- SBI Holdings announced plans to launch Japan’s first cryptocurrency ETFs, including a Bitcoin/XRP fund and a hybrid fund with 51% gold and 49% crypto allocations.

- The company is expanding into stablecoins, particularly JPY-backed versions, to strengthen the Japanese Yen’s stability and creditworthiness.

- SBI expects significant future gains from its 9% stake in Ripple, pending an IPO or similar valuation event.

- Despite positive news, XRP currently trades at US$2.99 (down 3% weekly) while Bitcoin sits at US$115,134, below key support levels.

Japan is about to get its first dual-asset cryptocurrency exchange-traded fund (ETF). SBI Holdings, a financial juggernaut in the Asian nation, released its earnings report on Thursday and outlined plans to launch an ETF holding Bitcoin (BTC) and XRP (XRP).

In fact, the company plans to launch two crypto-based ETFs: one that allocates 51% to gold ETFs and 49% to crypto ETFs – mainly BTC ETFs such as the Franklin Bitcoin ETF (EZBC) – and another ETF, as mentioned, that will be a Bitcoin/XRP fund.

SBI’s proposed ETFs, like some altcoin products in the US, are still pending regulatory approval.

The company is also actively working to advance its “crypto-asset domain” and plans to focus on stablecoins, citing recent developments in the US regulatory environment. SBI also noted that the Financial Services Agency (FSA) is reviewing the current regulatory landscape in Japan.

Related: Ripple’s RLUSD Stablecoin Hits $600M Market Cap, as XRP Leads Market Rally

SBI to Venture Beyond BTC, XRP

In addition to USD-backed stablecoins, SBI indicated its intention to expand into JPY-backed stablecoins.

The spread of JPY-backed stablecoins is expected to increase demand for Japanese government bonds, maintaining the stability of the Japanese Yen and strengthening its creditworthiness.

SBI is therefore considering “providing various financial services centered on stablecoins by connecting them with SBI Group’s securities and banking functions in the future”.

In its filing, SBI also notes that it expects significant future gains from its 9% stake in Ripple, pending valuation clarity through an IPO or equivalent event, although this is not reflected in current earnings.

Ripple’s XRP-based remittance network spans over 100 institutions in 55 countries, while its USD-backed stablecoin RLUSD is being considered for integration by SBI VC Trade.

XRP and BTC Trade Lower, Despite Positive News

The company noted that the XRP price has “more than quadrupled” over the past 12 months. XRP has dropped almost 3% over the past week but is slightly up on a 24-hour timeframe, currently trading at US$2.99 (AU$4.59).

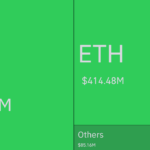

Meanwhile, Bitcoin is currently trading at US$115,134 (AU$176,731), slipping below key support levels, as we discussed here.

Related: Project Crypto: Bitwise Names Three Key Winners From the SEC’s Blockchain Utopia

The post SBI Holdings to Launch Japan’s First Bitcoin and XRP ETF appeared first on Crypto News Australia.