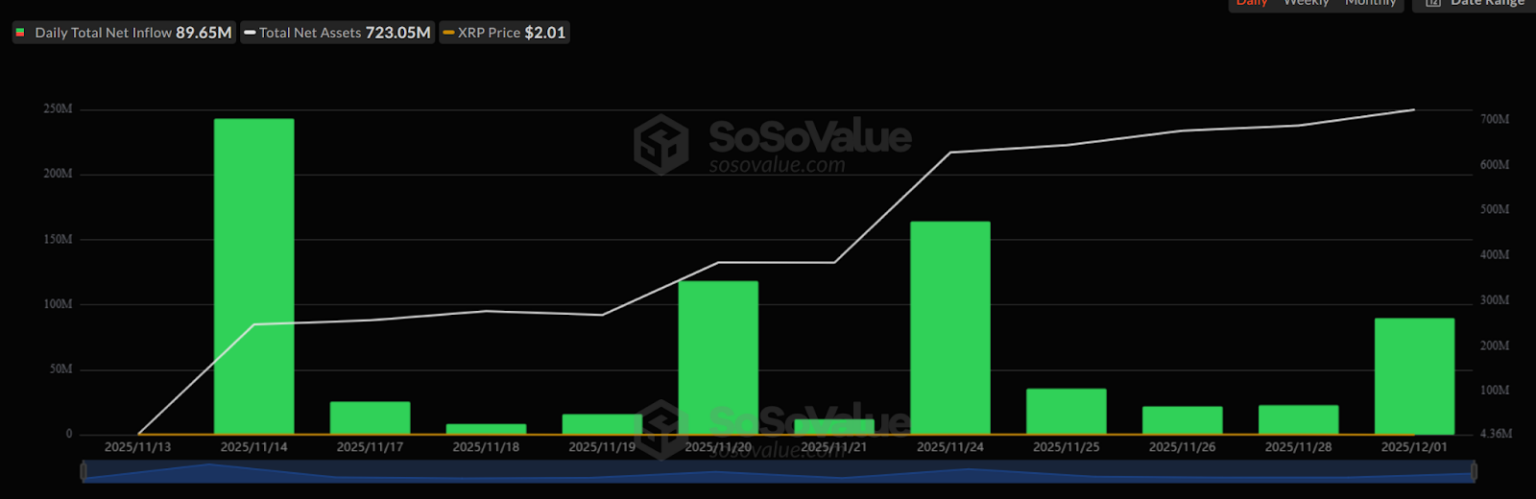

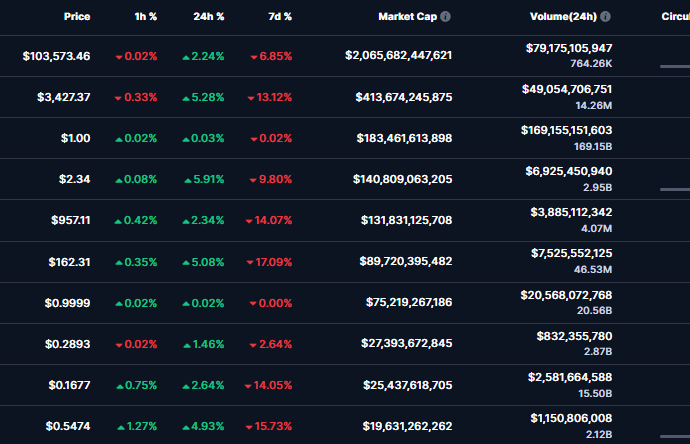

XRP ETFs Post 11th Straight Day of Inflows as Price Hovers Above $2

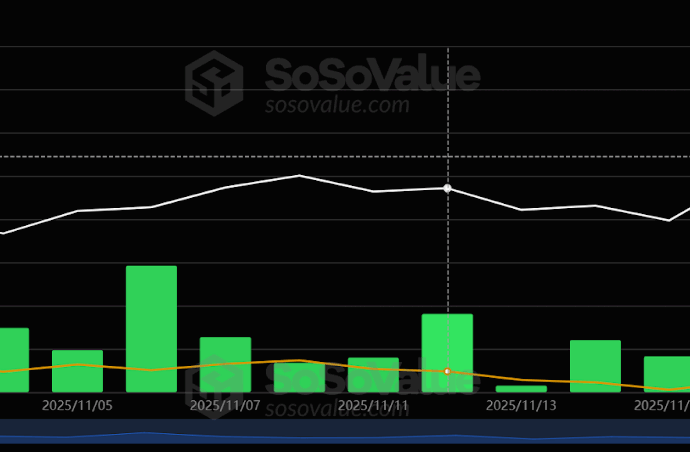

US spot XRP ETFs have recorded 11 consecutive days of web inflows, pulling in US$89.65 million on Monday and pushing whole inflows since launch to US$756 million. The cumulative influx has absorbed practically 330 million XRP in 11 days, surpassing Solana ETF flows and outpacing present Bitcoin ETF inflows. TheContinue Reading