After Bitcoin, decentralized finance (DeFi) is probably the most important innovation that got here out of the blockchain paradigm. DeFi’s speedy progress mirrors its formidable aim of recreating finance, having gone from below $1 billion complete worth locked (TVL) in early 2020 to $174 billion by late 2021.

As FTX and different crypto bankruptcies cooled down DeFi enthusiasm from 2022 to 2025, one other phenomenon was steadily rising – Actual-World Asset (RWA) tokenisation. From barely noticeable ~$200 million TVL in H2 2022, RWA’s footprint enlarged to $19.4 billion by January 2026.

Let’s look at what RWA tokenisation really means and from the place does it come from?

RWA: Rising from Metaverse

At this cut-off date, it’s honest to say that the metaverse narrative did not launch. To grasp the scope of this failure, it bears reminding that, in early 2022, J.P.Morgan Chase forecasted over $1 trillion in yearly revenues in its 17-page “Alternatives within the metaverse” report. This was three months earlier than the Federal Reserve began elevating rates of interest to curb inflation.

This macro set off then pulled the rug below Terra (LUNA) in Might 2022, which instigated a cascade of crypto bankruptcies all through the remainder of the 12 months. However did the metaverse sector recuperate as DeFi did (as much as the October 2025 market correction)?

Not even shut. Living proof, the vanguards of the metaverse narrative – Decentraland (MANA) and Sandbox (SAND) – seem like completely deflated, down 71% and 80% respectively year-over-year. Likewise, probably the most profitable NFT undertaking ever – ApeCoin (APE) – is down 80% YoY, additionally exhibiting no indicators of restoration.

After all, the metaverse narrative was tied to the hip with the non-fungible token (NFT) market, each economically and psychologically:

- Not simply being a digital land from outdated sci-fi films about VR, metaverse was the promise of the digital land’s tokenisation.

- NFTs are the possession primitives on this narrative, with out which a “metaverse” would simply be one other massive-multiplayer on-line (MMO) sport.

- These NFTs got here in lots of kinds: digital land, avatars, wearables and different in-world objects.

Using the hype, the complete metaverse/NFT market assumed future demand, pushing the value of tokenised digital land, and the demand for uncommon NFT avatars as future scarce social standing. The demand thesis collapsed, nonetheless, when the liquidity dried up through the aforementioned cascade of crypto bankruptcies, but in addition when successfully free AI picture era entered the general public highlight by the tip of 2022.

To place it in another way, the metaverse/NFT sector required mass retail perception to perform, simply pricked by macro triggers. Nonetheless, as a proof of idea, this era was profitable in pushing the concept of digital-mimicry property having worth.

RWA: A Totally different Form of Digital Beast

As we are able to see, the metaverse narrative failed for a lot of causes. The longer term demand was overpromised, probably as a result of novelty of NFTs themselves. The reflexivity of mass retail tradition, because the market’s engine, was too fickle as rising flooring costs signaled cultural relevance, which in flip attracted extra retail entrants that pushed costs even additional.

Consequently, the complete metaverse mannequin was essentially unsound because it relied on social proofing, meme density, influencer signaling and value charts (jpeg go up!). That is the alternative of real finance that accounts for discounted money flows, consumer retention curves and infrastructure prices.

Actual-World Asset (RWA) tokenisation is a breed other than that mannequin. As an alternative of mimicking real-world property with fantasy property, RWA is all about bridging conventional monetary worth to blockchain rails. In contrast to nebulous NFTs within the metaverse that relied on memery, RWAs merely faucet into current demand:

- Each governments and companies already increase debt by issuing bonds, that are basically an IOU – borrowing cash on totally different sorts of guarantees whereas making common curiosity funds till maturity date.

- Actual property is already a thriving market, basic for each financial system.

Whereas each metaverse initiatives and RWA platforms depend on good contracts, custody options, oracles and typically compliance layers, RWA worth is anchored to off-chain property below the regulated management of establishments, funds, treasuries and governments.

The query is, why is there a requirement for RWA tokenisation itself?

What RWA Tokenisation Is Actually About

Throughout the stimulus-triggered retail inventory buying and selling splurge, culminating in GameStop quick squeeze in early 2021, many anomalies emerged: payment-for-order-flow incentives, buying and selling halts, T+2 settlement delays, useless capital locked in a clearing cycle. All of those revealed the opaque plumbing of intermediaries, making it clear that the psychological mannequin of proudly owning a inventory is sort of totally different from what is definitely occurring.

In no unsure phrases, retail merchants found that monetary markets are usually not simply impartial arenas however layered techniques of discretionary intervention and latency. On this mild, RWA tokenisation isn’t just a marginal enchancment of entry however an overhaul. Particularly, by compressing worth rails – exchanges, clearinghouses, custodians, courtroom arbitrage – right into a single blockchain layer.

In apply, this interprets to RWA tokenisation considerably bettering the complete monetary system:

- Immediately settle in seconds as a substitute of ready for days for trades to settle. In a conventional approach, when money is shipped, a central depository has to tie it to a bond title, producing the so-called “threat window” that may last as long as two days. With good contracts, the declare is executed inside a single transaction block, near- immediately (relying on specific blockchain’s throughput).

