- The most recent quarterly report from Brisbane-based crypto alternate Swyftx argues that Bitcoin is behaving extra like a “beta for prime threat tech socks” than digital gold after a unstable This autumn punctuated by the crypto collapse of October 8.

- Different tendencies highlighted embrace the success of altcoin spot ETFs and the rise of privateness cash.

- David Hen (aka ASX Dealer) contributed to the report, forecasting a tough 2026 for crypto attributable to a convergence of a number of key cycles growing threat.

In its latest quarterly report, Brisbane-based crypto alternate Swyftx has argued that Bitcoin’s standing as digital gold has “materially weakened” within the wake of the October 10 crypto market calamity — the alternate says BTC is at present extra like a “beta for risk-on tech shares” than a protected haven asset.

Swyftx attributed the October 10 crypto market collapse to quite a lot of components, together with macroeconomic and geopolitical drivers, however highlighted the function of lowered US greenback liquidity and all-time excessive leverage charges within the crypto market.

These liquidity pressures ultimately reached boiling level, and, paired with the right storm of circumstances, the market gave method on October 10.

Pav Hundal, Lead analyst at Swyftx

Pav Hundal, Lead analyst at Swyftx Bitcoin’s comparatively weak efficiency all through 2025 — however significantly after October 10 — demonstrates it isn’t behaving in any respect like ‘digital gold’ in tough market circumstances. “This yr noticed a big decoupling between the 2 [gold and Bitcoin] with the divergence accelerating in This autumn 2025,” the report’s authors famous.

By the yr gold was a pre-eminent performer (+70%), whereas Bitcoin traded largely flat. By late November correlation between the property was persistently damaging, falling as little as -0.9.

The alternate additionally identified that Bitcoin’s worth decoupled from world M2 cash provide in 2025, with the decoupling accelerating throughout This autumn, which suggests the drivers of Bitcoin’s worth motion could also be altering and the market could also be “getting into unchartered waters.”

One other necessary narrative which emerged throughout This autumn was the launch of altcoin-based spot exchange-traded funds (ETFs) — with ETFs primarily based on Solana, XRP, Hedera, Dogecoin and Chainlink all being launched in fast succession.

Whereas virtually all altcoins have been weak by way of This autumn, investor demand for these altcoin-based ETFs has really been fairly robust, in keeping with Swyftx. The alternate mentioned that means a longer-term funding technique for these opting to achieve publicity by way of ETFs fairly than immediately shopping for altcoins.

Since being launched in November, Solana-based funds have amassed property underneath administration (AUM) of over US$700 million (AU$1b), whereas the XRP-based funds reached a market cap of over US$1 billion (AU$1.4b) in simply over a month and didn’t have a single day of internet outflows throughout this time.

Associated: Institutions Set to Supercharge Crypto’s Next Wave in 2026

Swyftx Metrics Present Prospects Want Bitcoin and a Few Different Narrative-Pushed Winners

Knowledge on Swyftx prospects’ behaviour exhibits that buyers sought the relative security of Bitcoin, with trades involving Bitcoin on the platform (Bitcoin dominance) surging 70% in This autumn of 2025 to 33.5% — up from 19.6% in Q3.

For a quick interval in December, Bitcoin dominance really hit 50%, displaying simply how a lot customers have been flocking to Bitcoin over alts.

There have been a number of choose winners apart from Bitcoin, with buying and selling volumes for Sui, Hedera and Bittensor all considerably larger than what could be anticipated primarily based on their market caps.

By way of worth motion, there was one big winner in This autumn — privateness cash, led by ZCash (ZEC). By This autumn, Zcash’s worth surged by over 600%, largely pushed by privateness considerations round Bitcoin.

