- Bitcoin noticed a 6% uptick, climbing again above $92K. This sparked a broad market rebound after a pointy selloff worn out almost $1 billion in leveraged positions.

- Whereas merchants welcomed supportive business headlines, general sentiment stays fragile amid ongoing market stress.

- Regardless of the value rise, detrimental funding charges point out merchants stay bearish, suggesting the restoration is fragile within the close to time period.

Bitcoin climbed again over US$90,000 (AU$137,700) on Tuesday, recovering a part of Monday’s sharp selloff that worn out almost US$1 billion (AU$1.53 billion) in leveraged positions and rattled sentiment throughout crypto markets.

Even shares of the Bitcoin mining firm led by Eric Trump, American Bitcoin Corp (ABTC), dropped exhausting this Tuesday, shedding half its worth in early buying and selling classes. Extra particularly, a 51% decline, in response to knowledge from Yahoo Finance

It appears the market is supportive headlines as an indication of reduction, because the US Securities and Change Fee (SEC) Chair Paul Atkins flagged plans to element an “innovation exemption” for digital asset corporations.

Learn extra: Kalshi Goes Onchain With Solana in Bid to Challenge Polymarket

In the meantime, Vanguard mentioned it could enable ETFs and mutual funds primarily holding cryptocurrencies to commerce on its platform, according to Bloomberg.

Wintermute strategist Jasper De Maere advised the publication that the transfer displays each sector-specific information and crypto “catching up” with broader danger belongings.

It appears to be a mixture of business particular headlines and crypto catching as much as the broader market that’s driving this sturdy value exercise.

Jasper De Maere, desk strategist at Wintermute

Jasper De Maere, desk strategist at Wintermute Have BTC-ETFs Turned Issues Round?

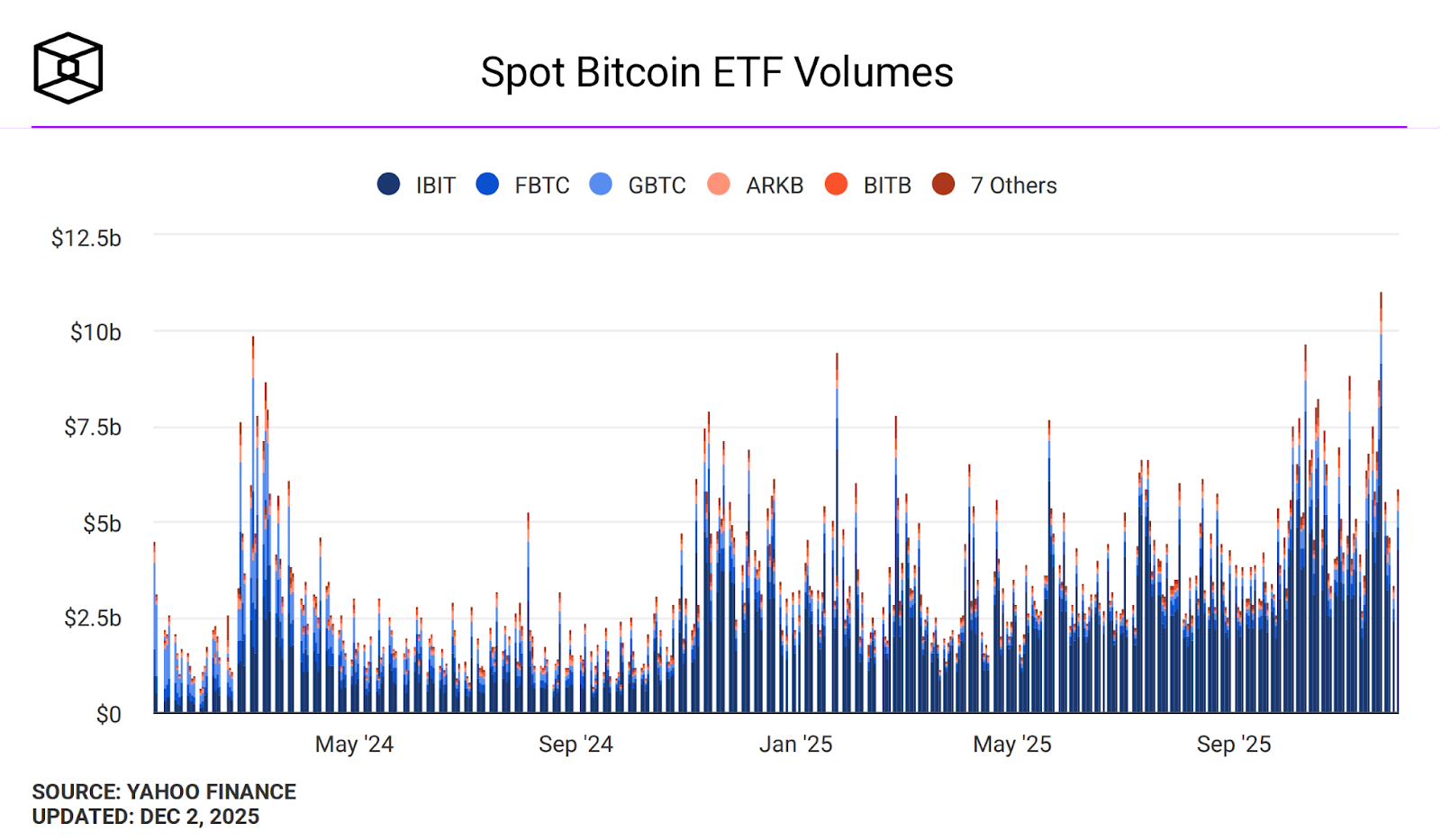

Regardless of the sell-off strain that rippled throughout the market, US spot Bitcoin ETFs noticed some regular positive aspects in the present day, reaching US$5.9 billion, an indication that establishments and retailers are nonetheless fascinated about publicity to the primary cryptocurrency, in response to The Block knowledge.

Regardless of Tuesday’s bounce, Bitcoin funding charges in perpetual futures have turned detrimental in current days, in response to CryptoQuant — an indication that demand for bearish publicity now outweighs curiosity in leveraged lengthy positions, and that any restoration might stay fragile within the close to time period.

In easy phrases, which means that despite the fact that Bitcoin went up, merchants are nonetheless nervous, and we are able to see that on futures markets, the place extra folks are actually shorting the crypto asset. It’s because the funding fee is detrimental: merchants who’re quick are getting paid by those that are lengthy (betting on an increase).

Learn extra: Upbit Halts Trading After $36.8M Solana Network Hack

The submit Bitcoin Reclaims $90K as Crypto Markets Snap Back After Heavy Selloff appeared first on Crypto News Australia.