Giving projects the ability to build on its distributed ledger network, Ethereum formed the bedrock for what we know today as decentralized finance or DeFi.

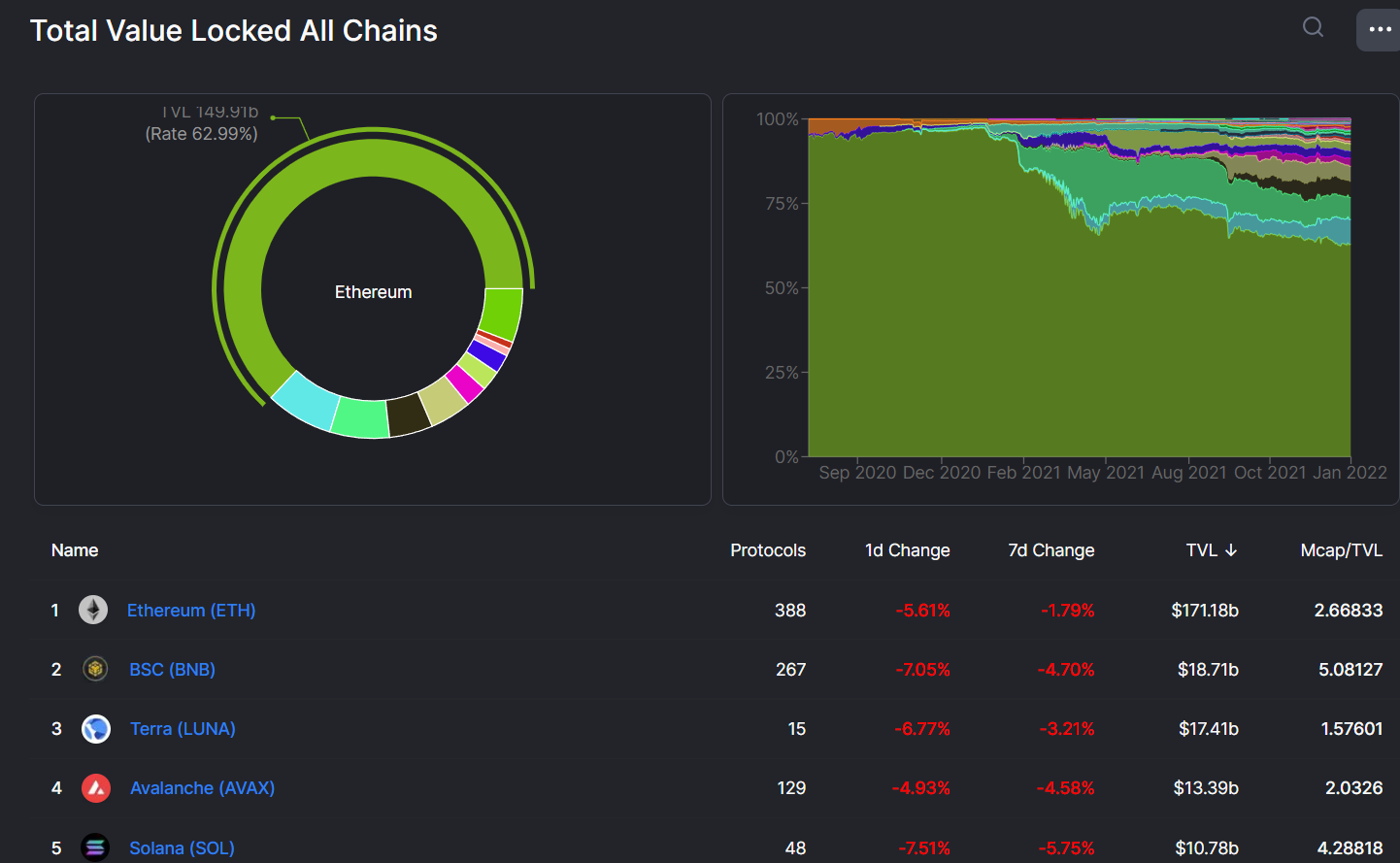

As the first DeFi chain, Ethereum enjoys unrivaled popularity and dominance in the DeFi industry – contributing nearly two-thirds of the value locked in the DeFi ecosystem.

Ethereum contributes $171.1 billion of the $269 billion locked in 87 DeFi chains. While this dominance and imminent ETH 2.0 migration has caused many to believe that Ethereum could only grow even further, JPMorgan believes it could lose this dominance.

Ethereum Could Lose its DeFi Dominance

According to analysts at JPMorgan, Ethereum’s dominance could wane even further as competitors push deeper into decentralized finance. Ethereum once dominated as much as 97% of the DeFi industry.

In addition, Ethereum’s late launch of sharding – an essential feature for Ethereum’s improved scalability – could mean the pioneer of DeFi play catchup in an industry where projects are offering greater scalability.

While Ethereum can complete between 15-45 transactions per second, Terra can reach 10,000 TPS and Solana up to 50,000 TPS. The average block time of Ethereum lies between 10 – 20 seconds, whereas Terra has an average block time of 6 seconds.

With the sharding feature expected to bring Ethereum up to speed with these faster chains looking to launch in 2023, JP Morgan believes the network’s market share in DeFi could continue to drop.

On The Flipside

- While JP Morgan believes Ethereum’s DeFi dominance is at risk, it believes that Ethereum would continue outperforming the pioneer crypto, Bitcoin.

Why You Should Care

The DeFi industry is growing at a frantic pace, and chains capable of supporting the growth of protocols look to be the biggest gainers.