Crypto financial savings accounts are a preferred kind of funding product that permit anybody to deposit crypto and earn curiosity on them over time.

As a substitute of incomes a decrease charge on money like in an everyday financial savings account within the financial institution, you’ll be able to earn a better yield in your crypto by depositing them right into a yield-generating app.

Beneath, you’ll see what a crypto financial savings account is, the core mechanics behind the yields, and the way these merchandise run. In fact, additionally, you will see particular sections and components that relate to Australian customers, alongside a couple of different elements to remember.

What’s a Crypto Financial savings Account?

A crypto financial savings account is a product that allows you to deposit cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and so on., and even stablecoins on a platform in alternate for curiosity, much like how a financial institution financial savings account pays curiosity on money.

Word {that a} crypto financial savings account isn’t a “financial savings account” within the conventional sense, however nearer to a high-yield, high-risk funding product that occurs to look so much like a financial savings account within the UI.

The platform, which generally is a single app like YouHodler or a crypto exchange product, lends out or deploys your crypto funds in varied yield-generating actions that may embody:

- Lending your crypto to merchants, market makers, and establishments that need leverage or liquidity, who pay curiosity on these loans.

- Staking property (immediately or through staking swimming pools) to assist validate blocks on proof-of-stake (PoS) networks, incomes protocol rewards plus transaction charges.

- Offering liquidity to DeFi protocols (AMMs, lending swimming pools, and so on.), the place you earn buying and selling charges or borrowing curiosity, and generally extra token incentives.

You earn curiosity in return, typically at charges a lot greater than conventional financial savings accounts. That curiosity is often paid in the identical asset you deposited and should compound incessantly (day by day or weekly).

Key Traits of Crypto Financial savings Accounts

Take into account that crypto financial savings accounts are run by the corporate, not a decentralised protocol, so it’s totally different to DeFi lending. Listed below are some key traits:

- If you deposit, the corporate holds your cash, not you. You don’t management the personal keys. In the event that they freeze withdrawals, you’ll be able to’t transfer your cash.

- These platforms earn yield by taking your crypto and lending it out to merchants and establishments. You don’t see precisely who they lend to or what dangers they’re taking. You’re trusting their inner workforce.

- As a result of they’re centralised companies, you might have to do KYC (ID, selfie, proof of handle, and so on). Your account is tied to your actual identification and could be reported to tax authorities.

You might like: Crypto Debit Cards Available in Australia

Finest Crypto Financial savings Account in Australia

With that data out of the way in which, let’s undergo a few of the greatest yield-generating platforms within the Australian market.

Nexo

Nexo works like a crypto financial institution with financial savings, borrowing, debit card, and alternate options. It provides rates of interest relying on a loyalty system tied to the NEXO token. It additionally gives a 2% cashback by the Nexo Card.

Supported Property and Charges

The platform helps over 100 crypto property:

- Stablecoins like USDT, USDC, DAI: As much as 14% with high tier and incomes in NEXO (base nearer to round 8%).

- Main cryptocurrencies like BTC, ETH, XRP, SOL, and so on., roughly 4% to eight% relying on tier and fixed-term lockups.

- It additionally helps digital representations of fiat currencies: USDx, EURx, GBPx. These are high-yield fiat accounts throughout the platform (as much as 15% yearly with currencies like USDx).

Nexo does have a posh payment construction, therefore why it’s essential to examine the final fee schedule. Charges and withdrawals rely on the loyalty tier. The platform provides round 5 free withdrawals monthly.

