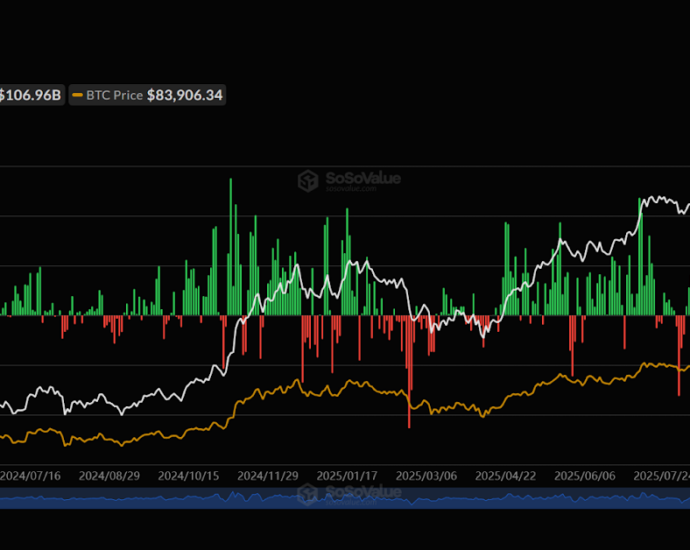

Morgan Stanley Taps BNY Mellon and Coinbase as Custodians for Bitcoin ETF

Morgan Stanley has appointed BNY Mellon and Coinbase Custody to safeguard Bitcoin for its proposed Morgan Stanley Bitcoin Belief ETF. A lot of the fund’s Bitcoin might be saved offline in chilly storage, with smaller quantities moved to scorching wallets to facilitate ETF share creation and redemption. BNY Mellon mayContinue Reading