- Grayscale views Chainlink as “essential connective tissue” important for the subsequent stage of blockchain adoption, linking crypto markets and conventional finance.

- The report highlights Chainlink’s evolution past easy worth oracles right into a broad stack, together with the Cross-Chain Interoperability Protocol CCIP and instruments for asset tokenisation.

- The report comes as Grayscale seeks SEC approval to transform its present Chainlink Belief right into a spot Chainlink ETF that might additionally incorporate staking.

Funding agency Grayscale says Chainlink can be on the middle of the subsequent stage of blockchain adoption, describing the protocol as “essential connective tissue” between crypto markets and conventional finance.

In accordance with the report, Grayscale highlighted Chainlink’s evolution past worth oracles right into a broader stack that features real-world knowledge feeds, compliance-oriented instruments for establishments, and cross-chain messaging.

Chainlink is the essential connective tissue between crypto and conventional finance. It may already be thought-about important infrastructure in blockchain-based finance, in our view, and it’s tough to think about how crypto can go mainstream with out making use of Chainlink’s suite of software program applied sciences.

Its Cross-Chain Interoperability Protocol (CCIP) is cited as a notable instance, enabling token and knowledge transfers throughout blockchains and underpinning a CRE case research with JPMorgan’s Kinexys platform and Ondo Finance, as reported by Crypto Information Australia in Could.

Associated: Samourai Wallet Co-Founder Gets 4 Years in Prison for $237 Million Bitcoin Laundering Scheme

Chainlink on the Heart of Tokenised RWAs

The report talks about how most monetary devices are nonetheless maintained off-chain, however that’s the place Chainlink’s worth exhibits up probably the most: by means of tokenisation. However to achieve the advantages of blockchain settlement, Grayscale says these property should be issued as tokens, attested, and constantly linked to dependable exterior knowledge, a course of it expects Chainlink to assist coordinate.

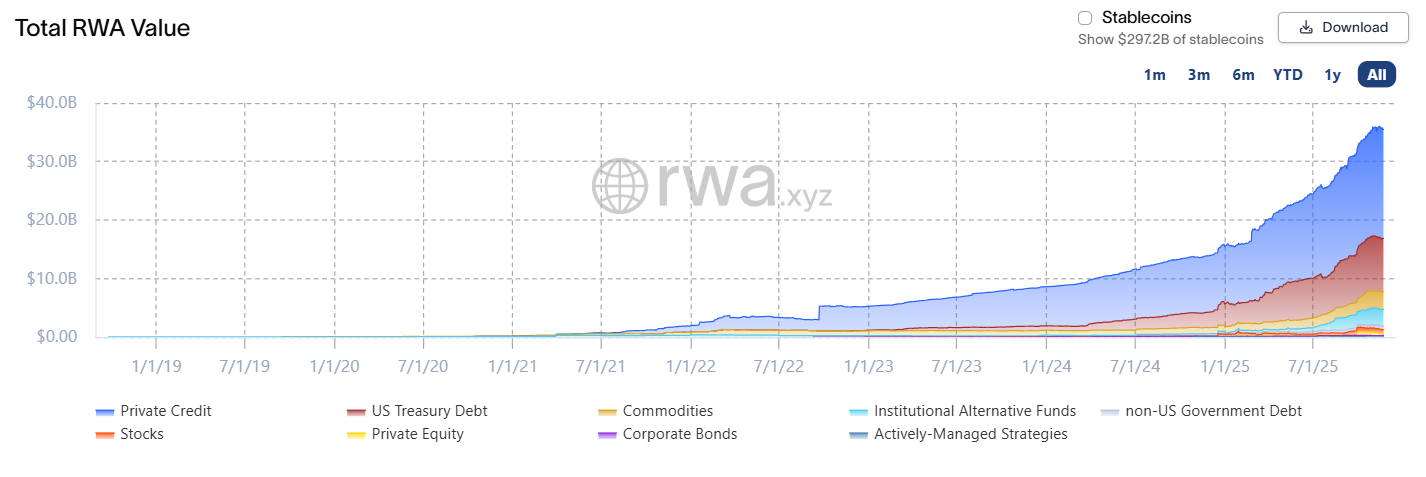

The full RWA on-chain worth has expanded from round US$5 billion (AU$7.5 billion) in early 2023 to over US$35.6 billion (AU$53.4 billion), in response to RWA.xyz knowledge, most of it being non-public credit score.

Grayscale argued that this market could possibly be more and more reliant on Chainlink-powered infrastructure because it scales, pointing to Chainlink’s partnerships with knowledge and index suppliers like FTSE Russell as an early indication of that position.

The analysis comes as Grayscale seeks SEC approval to transform its present US$29 million (AU$43.5 million) Chainlink Belief right into a spot Chainlink ETF, which might commerce on NYSE Arca below the ticker GLNK. This could even be one of many first crypto ETFs to include staking.

Associated: Index Axe Looms Over Saylor’s Strategy as Crypto Slump Threatens Billions in Passive Flows

The publish Grayscale: Chainlink Is the “Connective Tissue” Powering Wall Street’s Blockchain Future appeared first on Crypto News Australia.