Read in the Digest;

- Google Pushes Deeper Into Blockchain and Crypto – Partners with Coinbase, Hires Paypal Vet

- Grayscale Bitcoin Fund is Down 30%, Whales Add 40k BTC in Last 2 Days

- Ethereum Surpasses Visa’s Value Moved in 2021, JPMorgan Calls High Gas Fee A Big Problem for ETH

- Cardano Makes Metaverse Debut with Pavia Launch

- CEO of Crypto.com Admits that 400 Accounts were Exploited in Hack

Google Pushes Deeper Into Blockchain and Crypto – Partners with Coinbase, Hires Paypal Vet

Alphabet Inc.’s Google has ventured deeper into blockchain technology by forming a blockchain and distributed computing division. Led by Shivakumar Venkataraman, the new division will focus on “blockchain and other next-gen distributed computing and data storage technologies.”

Confirming the comment of Bill Ready, Google’s President of Commerce, that the company is paying “a lot of attention” to cryptocurrencies, Google has hired PayPal veteran Arnold Goldberg to lead its payments division. The hire could see Google Pay expand its services to include cryptocurrencies.

Bill Ready explained that the move is part of Alphabet Inc.’s broader plans to partner with a wide range of financial services, including cryptocurrencies. One of such partnerships is with America’s leading crypto exchange, Coinbase.

According to reports, Google’s partnership with Coinbase will see the duo work together to develop a means of storing cryptocurrencies in “digital cards” while still having users pay in traditional currencies.

Flipsider:

- Jack Dorsey has criticized the entrance of megacompanies and venture capital firms to centralize the blockchain industry.

Why You Should Care

According to Bill Ready, crypto is something Google needs to pay a lot of attention to and evolve with it.

Grayscale Bitcoin Fund is Down 30%, Whales Add 40k BTC in Last 2 Days

The world’s largest institutional Bitcoin fund – Grayscale Bitcoin Trust’s (GBTC) – has seen its discount relative to the underlying cryptocurrency widen. The drop, which spans over the past two months, has seen GBTC hit a discount of 26.5%.

With Bitcoin hovering around $42,000, the GBTC would be priced at equivalent to $30,870. In 2022 alone, the $27 billion GBTC Fund has dropped by almost 17%, outpacing Bitcoin’s nearly 9% decline.

Flipsider:

- Despite the two months-long price drop, whales have continued to increase their Bitcoin holdings

- According to whale tracker Santiment, large Bitcoin wallets have added almost 40,000 BTCs (worth around $1.68 billion at Bitcoin’s current price of $42k) in the last 48 hours.

Why You Should Care

Despite the bears applying pressure, bulls have taken a stance to hold their stake – increasing the argument that bitcoin can be used as a store of value.

Ethereum Surpasses Visa’s Value Moved in 2021, JPMorgan Calls High Gas Fee A Big Problem for ETH

