2026 is rising as a defining milestone for world finance. President Trump already signed the Genius Act on July 18, 2025, establishing shopper safety, month-to-month transparency, compliance, redemption rights, and full reserve backing for tokenised {dollars} – stablecoins.

Though quickly postponed, the CLARITY Act is to additional modernize finance by permitting secure yield applications, now contested by banks for purportedly giving crypto exchanges unfair benefit. Dealing with staunch opposition from TradFi, the upcoming draft lacks ‘readability’ in lots of areas, as noted by Brian Armstrong, CEO of Coinbase.

Nonetheless, each acts, in some kind or one other, sign an unmistakable shift in regulatory posture. Stablecoins are not handled as a peripheral crypto innovation however as a core element of the long run monetary system.

The query is, what’s to turn out to be of the crypto market with a stablecoin surge at hand? First, let’s look at what stablecoins have already turn out to be.

Stablecoins: Digital Export for the US Treasury

Through the pandemic narrative, the technocrat push for digital IDs (through COVID certificates) and “construct again higher” mania, it appeared virtually a certainty {that a} Central Financial institution Digital Forex (CBDC) would turn out to be a actuality. But, solely the EU, because the West’s main financial zone, is actively pursuing it.

In early September, Institute for European Policymaking at Bocconi College noted that the European Central Financial institution (ECB) “should step up” if President Trump weakens the Federal Reserve. Moreover, on January 13, 2026, the ECB launched a statement from Christine Lagarde that central bankers “stand in full solidarity” with the Federal Reserve System.

These sentiments indicate that the ECB is subservient to the Fed. In fact, this is also extrapolated from the actual fact of greenback hegemony. Particularly, if the Fed chooses a “hawkish” mode, whereas the ECB is within the “dovish” mode, the Euro weakens. This makes power and imports costlier, in the end driving up inflation.

Likewise, the ECB depends on everlasting swap traces by the Fed to offer greenback liquidity to European banks. In different phrases, the ECB’s purported independence is reliant on the Fed’s policymaking.

With that in thoughts, it’s simpler to know why the Fed deserted the CBDC venture, in contrast to the ECB. In any case, a CBDC would add little to Washington’s strategic place whereas introducing substantial political threat. On the home entrance, it could additionally collide head-on with American sensitivities round surveillance and monetary privateness.

On this mild, stablecoins are successfully privatized CBDCs that flow into globally, comparable to on Ethereum, Solana or Tron. Tether alone, issuer of USDT, backed its $181.2 billion stablecoin with $112.4 billion price of U.S. Treasury Payments, as of September 2025. For comparability, this single non-public firm holds extra T-bills than Germany’s holdings, whereas Japan nonetheless ranks first at $1.2 trillion in T-bills.

Against this, the ECB’s CBDC push reveals Europe’s structural weak spot. The digital euro will not be a worldwide export product and a option to venture financial energy outward. The ECB brazenly admitted as a lot in November final 12 months.

“Important development in stablecoins may trigger retail deposit outflows, diminishing an necessary supply of funding for banks and leaving them with extra risky funding total.”

In reality, the ECB is concerned about stablecoin focus and de-pegging occasions that might have an effect on the U.S. Treasury markets, as soon as once more confirming its subservience.

Now that we’ve cleared up this necessary dynamic, what occurs if stablecoins really find yourself strengthening the US greenback? Will this be helpful or detrimental for the crypto market?

However first, we have to revisit the Greenback Milkshake Concept.

The Greenback Milkshake Concept in a Nutshell

Regardless of how weak the U.S. is perceived, with numerous racial strife, mass welfare fraud, exorbitant funds deficits and degraded infrastructure, the greenback hegemony continues to be there to service world liquidity.

Accordingly, Brent Johnson proposed that the worldwide financial system is a big milkshake of liquidity, with the US greenback because the straw. And in occasions of stress, capital doesn’t simply go away markets however it’s sucked into the US greenback because the world’s reserve foreign money, deeply entrenched into capital markets.

Within the context of stablecoins, the Greenback Milkshake Concept is already boosted by the GENIUS Act, and certain with the upcoming CLARITY Act. Consequently, stablecoins like USDC and USDT could be essentially the most environment friendly supply system for US financial coverage ever invented.

To place it otherwise, stablecoins would exchange the outdated, slim paper straw with a high-speed digital turbine within the type of numerous blockchains, both institutional just like the Canton Community or decentralized. But, this additionally implies that the greenback would strengthen as nicely. In any case, the demand for U.S. Treasuries, serving as a reserve for stablecoins, sometimes strengthens the greenback by attracting overseas capital in search of secure and high-yielding U.S. property.

