- Bitcoin dropped sharply to US$110,833 after briefly reaching US$115,870 early Tuesday, regardless of the Federal Reserve’s 25 foundation level price discount.

- Fed Chair Powell signalled no December price lower is assured, citing “strongly differing views” throughout the committee about future coverage course.

- Analysts at Glassnode warned that Bitcoin’s battle above the US$113k degree signifies weakening demand and potential additional declines towards US$88k.

- Institutional buyers offered US$382.6 million from spot Bitcoin ETFs on Wednesday, breaking a four-day shopping for streak and signalling lowered conviction amongst massive gamers.

After reaching US$115,870 (AU$175,817) within the early hours of Tuesday Australian time, Bitcoin has sharply corrected and is at present buying and selling at US$110,833 (AU$168,174). The downward transfer comes regardless of the US Federal Reserve slicing rates of interest by 25 foundation factors – a transfer normally bullish for crypto.

In a statement, the Federal Open Market Committee (FOMC) defined that “obtainable indicators recommend that financial exercise has been increasing at a average tempo”, including that the US job market has cooled and unemployment has elevated, although it “remained low by way of August”, whereas inflation has risen.

Inflation has moved up since earlier within the yr and stays considerably elevated.

Associated: Australia’s ASIC Updates Crypto Licensing Rules, Clarifies Bitcoin’s Status

Powell Hints December Reduce Not Assured

Moreover, Fed Chair Jerome Powell dampened hopes for a December lower, saying there have been “strongly differing views about tips on how to proceed in December.”

An extra discount within the coverage price on the December assembly will not be a foregone conclusion – removed from it.

Jerome Powell, Fed Chair

Jerome Powell, Fed Chair Matt Mena, an analyst at 21Shares, stated the transfer was “totally priced in” and anticipated by market contributors. Whatever the present value efficiency, Mena stated 21Shares stays “reasonably risk-on”, including that the agency sees “a reputable path for Bitcoin to interrupt its all-time excessive earlier than year-end”, partly based mostly on historic efficiency:

November has traditionally been one in all Bitcoin’s best-performing months, with constructive returns in eight of the previous 12 years, averaging 46.02%.

Matt Mena, 21Shares

Matt Mena, 21Shares Nonetheless, analysts at Glassnode stated the “battle beneath key cost-basis ranges” reveals “fading demand and continued long-term holder distribution”, which might trigger additional drawdowns:

The market continues to battle above the short-term holders’ price foundation (~$113K), a important battleground between bull and bear momentum. Failure to reclaim this degree raises the chance of a deeper retracement towards the Energetic Buyers’ Realized Worth (~$88K).

Glassnode

Glassnode The analysts wrote in a current report that short-term buyers are closing positions at a loss, suggesting declining conviction. The current fall in market uncertainty implies cautious optimism, although stability stays fragile and depending on the Federal Reserve’s subsequent coverage strikes, they added.

ETFs Present Outflows as Warning Builds

Institutional curiosity has additionally dipped, with the newest data for US spot Bitcoin exchange-traded funds (ETFs) exhibiting renewed promoting. On Wednesday, US$382.6 million (AU$580.71 million) exited the funds, ending a four-day streak of US$462.6 million (AU$702.1 million) in inflows over these days.

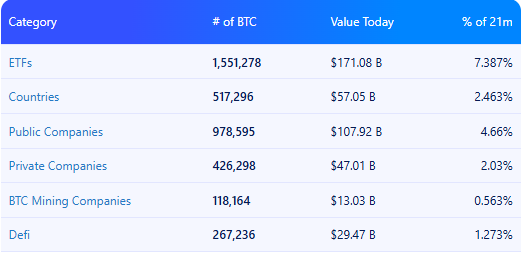

Regardless of this, the US ETFs nonetheless maintain 6.4% of all BTC, whereas world Bitcoin funds account for 7.3%, making them the biggest group of HODLers.

Associated: Altcoin ETFs Make Splashy Wall Street Debut as Solana Fund Leads With Record Volume

The submit Bitcoin Slides as Fed Signals Uncertain Path on Future Rate Cuts appeared first on Crypto News Australia.