- Iranians moved important funds from home exchanges to private Bitcoin wallets throughout late 2025 as a flight to security earlier than a nationwide web blackout.

- Complete crypto exercise hit 7.78 billion {dollars} in 2025 as residents sought alternate options to a home foreign money that has misplaced 90 p.c of its worth since 2018.

- Wallets linked to the Revolutionary Guard acquired over 3 billion {dollars} in 2025 and accounted for greater than half of all transaction worth within the closing quarter.

Crypto transactions linked to Iran rose sharply throughout late-2025 protests, with blockchain knowledge exhibiting a surge in withdrawals from Iranian exchanges into private Bitcoin wallets between December 28, 2025, and January 8, 2026, the interval main as much as a nationwide web blackout.

In response to a report from Chainalysis, each the typical day by day transaction worth and day by day transfers to self-custodied wallets elevated in contrast with the interval from November 1 to December 27, 2025.

The report put Iran’s complete crypto exercise at a large US$7.78 billion (AU$11.6 billion) in 2025, rising sooner than the 12 months earlier than.

Learn extra: Analysts Say Stress-Testing Gold vs. Bitcoin Reveals a Clear Winner

Crypto as an Different to the Rial

Crypto has grow to be a monetary different because the rial has fallen about 90% since 2018 and inflation has run at roughly 40% to 50%, in line with the report, pushing extra households to hunt belongings that may be held outdoors the home banking system.

It additionally discovered a rising share of flows tied to wallets related to the Islamic Revolutionary Guard Corps (IRGC). IRGC-linked addresses accounted for greater than 50% of complete worth acquired in This fall 2025.

Furthermore, the report estimated IRGC-associated wallets acquired greater than US$2 billion (AU$2.9 billion) in 2024 and greater than US$3 billion (AU$4.3 billion) in 2025, primarily based on a set of addresses recognized by means of sanctions designations by the US Treasury’s Workplace of Overseas Property Management (OFAC) and Israel’s Nationwide Bureau for Counter Terror Financing (NBCTF).

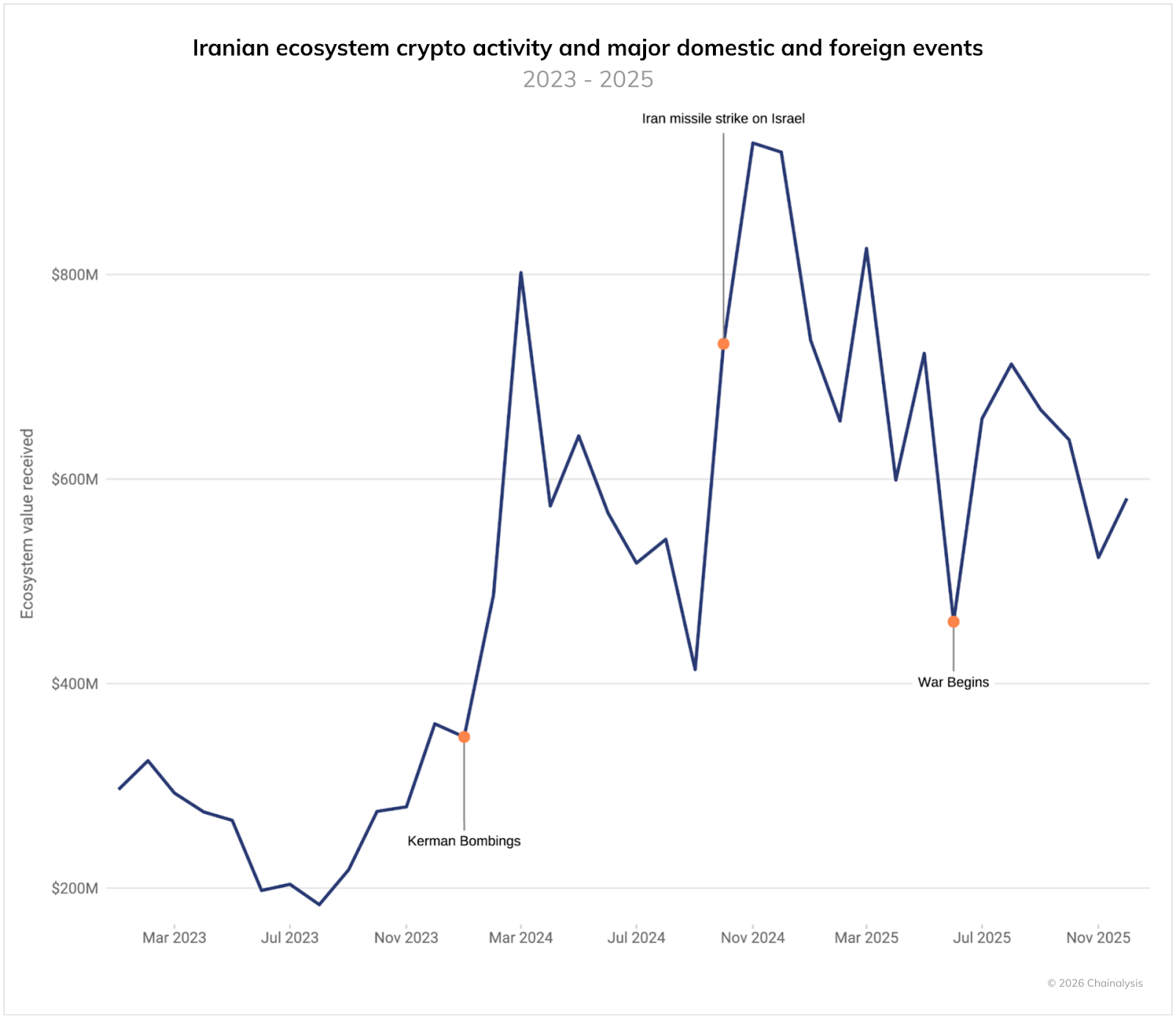

The identical dataset confirmed spikes in Iranian crypto exercise round main safety and geopolitical occasions, together with the Kerman bombings in January 2024, Iran’s missile strikes on Israel in October 2024, and a 12-day battle in June 2025. The report linked the June 2025 spike to cyberattacks on Nobitex, Iran’s largest crypto trade, and Financial institution Sepah, an Iranian financial institution described as closely utilized by the IRGC, in addition to a breach of Iranian state TV.

The evaluation mentioned its IRGC figures are a lower-bound estimate as a result of they depend on a restricted set of publicly recognized wallets and don’t embrace potential shell entities or unidentified addresses.

Many different international locations all over the world, often combating sanctions and a deteriorating economic system, typically flock to cryptocurrencies with a purpose to avoid wasting buying energy as inflation takes a toll on their respective currencies.

One case is Venezuela: from July 2024 to June 2025, Venezuela ranked fourth in Latin America by crypto worth acquired, largely by means of Binance.

Associated: From Mania to Infrastructure: Crypto’s 2026 Setup

The submit Iran’s Crypto Surge Reflects Economic Flight—and Sanctions Pressure appeared first on Crypto News Australia.