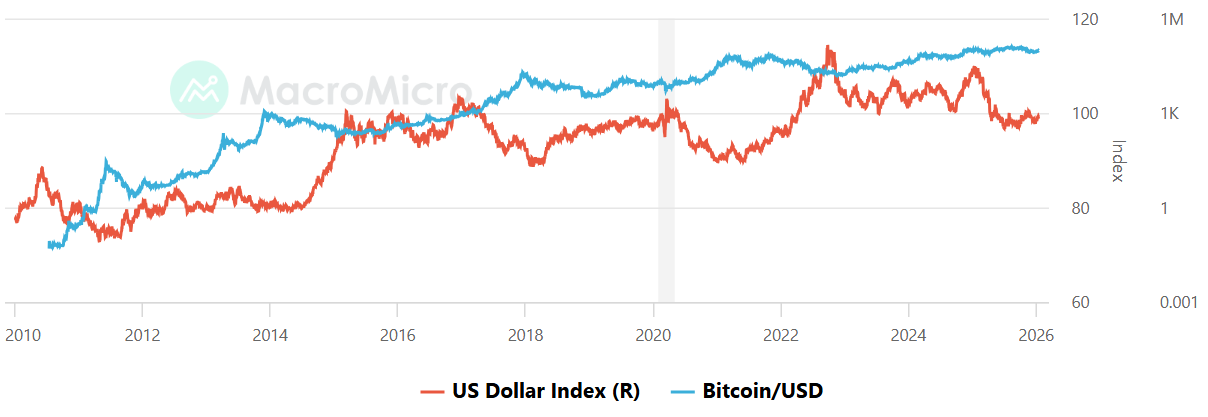

This correlation solely broke down throughout President Trump’s world tariff realignment. Nonetheless, with tariff nervousness within the rearview mirror, it’s expected that the greenback will strengthen. In that case, it’s simple to turn out to be fearful because the greenback power index (DXY) sometimes has an inverse correlation with Bitcoin.

Subsequently, a case might be made that the stablecoin surge would find yourself making crypto weaker, but additionally stronger. Let’s look at each situations.

Stablecoin Surge: The Stronger Case

If stablecoins efficiently strengthen the greenback, the crypto market may transition from a speculative area of interest right into a systemically necessary world utility. This might be the case for a number of causes.

The US authorities would have a vested curiosity within the survival of the blockchain rails the stablecoins run on. All through 2025, the Trump admin officers signaled such a stance of political shielding on quite a few events. In comparison with Gary Gensler’s reign of arbitrary terror, this was unthinkable simply two years in the past.

By appearing as a digital greenback, stablecoins hold capital trapped throughout the crypto ecosystem. As an alternative of cashing out to a conventional financial institution, customers transfer into USDT or USDC. Consequently, which means capital is able to rotate again into BTC, ETH or any variety of infrastructure coins at a second’s discover.

In fact, the CLARITY Act must be favorable sufficient to make that occur.

Lastly, if the greenback turns into the killer app through stablecoins, TradFi giants like BlackRock or JPMorgan would turn out to be main contributors. BlackRock’s BUIDL fund already operates on a number of blockchains like Ethereum, Solana, Avalanche, Aptos, and BNB Chain, in addition to L2 scaling options like Arbitrum, Optimism and Polygon.

Briefly, stablecoins may turn out to be a high-velocity on-ramp. Throughout the context of the milkshake, capital will not be solely sucked into digital {dollars} nevertheless it sits in crypto-native wallets.

Stablecoin Surge: The Weaker Case

If stablecoins find yourself strengthening the greenback, they may act as a Trojan Horse, within the sense they may exchange the crypto ethos of decentralization with a digital model of TradFi.

In October 2025, 10 major banks launched into an initiative to create blockchain-based property pegged to G7 currencies.

“The target of the initiative is to discover whether or not a brand new industry-wide providing may convey the advantages of digital property and improve competitors throughout the market, whereas making certain full compliance with regulatory necessities and greatest follow threat administration.”

Furthermore, if the greenback’s power is the aim, the US authorities will demand the power to freeze property and implement KYC on each pockets. To function freely, corporations like Tether are tied on the hip with USG, as evidenced by the multi-million greenback collection of stablecoins freezes, possible tied to the particular operation in Venezuela.

If this turns into the norm, the basic proposition of the crypto market weakens, as censorship resistance is steadily eliminated. Extra importantly, if the greenback turns into extremely environment friendly, accessible 24/7 from a digital pockets and programmable through stablecoins and accompanied by sensible contracts, the urgency for a non-sovereign foreign money like Bitcoin might diminish – echoing older debates comparable to dividend irrelevance theory, the place the construction of returns issues lower than the underlying system that generates them.

In any case, the worldwide consumer might choose a handy option to pay for items, as a substitute of on the lookout for a long-term hedge. Lastly, by linking crypto on to the US Treasury market, a contagion bridge could also be erected. That’s to say, if there’s a disaster within the US bond market, this stress may quickly transmit to a liquidity disaster in crypto, probably inflicting a market-wide hearth sale that decentralized property can not structurally forestall.

This might depend upon redemption mechanics, market construction and leverage.

On the Australian Stablecoin Entrance

Throughout 2025, Australia crossed a number of milestones. Most notably, the Australian Securities and Investments Fee (ASIC) up to date its steerage on digital property in October 2025. This was additional clarification of how financing legal guidelines apply to stablecoins, granting momentary aid for distributors till June 2026.

In December 2025, ASIC additionally issued new exemptions for intermediaries dealing with eligible stablecoins and wrapped tokens, with one other exemption from sure licensing necessities. Within the meantime, after Nationwide Australia Financial institution (NAB) shuttered its AUDN stablecoin venture, ANZ took the stablecoins reins with A$DC.

Most lately, Zodia Custody, beforehand invested in by NAB Ventures, expanded its digital asset portfolio to AUDM – the Australian stablecoin issued by Macropod.

AUDM is extremely regulated, owing to the Australian Monetary Companies Licence (AFSL), which makes it the primary institutional-grade stablecoin within the Australian market. As such, AUDM is backed 1:1 with bodily AUD held in 4 main Australian banks – the “Massive 4”.

Nonetheless, holding AUDM continues to be not lined by the federal government’s Monetary Claims Scheme (deposit insurance coverage). Likewise, it doesn’t pay curiosity or yield however serves primarily as a cost and settlement instrument. Relying on the finalized CLARITY Act, this is able to make AUDM an inferior digital product.

The submit Stablecoin Surge: Threat or Boon? appeared first on Crypto News Australia.