In 2004, James Surowiecky, working at The New Yorker as a enterprise columnist, popularised the idea of ‘knowledge of crowds’ in his eponymously titled guide. Since then, a number of research explored the impact of getting a big crowd performing higher than both people or smaller teams.

One research in 2014, published within the Journal of Enterprise Economics, arrived at 0.59% higher annualised funding outcomes from recommendation on the web than from skilled brokers and analysts. Stanford’s largest examination of the wisdom-of-crowds impact throughout half one million responses discovered that crowds carry out higher than constituent members by a big margin.

In different phrases, the group impact is much more noticeable when contributors are quizzed on a collection of a number of, associated questions. Related research level to having various mindsets offsetting particular person biases. Likewise, anonymity reduces error-generating social pressures, whereas exhibiting consensus sometimes results in ‘herding’ – lowering accuracy.

One of many implications of the wisdom-of-crowds impact is the suggestions loop potential. In essence, the extra folks Googling an asset, the extra seemingly it’s to foretell market motion.

This additionally affirms prior empirical findings that heightened volatility attracts investor consideration.

What does all of this imply?

Collective sentiment can supply real perception, however it’s a double-edged sword. Simply as market consideration displays info movement, it additionally amplifies volatility. In different phrases, the mixture of people known as the “crowd” can highlight traits earlier than establishments react, however additionally they gas bubbles earlier than they burst.

Provided that market timing is every thing on the subject of worthwhile trades, might AI brokers decipher market sentiment, complementing the wisdom-of-crowds impact in an automatic method?

The Downside of Deep Context for AI Brokers

It’s common to painting synthetic intelligence development as a hazard to humanity, borrowing closely from science fiction. Nevertheless, this portrayal fails to account for one easy truth, which makes it exceedingly unlikely for that situation to ever transpire: As organic beings, people have a steady state of being versus AI’s instanced state.

In flip, AI has an issue of contextual continuity, which is the capability to maintain an embodied sense of expertise that informs notion. Consequently, AI fashions lack the power to build up refined environmental cues that have an effect on decision-making.

That is exceedingly essential for forecasting as a result of it closely depends on such deep context. In spite of everything, how would one prepare AI on future occasions that haven’t transpired but?

On the upside, it’s a simple course of to find out AI’s accuracy – both the prediction occurred or it didn’t. Likewise, there’s a regular stream of knowledge from platforms like Polymarket to check in opposition to. Mixed with reasoning derived from information, an AI might achieve a way of deep context relevant for forecasting.

For instance, when the Federal Reserve makes an rate of interest resolution, an AI mannequin would have a stable launchpad to observe its potential affect on the markets.

And simply as there are AI benchmarks for AI doing math, there are going to be benchmarks to gauge AI’s predictive prowess, akin to FutureBench. Most significantly, by doing predictions time and again, the AI can enhance, offsetting the issue of deep context.

What to Count on from AI Brokers’ Integration

The Polytrader.ai platform was the primary to launch an AI agent on Virtuals Protocol in late 2024. Tokenised as $POLY, the AI agent will sift by means of information throughout social media akin to X, observe information and different prediction markets to identify worthy trades.

The platform’s roadmap is to make AI brokers carry out these capabilities 24/7, even connecting the bot to customers’ X account to obtain updates and handle portfolios. For the platform, the underlying monetisation goes by means of the $POLY token, which the AI agent makes use of to generate sentiment evaluation.

This token on Virtuals, nevertheless, shouldn’t be confused with upcoming $POLY for the most important prediction market platform – the Polygon-based Polymarket. Solely final week, Polymarket’s Chief Advertising Officer Matthew Modabber, confirmed “there will likely be a token, there will likely be an airdrop” on the Degenz Dwell podcast.

