickly achieved memetic escape velocity throughout websites reminiscent of Tumblr and 4chan.

Simply previous to President Trump’s first time period, the “alt-right” motion co-opted Pepe, serving as a canine whistle in, as soon as once more, group dynamics. The first purpose for Pepe’s success is the nippiness frog’s universatility. Particularly, folks can specific advanced feelings (narratives) with visible shorthand. That shorthand then serves to carve a neighborhood of like-minded folks.

Out of dozens of Pepe memecoins, Pepe (PEPE) continues to be probably the most capitalized one at $2.9 billion, having launched in April 2023. Pepe’s reputation largely stems from its first-mover benefit, easy identify and no transactional charges. Throughout 2025, merchants had a number of alternatives to faucet into PEPE’s volatility for out of doors good points, however the YTD consequence nonetheless reveals a depreciating memetic asset.

As with different memecoins, one by no means is aware of when massive holders will erect a promote stress, triggering a selloff stampede. And since PEPE lacks elementary utility, counting on hype and communal sentiment as an alternative, the token’s valuation is perpetually on the mercy of collective psychology.

Little Pepe (LILPEPE) is a comparatively new addition into the ERC-20 memecoin ecosystem, having launched in early September. Over a month, LILPEPE achieved the alternative efficiency to PEPE, gaining +65.9% worth, regardless of the latest crypto market crash.

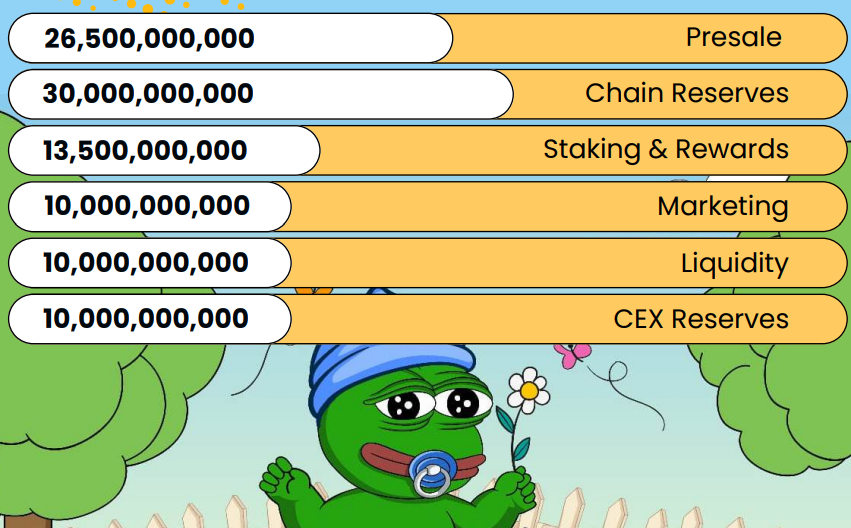

The primary narrative centering LILPEPE is the next-gen layer-2 blockchain promise of low transaction charges, no taxes and rugpulls, excessive velocity and “pure meme magic”. The memecoin is capped at 100 billion tokens, organized within the following tiers:

With 10% of the finances devoted to advertising and marketing efforts to unfold memes and influencer collabs, LILPEPE is hinting on large identify partnerships for “max vibes”. In different phrases, for each PEPE and LILPEPE, the narrative shouldn’t be a lot memetic as it’s about performing worth creation by way of communal participation.

When the alt-right used Pepe, it had natural virality because it clashed towards the sacred cows (prime memes) of society. As such, the meme had an energizing edge by itself, spreading wider and quicker, with out design or coordination.

In distinction, the brand new era of Pepe memecoins operates in a closed loop. Their virality is manufactured as an alternative of emergent, which limits their attain. In all chance, LILPEPE will share the depreciating arc of PEPE, as a result of monetary theater is much less thrilling than tradition wars.

The Backside Line

Memes should not simply cultural artifacts. They’re the scaffolding of society. One might say that all the post-WWII narrative is a group of memes that inform all elements of tradition, signaling permissibility. When friction arises towards these dominant memes, that is when counter-memes acquire their power, as demonstrated by Pepe previous President Trump’s first election.

Memecoins, nevertheless, are extra post-memetic than memetic. When virality is engineered relatively than emergent, it ceases to be a spontaneous cultural pressure and turns into indistinguishable from a advertising and marketing marketing campaign.

And like all campaigns, even probably the most viral ones develop stale. That’s the reason, finally, the market treats memecoins precisely as they behave – not as residing memes, however as fleeting promotions dressed within the language of tradition.

But ultimately, it doesn’t matter whether or not memecoins are tradition or playing. The market will preserve creating and buying and selling them, although members ought to do not forget that virality isn’t any substitute for fundamentals.

The publish Is Meme Culture Real or Just Gambling? appeared first on Crypto News Australia.