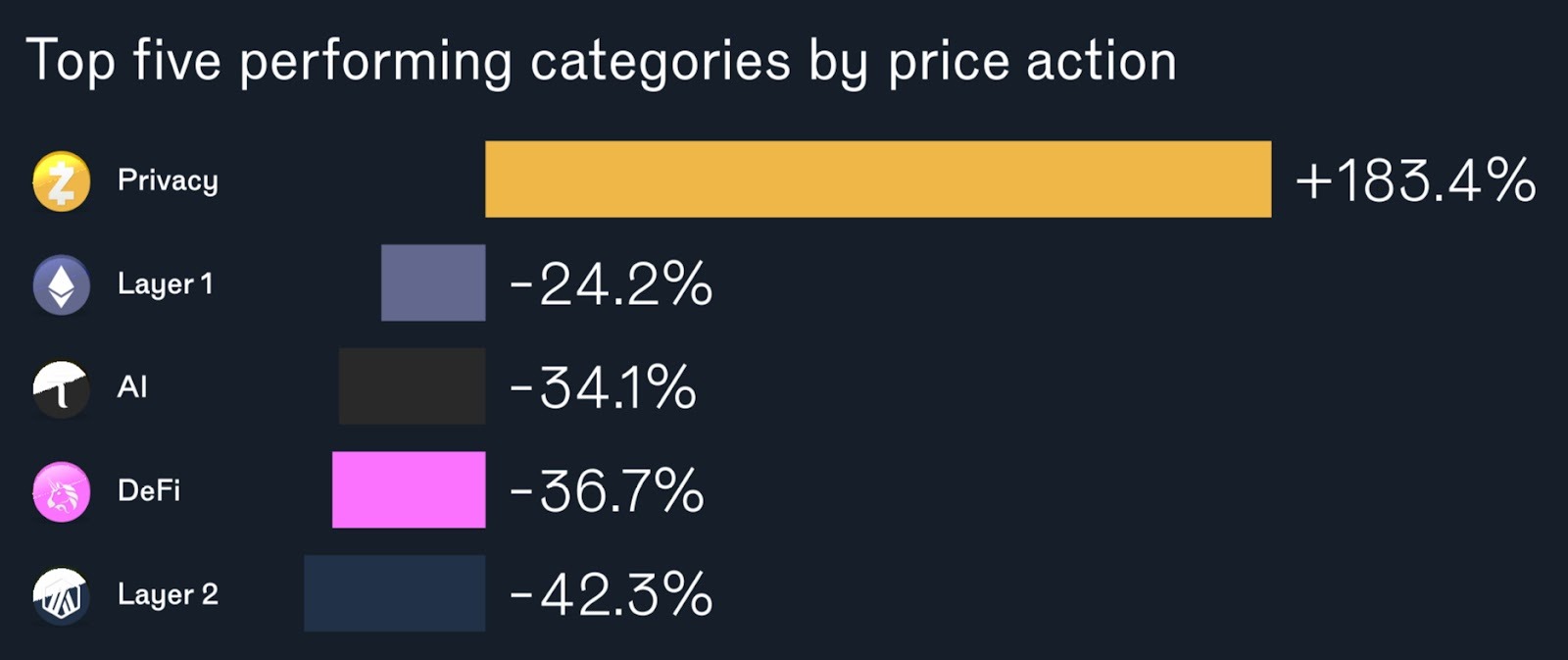

Privateness-based tokens have been the one class on Swyftx to see common worth will increase in This autumn, being up on common 183.4%. All different classes fell, with the second-best-performing class, ‘layer 1s’, dropping by a median of 24.2%.

2026 a Yr For “Taking part in Defence,” Says ASX Dealer

Funding adviser and report contributor, David Hen (Aka ASX Dealer), mentioned 2026 was prone to see “defensive property” resembling gold outperform larger threat property resembling Bitcoin and crypto.

“From a macro perspective a number of main cycles seem like approaching peaks — the Land Cycle, Brenner Cycle, broader financial cycle, the mid-term election cycle and even the 4-year crypto cycle itself. When a number of cycles align this fashion, threat tends to rise not fall. Crypto, being extremely delicate to liquidity and sentiment, is especially uncovered,” he mentioned.

Associated: Crypto Investment Products See Largest Weekly Inflows Since October 2025

Investing YouTuber Jason Pizzino additionally contributed his insights to Swyftx’s report and shared an identical outlook for 2026: he thinks a number of indicators at the moment are aligning to verify crypto has entered a bear market.

“Time and sentiment indicators have now slowed to ranges not seen because the prior bear market in late 2021 / early 2022, which led us to consider this time isn’t totally different.”

Pizzino prompt one doubtlessly optimistic indicator is that we haven’t (but) seen Bitcoin fall 50% from its bull market excessive. If Bitcoin can proceed to carry above this degree (round US$71,000 in keeping with Pizzino), we could but see it rally if different macro circumstances develop into extra beneficial.

The publish Behind the Volatility: Key Takeaways from Crypto’s Q4 2025 appeared first on Crypto News Australia.