- On the spot settlement itself elevates liquidity as a result of banks and funds not must comprise money to insure towards settlement failure. In flip, the speed of cash is elevated as freed-up capital will be instantly deployed into different trades.

- Granular, smart-contract-powered programmability permits for extra dynamic worth deployments. As an illustration, a bond can mechanically pay curiosity right into a pockets each second, quite than as soon as each six months.

With benefits so clear, it’s then additionally clear why the push for RWA tokenisation shouldn’t be a favor to the retail merchants, however streamlining monetization. It’s simple to see a tokenised Treasury invoice that would settle in minutes and permit for steady collateral optimization, intraday liquidity reuse, real-time margin and automatic compliance/reporting.

Within the inventory market and actual property, it’s equally simple to see automated dividend payouts and buyback executions – bringing historically guide processes like cash dividends immediately on-chain – alongside tokenised shareholder rights for voting and computerized distribution of rental earnings from tokenised actual property property.

RWA In Apply: TradFi Dominates DeFi

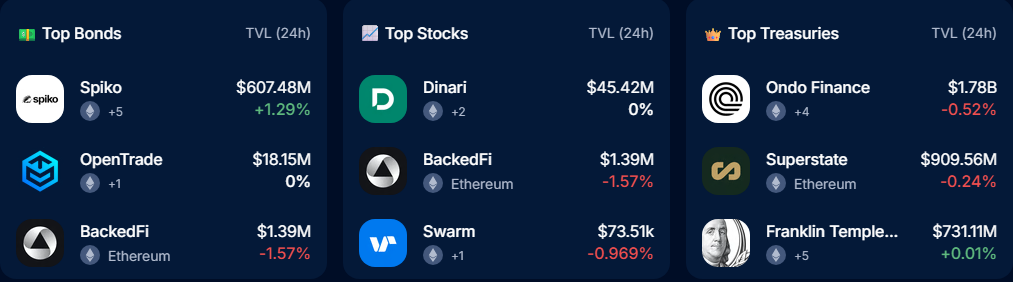

As of January 2026, the tokenised RWA market is holding at $19.38 billion, largely composed of the most secure asset on the planet – US Treasury debt at $8.76 billion – provided that it’s backed by the world’s largest navy.

Commodities rank second at $3.6 billion, adopted by institutional various funds at $2.4 billion and personal credit score at $2.3 billion. All different property – public fairness, non-public fairness, non-US authorities debt, actively managed methods and company bonds – are below $800 million.

However how does this work precisely?

Given the fragile nature of those property, they require particular permissioned blockchains. One such blockchain we lined lately – the Canton Network. This institutional blockchain community was backed by all main banks and pertinent tech/monetary corporations like Microsoft, Deloitte, Circle, Paxos and S&P World.

Presently, Canton holds the majority of the RWA market share at 95%, confirming as soon as once more that RWA tokenisation shouldn’t be geared toward retail (but). In apply, establishments that achieve entry to Canton function sovereign participant nodes linked by means of shared World Synchronizer, which is ruled by the non-profit Canton Basis.

Canton’s privateness is insured by means of Daml as the first good contract language that additionally has built-in compliance checks.

Nearer to the DeFi ecosystem is Provenance blockchain, holding 3.72% RWA market share, as it’s constructed on Cosmos SDK framework. Though Cosmos (ATOM) shouldn’t be a lot within the crypto highlight as of late, it inherently helps constructing non-public, permissioned networks.

As we are able to see, privateness/permission and regulation are tied to the hip, making the RWA market presently certain inside establishments. Nonetheless, some RWAs are accessible by means of DeFi, which largely depends on Swarm for compliance functions whereas additionally immediately offering publicity to RWAs.

Though some, like Spiko, have blockchain presence, they’re regulated FinTech corporations. Due to this fact, entry to them might differ primarily based on area.

As an L2 scaling resolution for Ethereum, Base (from Coinbase) hosts the biggest RWA platforms – Centrifuge and Maple. Sadly, each require particular accreditation by means of KYC/AML and thru KYB (Know Your Enterprise) onboarding.

Nonetheless, Maple has Syrup (SYRUP) protocol that provides entry to the broader DeFi viewers and publicity to institutional yield streams. Resulting from regulatory/compliance necessities,

current DeFi platforms like Aave and MakerDAO have moved to hybrid fashions.

Whereas MakerDAO makes use of RWA (Treasuries) as a collateral for its DAI stablecoin, Aave launched the accredited Horizon RWA market that integrates VanEck Treasury Fund (VBILL) through Securitize.

Then again, entry to commodities like gold is far simpler owing to Paxos Gold (PAXG) and Tether Gold (XAUT).

The Backside Line

RWA tokenization shouldn’t be a revival of crypto’s retail-driven goals however a gradual institutional re-plumbing of finance. The place the metaverse and NFTs relied on mass perception, RWAs are pushing forward by anchoring blockchains to property that already matter – sovereign debt, credit score, commodities and money flows.

Throughout this course of, having a compliance layer is all the pieces, making broader retail entry to RWAs primarily a perform of legislative frameworks quite than technical functionality.

The put up From Metaverse to Institutional Money: Why Real-World Assets Are Blockchain’s Real Breakthrough appeared first on Crypto News Australia.