- DePIN token costs stay depressed, with most tasks launched between 2018 and 2022 nonetheless buying and selling 94% to 99% under their all-time highs.

- On-chain income hit $72 million in 2025, signaling a shift towards sustainable enterprise fashions with valuations now averaging a sensible 10–25x income.

- Prime networks are proving real-world demand, with the sector’s $10 billion market cap more and more pushed by cost-efficient infrastructure relatively than pure hypothesis.

The overwhelming majority of DePIN token costs are nonetheless crushed, however some networks are beginning to present actual enterprise traction.

Messari says most DePIN tokens launched in 2018–2022 stay 94%–99% under their all-time highs. That’s the speculative premium evaporating.

The Main DePINs at the moment are actual, worthwhile, and rising onchain companies, and so they’re buying and selling at costs that suggest little likelihood of survival, not to mention success. The perfect DePIN tokens as we speak present publicity to next-gen infrastructure companies which have confirmed consumer demand, pushed by price and velocity benefits.

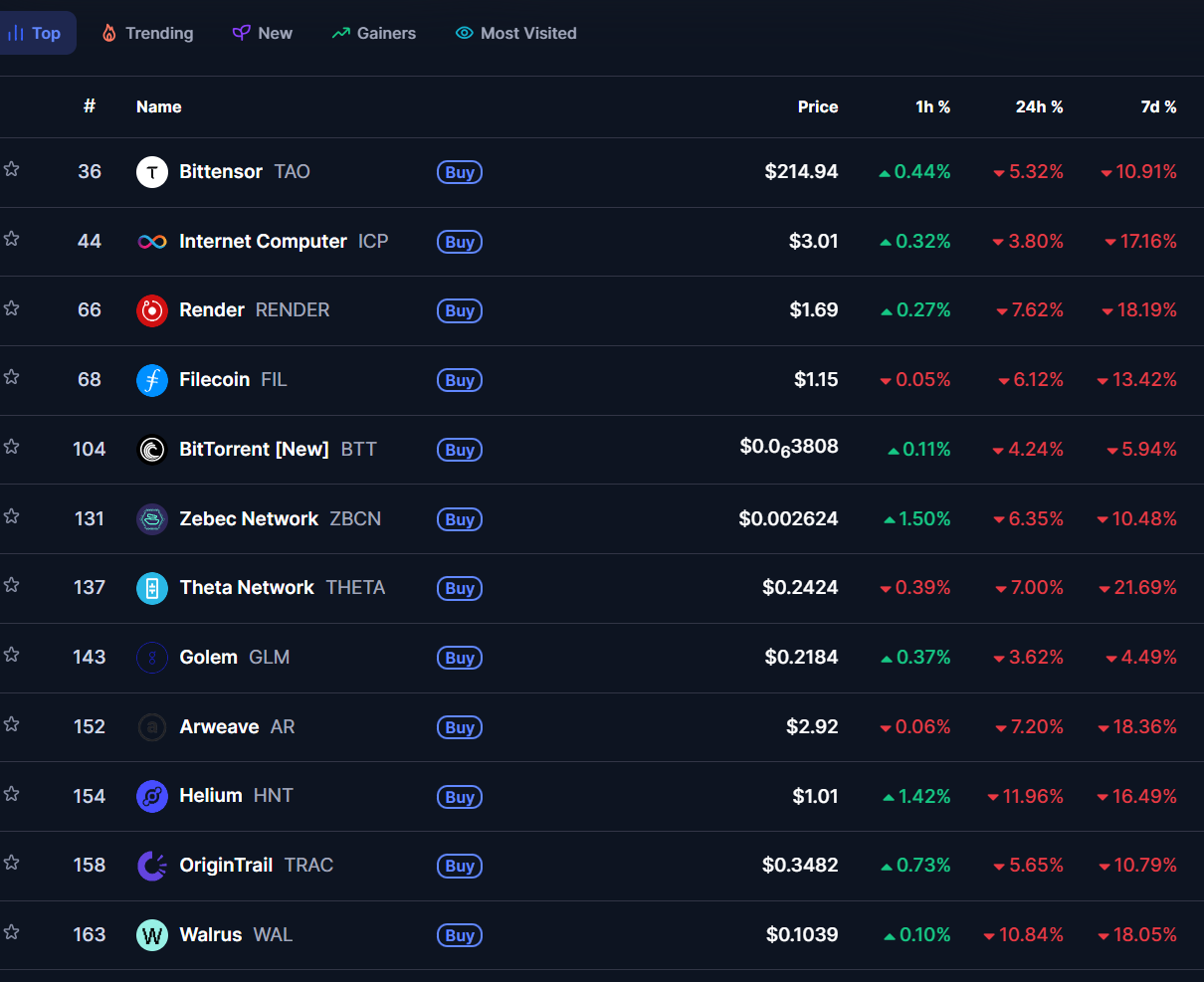

One easy have a look at the overall market capitalisation of the DePIN sector on CoinMarketCap and so they’re all just about in deep crimson, not simply previously seven days, however for a number of months now.

DePIN Sector Nonetheless Producing Income

But the sector continues to be producing measurable exercise. About US$10 billion (AU$15.3 billion) in circulating market cap and roughly US$72 million (AU$110 million) in on-chain income in 2025.

DePIN (decentralised bodily infrastructure networks) could be summarised as crypto-coordinated {hardware}. In them, networks pay customers to deploy, function and keep real-world infrastructure.

Learn extra: Stablecoins Could Drain $500B From U.S. Banks, Standard Chartered Warns

However valuations have reset laborious. In 2021, some DePIN tasks traded at greater than 1,000x income. At present, the highest revenue-generating networks are nearer to 10–25x income. That’s nearer to how early-stage tech will get priced when traders care about enterprise fundamentals and never simply narratives.

Associated: Australia’s Regulator Trains Its Sights on Crypto’s Regulatory Grey Zones

The put up DePIN Isn’t Dead — It’s a $10B Revenue-Driven Market, Messari Says appeared first on Crypto News Australia.