- Strategy completed the largest US IPO of 2025, raising US$2.47 billion through perpetual preferred stock to purchase 21,021 Bitcoin at an average price of US$117,256 each.

- The company now holds 628,791 Bitcoin worth US$46.8 billion total, making it the largest corporate Bitcoin holder with an average cost basis of US$73,227 per coin.

- Japanese firm Metaplanet also expanded its Bitcoin treasury by purchasing 780 BTC, bringing its total to 17,132 Bitcoin and securing sixth place among public companies.

- The SEC has approved in-kind redemptions for crypto ETPs under new leadership, marking a significant shift from the previous anti-crypto regulatory stance.

Michael Saylor’s Bitcoin-buying machine, Strategy (formerly MicroStrategy), just bought another 21,021 Bitcoin.

The company raised approximately US$2.474 billion (AU$3.79 billion) in net proceeds from a US$2.521 billion (AU$3.87 billion) IPO of its STRC perpetual preferred stock, per a Tuesday press release – the largest US IPO of 2025 so far.

It used the funds to acquire 21,021 Bitcoin at an average price of US$117,256 (AU$180,058), bringing its total holdings to 628,791 BTC – worth US$46.8 billion (AU$71.85 billion) in total at an average cost of US$73,227 (AU$112,427) per coin.

The STRC offering is historic: it’s the first US-listed perpetual preferred security by a Bitcoin Treasury Company, the first to offer monthly dividends with a board-set rate, and it opens up income-oriented access to Bitcoin exposure for a broader class of investors.

Related: Aussie Fund Managers Team Up With OKX, Franklin Templeton to Boost Crypto Collateral Efficiency

Strategy’s share price traded lower over the past few days, down 6.8% over the past week and currently trading at US$394.66 (AU$605.97).

Strategy’s move comes at a time when others are stepping up their game. Metaplanet, often called the Strategy of Japan, also just bought another 780 BTC, with its holding now topping 17,132 BTC, placing Metaplanet at sixth spot in public companies holding the asset. It’s also the largest non-US HODLer.

The only other non-US firm in the top ten is German Bitcoin Group SE with 12,387 BTC – just a few Bitcoin ahead of Elon Musk’s Tesla.

SEC Changes Tune on Industry

At the same time, the US Securities and Exchange Commission (SEC) has just approved in-kind redemption for crypto exchange-traded products (ETPs). This is a huge step for the SEC and shows that the anti-crypto stance under former chair Gary Gensler has given way to a more pro-crypto approach under Paul Atkins.

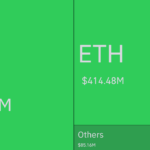

The US spot Bitcoin ETFs have been a huge success and well-received. Since their approval in early 2024, they have now attracted 1.29 million Bitcoin, which is 6.18% of all Bitcoin supply.

At the time of writing, BTC trades at US$118,166 (AU$181,444), 4% under its all-time high, but still up over 9% over the past month.

Related: Ray Dalio Says 15% in Bitcoin or Gold Is Smart—But Prefers Gold Himself

The post Strategy Adds 21,021 Bitcoin Through Historic $2.5bn Perpetual Preferred Stock IPO appeared first on Crypto News Australia.