- Ark Make investments’s “Huge Concepts 2026” report initiatives Bitcoin will attain a $16 trillion market cap by 2030, pushed by institutional adoption and ETF progress.

- The forecast assumes a 63% compound annual progress fee, with Bitcoin more and more capturing the “digital gold” market as its volatility declines.

- Good contract platforms are anticipated to succeed in a $6 trillion market cap by 2030, fueled by the rise of on-chain finance and tokenised real-world belongings.

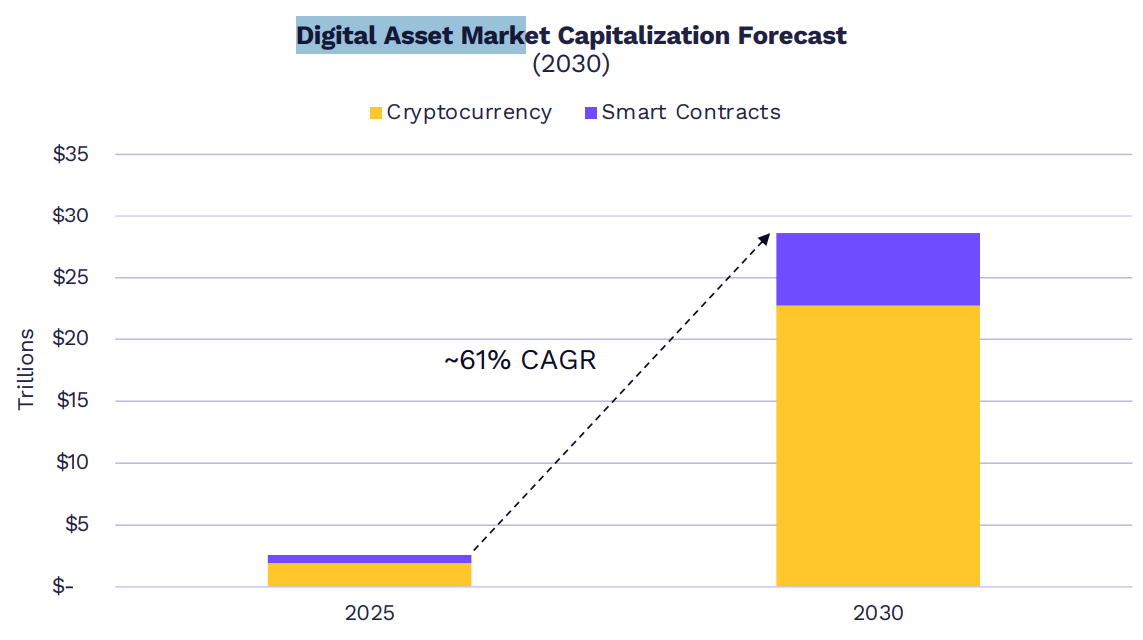

Ark Make investments initiatives Bitcoin may attain a market capitalisation of about US$16 trillion (AU$24.48 trillion) by 2030, with the full crypto market rising to roughly US$28 trillion (AU$42.84 trillion) over the identical interval.

That signifies that at a US$16 trillion (AU$24.48 trillion) market cap, Bitcoin would commerce round US$761,900 (AU$1.16 million) per coin, primarily based on the mounted 21 million provide. So that suggests a couple of 765% rise from costs close to US$90,000 (AU$134K).

The forecast appears in Ark’s “Huge Concepts 2026” report revealed Wednesday. The report argues bitcoin is turning into the main asset in an institutional crypto allocation, supported by increasing ETF use, extra company treasury holdings, and a decline in volatility in contrast with earlier cycles.

Based mostly on ARK’s forecast, bitcoin is more likely to dominate the market cap for cryptocurrencies, growing at a compound annual progress fee (CAGR) of ~63% through the subsequent 5 years, from almost ~$2 trillion to ~$16 trillion by 2030.

Learn extra: Crypto Investment Products See Largest Weekly Inflows Since October 2025

Huge Bitcoin Projections

The report initiatives bitcoin’s market cap may develop at a couple of 63% compound annual fee over the following 5 years, from almost US$2 trillion (AU$3.06 trillion) to about US$16 trillion (AU$24.48 trillion) by 2030.

It additionally says the 2030 outlook has stayed largely unchanged regardless of two mannequin updates: a 37% improve within the “digital gold” addressable market after gold’s market cap rose 64.5% in 2025, and a reduce to expectations for Bitcoin as an emerging-market protected haven as a result of fast stablecoin adoption in growing economies.

Exterior Bitcoin, the report expects a lot of the remaining market worth to return from sensible contract platforms, forecasting sensible contract networks to collectively attain about US$6 trillion (AU$9.18 trillion) in market cap by 2030.

In keeping with the agency, that market cap can be achieved by on-chain finance, tokenised securities and decentralised purposes (dApps), and producing annualised income of roughly US$192 billion (AU$293.76 billion) at a median take fee of 0.75%.

Two to 3 Layer 1 sensible contract platforms ought to take the lion’s share of the market, however garner extra market cap from their financial premium (store-of-value and reserve asset traits) than discounted money flows

Ark Make investments

Ark Make investments Associated: How Zero-Knowledge Proofs Are Turning Bitcoin into a Settlement Layer

The submit Cathie Wood’s Ark Sees Bitcoin Hitting $16T Market Cap by 2030 appeared first on Crypto News Australia.