- The Malaysian central financial institution’s Digital Asset Innovation Hub has launched three pilot initiatives to discover using stablecoins and tokenised deposits.

- The initiatives will discover using Malaysian ringgit-pegged stablecoins and tokenised deposits for each home and cross-border transactions, with the outcomes used to tell future coverage course together with the attainable future launch of a wholesale CBDC.

Malaysia’s central financial institution is about to launch three regulatory sandbox initiatives to discover using distributed ledger expertise (DLT) in “real-world functions.”

The Financial institution Negara Malaysia (BNM) announced February 11 that its Digital Asset Innovation Hub (DAIH) will ship the pilot initiatives, with a concentrate on “wholesale cost use instances throughout each home and cross-border transactions.”

The initiatives will contain using stablecoins pegged to Malaysia’s ringgit fiat foreign money and tokenised deposits. Malaysia is a Muslim-majority nation and a few of the use-cases can even discover “Sharia-related concerns.”

The three particular use instances listed on the BNM’s web site are:

- The usage of ringgit stablecoins for business-to-business funds involving Customary Chartered Financial institution and Capital A;

- The usage of tokenised deposits for funds involving Malayan Banking (Maybank); and

- Utilizing tokenised deposits for funds, this time involving CIMB Group Holdings (CIMB).

It hasn’t been disclosed which community might be used within the initiatives. Nonetheless, related central financial institution trials of digital asset–based mostly expertise, similar to Australia’s Undertaking Acacia, have concerned a number of networks.

These initiatives might be performed in a managed setting and contain collaboration with ecosystem companions, together with company purchasers of economic establishments and different regulators.

BNM mentioned the outcomes of the initiatives could possibly be used to tell the eventual implementation of a Malaysian wholesale central financial institution digital foreign money (wCBDC).

The first objective within the medium-term is to permit the financial institution to evaluate the implications of stablecoins and tokenised deposits for Malaysia’s “financial and monetary stability,” and to information additional coverage improvement. BNM famous that it intends to supply extra details about plans to make use of ringgit stablecoins and tokenised deposits earlier than the top of 2026.

Malaysia’s DAIH was launched lower than a yr in the past, in June 2025. On the time of its launch, the BNM described the innovation hub’s objective as being to “stimulate monetary innovation in a managed setting,” with a view to supporting “the event of digital property and the applying of modern monetary expertise in Malaysia.”

Associated: UK Lawmakers Hear Skepticism on Stablecoins as Lords Launch Regulation Inquiry