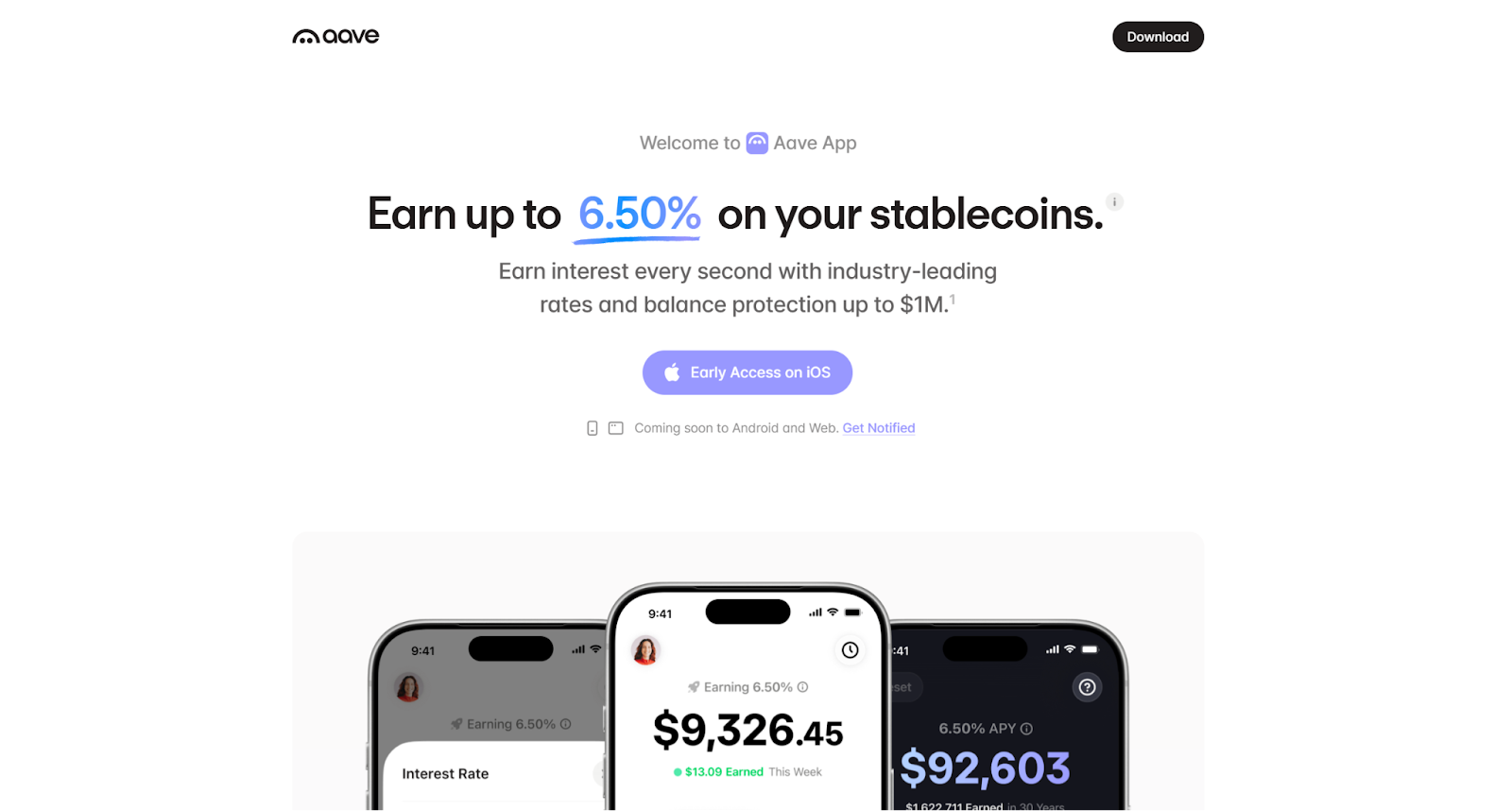

Aave App

Aave App is the upcoming crypto savings-like app of the Aave protocol, the biggest decentralised lending protocol that has generated billions of {dollars} in curiosity paid.

The Aave App Hybrid interface is an addition to the Aave DeFi protocol that provides KYC, a simplified UX, and a US$1 million (AU$1.53 million) insurance coverage safety.

Supported Property and Charges

Principally stablecoins: USDC, USDT, and Aave’s GHO, usually averaging between 4% and 6%. Customers can use ETH and wBTC for collateral for borrowing, not as main yield property.

Concerning charges, Aave app doesn’t cost you any month-to-month subscription. Apart from common ETH-based fuel charges, the one express payment comes from the unfold. For instance, if the Aave protocol is producing 7% APY on USDC from debtors, the Aave App would possibly pay you 6% APY.

Ledn

Ledn is a Bitcoin-focused lender based mostly within the Cayman Islands and operates in over 100 nations, and now focuses solely on Bitcoin-based loans and stablecoins.