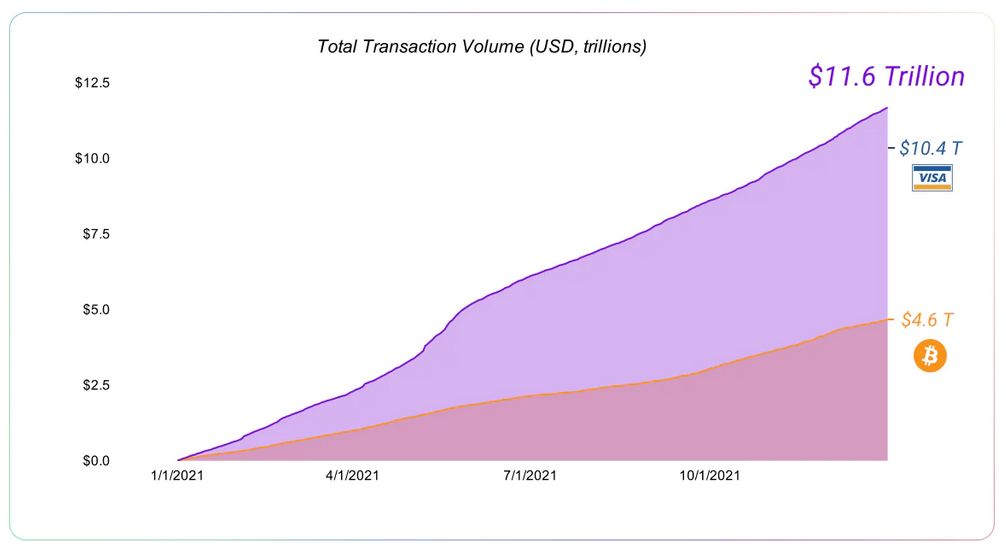

While Ethereum’s ongoing network migration was one of the project’s most talked about milestones in 2021, the smart contracts platform achieved even more. Moving more value than Visa in 2021 is one of many unsaid milestones for Ethereum.

According to new reports, Ethereum moved approximately $11.6 trillion, outperforming the payment giant Visa, which moved $10.4 trillion in 2021. On the other hand, Bitcoin managed to move just $4.6 trillion in the same period.

Ethereum total transaction volume in 2021. Source: Josh Stark

Flipsider:

- Although Ethereum has made significant advances, JP Morgan has opined that the platform’s high gas fee and network congestion are a big problem.

- These led to a drop in Ethereum’s NFT market share from 95% to 80% – at the beginning and end of 2021, with Solana being one of the growing NFT hubs.

- According to JP Morgan, if Ethereum continues losing its NFT and DeFi dominance, it could pose a big problem to Ether’s valuation.

Why You Should Care

According to Pantera Capital, improving its scalability with its PoS migration, Ethereum could be in line to facilitate 50% of all global transactions in ten years.

Cardano Makes Metaverse Debut with Pavia Launch

Pacesetting proof-of-stake network, Cardano, has made its metaverse debut with the launch of Pavia on its blockchain. Play-to-earn gaming and non-fungible token (NFT) project – Pavia – calls itself the “first Cardano metaverse.”

Cardano’s metaverse project has been touted to be the next Decentraland, only that it uses the eco-friendly Cardano blockchain instead of Ethereum. Pavia launched with an in-game currency – PAVIA – used for utility inside its metaverse ecosystem.

The project has issued around 100,000 “land parcels,” each being minted as a uniquely numbered Cardano NFT (CNFT) based on coordinates. The asking prices for plots of land in Pavia going for more than $1,000 apiece.

Pavia has announced that it would add liquidity to Cardano decentralized exchanges [DEXs] and explore cross-chain liquidity in the first quarter of 2022.

Flipsider:

- Cardano makes a late entry into the metaverse and looks to compete with already established projects like The Sandbox and Decentraland.

Why You Should Care

Despite the slow start to life on smart contracts, Pavia could be the first of many big projects launching on the Cardano blockchain.

CEO of Crypto.com Admits that 400 Accounts were Exploited in Hack

After shutting down withdrawals for around 14 hours due to unauthorized activities, Singapore-based cryptocurrency exchange – Crypto.com, announced that all funds were safe and accounted for, despite reports of up to $15 million in ETH missing.

Contradicting their earlier reports, the exchange’s CEO, Kris Marszalek, stated in an interview that 400 accounts were breached as a result of the hack. According to Mr. Marszalek, all affected customers have been reimbursed.

Marszalek explained that the exchange is still working on a post-mortem which would be made public “in the next couple of days.” The exchange has asked customers to reset their two-factor authentication out of “an abundance of caution.”

Flipsider:

- While PeckShield put the losses at $15 million, OXT Research speculates that the hack may actually have cost the exchange $33 million.

Why You Should Care

The hack serves as a reminder for exchanges to constantly improve their security architecture to keep their users’ funds safe.