Read in the digest:

- Cryptocurrency markets recover after Russia scare, but stablecoins are the biggest winners.

- Bitcoin donations pour in for the Ukrainian military, but Russia could also turn to crypto.

- Jack Dorsey’s ‘Block’ hits unprecedented revenue levels thanks to Bitcoin.

- ETH zkSynct testnet offers a ray of hope for Ethereum users with cheaper transaction fees.

- Despite over 15 million SHIB burned, the token slides by over 12% in 24 hours.

Markets Recover, But Stablecoins Soar In Value

After the start of the Russian invasion on Ukraine, the global cryptocurrency market lost over $400 billion as prices plummeted. Barely 24 hours later and the markets are in recovery mode, but stablecoins seem to be headed to the moon with their combined market capitalization standing at $180 billion.

One year ago, the number was just $34 billion, making the leap of stablecoins nothing short of remarkable, even in the midst of a brewing global conflict. The reason for the growth of the asset class has been attributed to the volatility faced in the cryptocurrency markets as traders convert their assets into “stablecoins” to wait out the downtrends, without taking funds out of the ecosystem entirely.

USDT remains the leading stablecoin with a market capitalization of $80 billion, while USDC and BUSD have $53 billion and $6 billion respectively. According to a hypothesis by Arcane Research, if USDC and USDT continue on their present trajectory, USDC will flip USDT before the end of June.

Flipsider:

- There are only two stablecoins in the top ten largest cryptocurrencies, despite their soaring growth.

- Binance USD stands at 11th and has to stave off Avalanche for a spot in the top 10.

Why You Should Care

Stablecoins are beginning to find increasing adoption from simple uses in settling payments, to navigating the volatility of the cryptocurrency markets.

BTC Donations to the Ukrainian Military

Bitcoin is showing the multiplicity of its use cases even in the face of multinational armed conflict. Reports indicate that ‘Come Back Alive’, a Ukrainian NGO, has raised over $400,000 worth of cryptocurrencies for the Ukrainian army.

According to blockchain analytics firm Elliptic, the average amount donated to the cause is between an estimated $1000 and $2000 from over 300 individuals. Elliptic notes that there has been a steady rise in Ukrainian NGO and volunteer groups using cryptocurrencies to raise funds through donations, with the current amount raised by these organizations exceeding $500,000.

The use of cryptocurrency funding allows “international donors to bypass financial institutions that are blocking payments to these groups,” noted Elliptic. Bitcoin took a hit at the start of the conflict and will be interesting to see if the asset will holds up amid the raging chaos.

Flipsider:

- While Ukrainians are in receipt of Bitcoin funding, Russia could also turn to cryptocurrencies as a way of circumnavigating the incoming sanctions imposed by the U.S. and other countries.

Why You Should Care

The use of cryptocurrency donations has spiked in recent weeks as traditional platforms such as ‘GoFundMe’ impose certain restrictions around causes.

Block BTC Revenue Hit 2 Billion In Q4

Block, formerly known as Square, has released its 2021 Q4 earnings report, displaying a gargantuan $4.08 billion in net revenue. Almost half of the sum comes from Bitcoin revenue, with the figure pegged at $1.96 billion.

Jack Dorsey’s Cash App has become a major vehicle for the purchase of Bitcoin, contributing a large chunk to this astounding revenue. The company notes that the rise in asset prices in 2021 played a significant role, seeing the company’s revenue spike by over 124%.

Only 2% of the revenue will be calculated as profit for Block, which is around the percentage charged for transaction fees. According to the earning report, Block netted a profit of $46 million, but the glut in Bitcoin prices could mean a bleak Q1 for the company.

Flipsider:

- Jack Dorsey’s firm stance on Bitcoin has brought him into direct conflict with proponents of other blockchains like Ethereum and Dogecoin.

- Cash App does not allow the purchase of other cryptocurrencies on the platform.

Why You Should Care

Block changed its name from Square in a bid to reflect its interests in Bitcoin and analysts are keeping a close watch to see if the rebrand will impact its profitability.

Eth zkSync Testnet Deployed

Ethereum’s zkSync testnet has been launched to experiment with ways of circumventing the soaring costs of transaction fees. The zero-knowledge roll-up is designed to operate without human input to validate transactions and would allow the deployment of dApps in Layer 2, but without the traditional challenges of scalability.

Developers believe that the deployment of these roll-ups are light years ahead, but the testnet offers a ray of hope to an Ethereum community praying that the days of expensive transaction fees are over. It is believed that the bulk of developers are lining up to begin deployment on zkSync 2.0.

This small win has had a positive mark on Ethereum’s valuation as the asset climbed by a staggering 12% to trade at $2,672. Seller exhaustion and recovery from the shock of Russia’s invasion have all contributed to the recent increase in value.

Flipsider:

- Ethereum’s struggles with its transaction fees have seen it lose some of its market share to blockchains like Solana and Polkadot.

Why You Should Care

Ethereum plays a significant role in the cryptocurrency ecosystem, housing a large number of dApps, NFTs and DeFi projects.

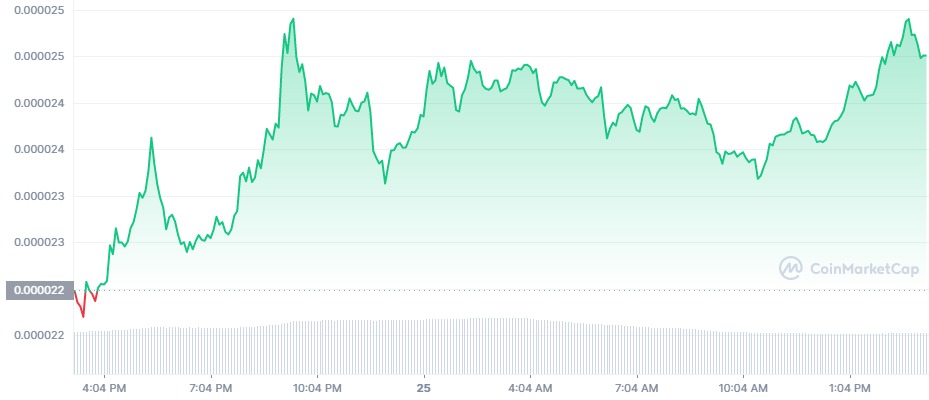

15.43 Million SHIB Burned as Token Plunges 12%

SHIB spiralled down by over 12% in the wake of the brutal downtrend of the cryptocurrency markets. The memecoin also burned a staggering 15.43 million tokens by transferring them to addresses where they cannot be spent or utilized.

Source: Coinmarketcap

The report of the burn was disclosed on the Shibburn Twitter page, an account that tracks token burns in the SHIB ecosystem. Token burns are used to reduce the overall supply of an asset for deflationary purposes.

With this most recent burn, there are now 549 trillion SHIB in circulation. Although trading volumes are on the rise, the asset’s price is a staggering 72% down from its all-time highs of 2021.

Flipsider:

- Despite the increasing frequency of the burns, SHIB has dropped down the leaderboard, ranking at 14th, two spots below its fellow memecoin rival, Dogecoin.

Why You Should Care

The deflationary event of a burn often serves to increase the value of the assets in circulation.