Ledn separates balances into “held” (not lent) and “interest-earning” (lent) buckets to isolate threat, which could be defined as follows:

- Held Balances (not lent): These are commonplace custodial accounts. If a consumer merely shops their Bitcoin with Ledn with out opting into an curiosity program, that crypto is saved in safe, segregated storage and isn’t used for lending functions. This gives peace of thoughts that these particular property should not topic to lending threat.

- Curiosity-Incomes Balances (lent): Customers who explicitly transfer funds right into a “Progress Account” (for stablecoins) or take part in a B2X mortgage settlement consent to their funds getting used within the lending pool. Funds in these accounts are used to generate yield paid to the consumer.

Supported property and Charges

As said, Ledn solely helps BTC and stablecoins:

- Bitcoin: up 3% APY.

- Stablecoins like USDC and USDT, as much as 8%-12% APY for balances over 100K.

Ledn has a number of charges that rely on the stability quantity and APY. You’ll be able to examine the charges phrases web page here, however it may be summarised as:

- Stablecoin withdrawals: 10 USDC and USDT mounted payment (or equal).

- BTC withdrawals: 0.0005 BTC.

- In-app alternate from unfold on every swap.

Youhodler

Youhodler is a EU-regulated yield platform that provides a variety of crypto-based options, combining financial savings, lending, and leverage in a single app. It additionally gives crypto-backed loans, interest-earning accounts, and even a crypto card.

Supported Property and Charges

Youhodler helps over 50 cryptocurrencies, together with stablecoins, and gives weekly payouts and no lock durations. Customers can achieve as much as 20% APY on their crypto funds. A number of the supported cash are:

- Main cryptocurrencies like BT, ETH, SOL, XRP, ADA, and extra. The rewards are sometimes tiered by buying and selling exercise or stability.

- Stablecoins like USDT, USDC, usually round 8%-12% APY.

Youholder prices a number of sorts of charges, so you may additionally need to take a look at their charges page, however usually, you will see that the next:

- 1% for fiat withdrawals, 0.5% for deposits.

- Financial institution wire payment, relying on the foreign money.

- Potential inactivity payment if the account is dormant for months.

- Min. deposit for yield accounts in US$100 (AU$154).

Uphold

Uphold is offered in Australia as a multi-asset brokerage with yield primarily from staking. It additionally permits customers to commerce throughout crypto, metals, and fiat in a single app.

Supported Property and Charges

There are a number of sorts of crypto property (and commodities) that customers can earn pursuits by Uphold, primarily staking: ETH, SOL, ADA, DOT, TEZOS, and so on., roughly 3%–17% APY relying on asset.

Uphold staking charges generally is a bit greater than most, round 20% of staking rewards, relying on the asset.

Professionals and Cons of Crypto Financial savings Accounts

Crypto financial savings accounts could make sense for somebody who already holds crypto and understands the dangers.

Consider the cash earned by crypto financial savings accounts is taxable. There’s no particular tax-advantaged remedy right here; the Australian Taxation Office (ATO) treats crypto financial savings accounts, staking, lending, and different crypto merchandise/investments as extraordinary revenue, so you continue to have to pay revenue tax on the complete quantity of curiosity earned (at your marginal tax charge).

Professionals defined:

- Greater potential yield than financial institution deposits.

- Passive revenue on crypto you already maintain.

- Frequent compounding.

- Easy UX in comparison with DIY staking/DeFi (the platform does the staking for you in some instances).

- Versatile alternative of property and lock-up phrases.

Cons defined:

- You’ll be able to lose principal (what you deposit) on account of market volatility, platform failure, hacks, sensible contract bugs, or regulatory motion.

- No government-backed insurance coverage or assured security web (although depends upon the app, a few of them supply their very own insurance coverage funds).

- Be cautious of merchandise providing extraordinarily excessive yields. These are sometimes a rip-off.

Closing Ideas

Crypto financial savings accounts are usually yield merchandise that facilitate lending, staking, and DeFi methods, often run by centralised firms that custody your property and require full KYC.

Whereas these merchandise supply greater potential returns and comfort, customers must be totally conscious of the downsides, like market volatility, centralisation, the solvency and safety of the platform, tax implications and no broad authorities assure.

The put up Top Crypto Savings Accounts in Australia appeared first on Crypto News Australia.