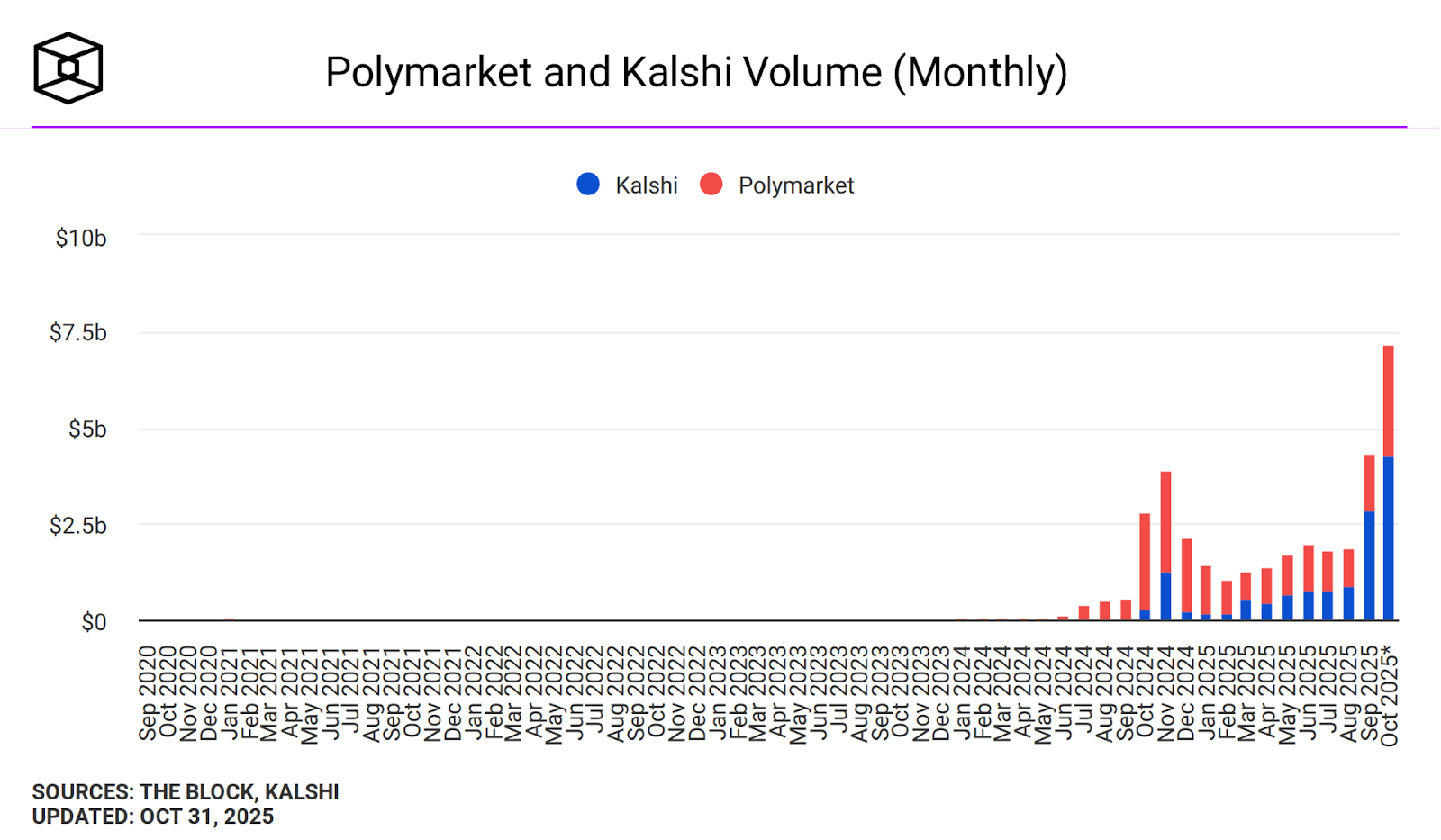

At current, Polymarket is by far the most important prediction platform, having just lately hit a brand new document simply above $2 billion weekly buying and selling quantity in accordance with Dune Analytics information. The rival Kalshi platform gained half as much weekly quantity.

Cumulatively, Polymarket churned $21.4 billion in buying and selling quantity, drastically outpacing Kalshi at $13.7 billion, with a distant third, SX, at solely $158 million, making Polymarket and CFTC-regulated Kalshi the centres of prediction markets.

Given the quickly rising curiosity in on-line betting, it’s secure to say that Polytrader’s AI-powered forecasting can have an equally sturdy demand within the DeFi enviornment when the platform positive aspects extra traction with token airdrops.

An fascinating undertaking that enhances AI agent deployment is multi-chain PredX.ai. In contrast to Polytrader, PredX permits customers to foretell influencers’ affect on markets and communities.

Because of this customers can successfully test the validity of the platform’s AI solutions. As PredX’s AI sifts by means of information occasions to counsel occasion predictions – market traits, influencers’ affect, elections – customers’ participation decide if they’re worthy of betting.

This successfully challenges AI conclusions, serving to curtail infamous AI confabulation.

The Backside Line

A cautious reader might need seen that crowds are already akin to AI. Lengthy earlier than neural networks, markets turned tens of millions of particular person judgements right into a single probabilistic output. On this mild, AI brokers are merely poised to formalise this course of, successfully compressing the group’s instinct into code.

Mixed with the present crowd habits throughout social media, we’re a seamless suggestions loop of human sentiment and machine reasoning. In that sense, AI isn’t changing the knowledge of crowds. As a substitute, it’s studying to grow to be one.

The submit Decoding the Crowd: AI Agents in Prediction Markets appeared first on Crypto News Australia.