Malaysian Central Financial institution Lays Out 3-Yr Tokenisation Street Map

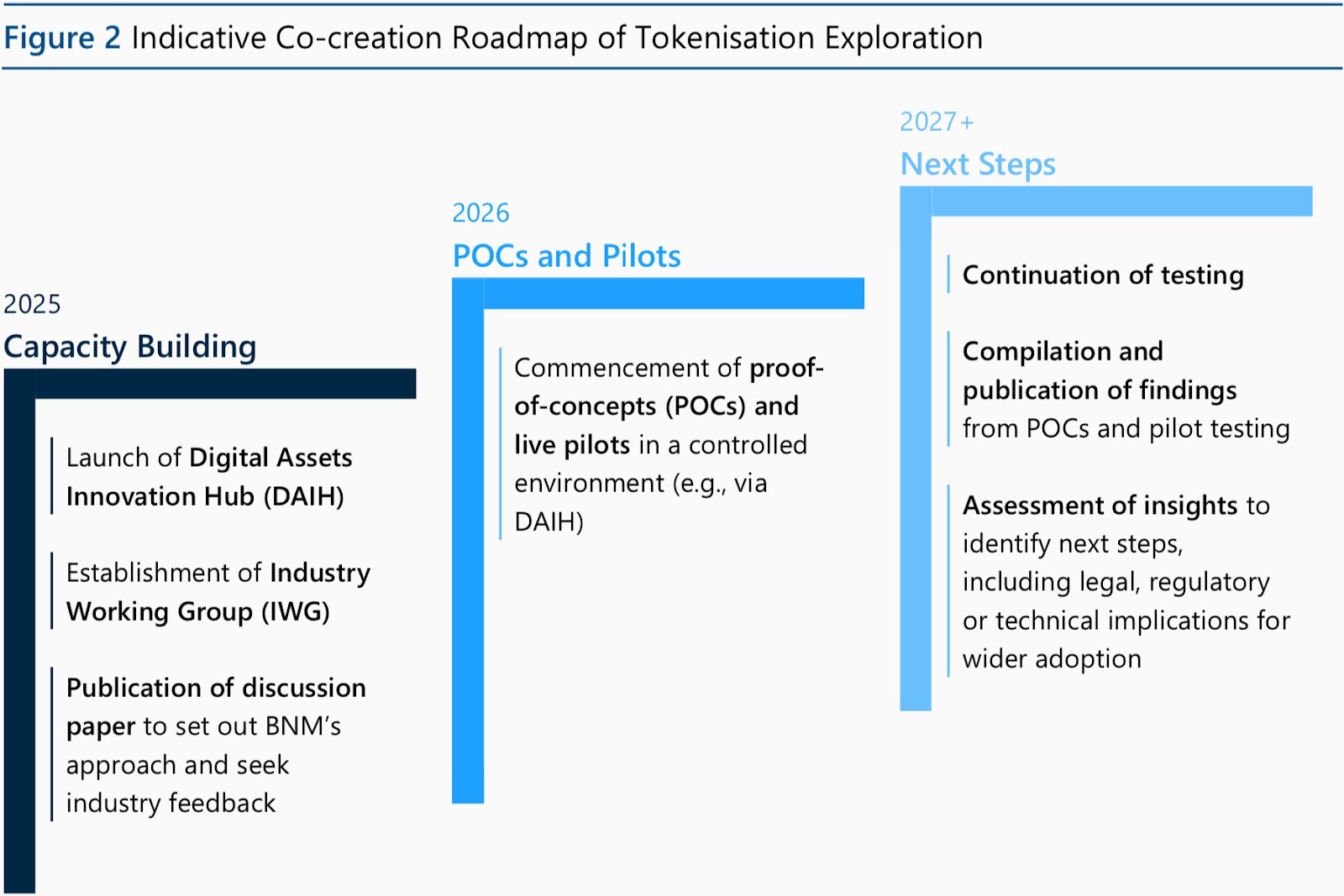

In October of final yr, the BNM launched a discussion paper titled Asset Tokenisation within the Malaysian Monetary Sector, which laid out a 3-year roadmap for the event of digital property with a specific concentrate on tokenisation.

The dialogue paper laid out what it calls a “co-creation roadmap,” involving co-operation between “regulators, business individuals and different stakeholders,” to discover and form the implementation of tokenisation within the Malaysian economic system.

The launch of the BNM’s stablecoin and tokenisation initiatives constitutes a part of stage 2 of this street map. In line with the roadmap, following the completion of the pilot initiatives by the top of 2026, any insights gained might be used to information additional regulatory, authorized and technical progress in stage 3, beginning in 2027.

There have been a number of notable latest developments round digital property in Malaysia, together with the announcement in December by Capital A (the operator of the airline Air Asia) that it had signed a letter of intent to develop and take a look at a brand new ringgit-pegged stablecoin in partnership with Customary Chartered Financial institution via the DAIH.

Below this plan, Customary Chartered can be the issuer of the stablecoin whereas Capital A and its broader ecosystem would look to develop, take a look at and pilot “real-world wholesale use instances.”

Associated: Visa, Mastercard Play Down Stablecoins for Payments as Consumer Demand Falls Short

Additionally in December, the present King’s eldest son, Ismail Ibrahim, launched a ringgit-pegged stablecoin, RMJDT, to be issued by telecommunication firm, Bullish Goal — which can be owned by Ibrahim.

Whereas at the moment nonetheless present process testing within the regulatory sandbox, a statement from Zetrix, the privately-owned blockchain on which RMJDT will run, mentioned that the stablecoin’s objective is to “strengthen the worldwide use of the Malaysian Ringgit in cross-border commerce settlements and to behave as a catalyst for attracting elevated overseas direct funding (FDI) into Malaysia.”

The publish Malaysia’s Central Bank Launches Stablecoin, Tokenised Deposit Pilots appeared first on Crypto News Australia.