As the national currency of Turkey continues to plummet, Bitcoin represents an escape hatch for citizens looking to preserve wealth.

2021 was a rough year for the people of Turkey, as the country experienced rapid devaluation of its currency, the lira. Things haven’t improved in 2022 as the lira has suffered since Russia invaded Ukraine as sanctions and export bans have resulted in soaring commodity prices. According to official government reports,

https://twitter.com/WallStreetSilv/status/1502819230357483523

The government denied these shortages only to later ban exports of oils and margarine due to “domestic demand issues and problems with price movements.”

Bread lines are becoming a more common occurrence, as The New York Times reports shows in this article.

At the start of the year, the state raised electricity and natural gas tariffs that some estimate could raise household energy costs by up to 130%. Mind you this was before the war between Russia and Ukraine caused oil prices to spike.

The rising inflation has also resulted in soaring rent prices across the country. Rent prices increased some 60% in some districts of Istanbul this year. Turkish students are struggling to afford rent and have taken to the streets to protest by sleeping in parks to highlight their struggles.

Another friend explained to me how restaurants in Turkey for the first time started requiring a minimum dollar amount before customers were allowed to sit down and also started charging customers by the hour to use a heating lamp due to the rising energy costs.

In addition to the rising cost of living, locals also have to deal with opportunistic foreigners. Foreigners from neighboring countries like Bulgaria have been crossing the border to take advantage of the lira’s struggles by using their stronger currencies to clear out grocery stores. They pack their cars full of goods they purchase for cheap and then return home with their bounty. Turkey’s wealth is being pillaged by foreigners, adding pressure on ordinary Turkish people who are already struggling to afford food, housing and other essentials.

https://twitter.com/1e9petrichor/status/1467634582526779405?s=20

All of these developments have led to anger and desperation amongst the people of Turkey. As their savings continue to evaporate, they have taken to the streets to protest against their president’s economic policies and their wages.

Over 13,000 Turkish workers from 61 companies have gone on strike demanding higher wages according to independent researcher Labor Studies Group.

Some of the strikes have been successful and received up to 30% real wage increases, but even that didn’t keep up with the rising cost of living.

Last month, thousands marched in Istanbul to raise their voice against the direction of their economy and their country. This is what happens when money dies. When people’s life savings are destroyed and they are finding it harder to afford necessities, the only thing left to do is take to the streets and demand change.

https://twitter.com/TheInsiderPaper/status/1467171867266101248

How Are The People Of Turkey Protecting Themselves?

Much to the dismay of President Erdoğan, the people of Turkey did not heed his call to sell all of their gold and dollar holdings to protect the falling lira. The Turkish people are instead seeking refuge from the inflating lira in various stores of value like real estate, gold, dollars and bitcoin.

An Istanbul-based research company, Aksoy Research, recently took a poll and asked the people of Turkey, “If you had an extra 10,000 liras, which one would you invest in?”

The results were only 11.4% of respondents said they would keep their savings in the lira. The rest of the poll results were the following:

- 39.6% said they would invest in gold

- 18.9% said they would hold dollars

- 14.3% said they would hold cryptocurrencies

This poll corroborates some of the stories I’ve heard and data I’ve seen that shows a rush to dollars and gold amidst the lira’s turmoil.

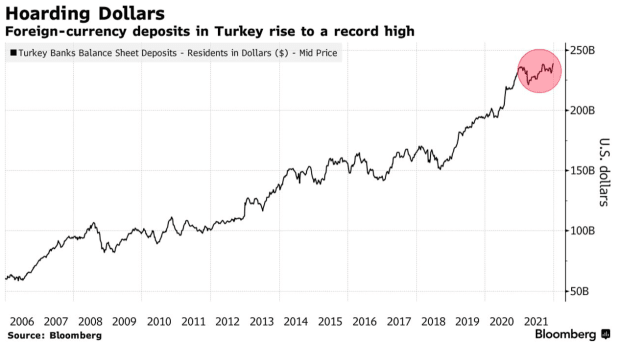

Foreign-currency deposits in Turkey hit a record high of $239 billion dollars at the start of the year.

This increasing dollarization in Turkey shouldn’t surprise anyone because dollars offer short-term stability for these individuals to pay their bills each month amidst the rising inflation. Turkey also imports most of its energy needs, which are priced in dollars, and also gorged on dollar-denominated debt coming out of the Great Recession. Both of these factors have contributed to the increased dollarization of Turkey’s economy over the last decade.

In Turkey, gold has been the preferred “under-the-mattress” protection from inflation for many generations. Gold has a central place in Turkish customs often given as gifts from births to weddings. Over the last couple of years, we’ve seen a gold rush occurring as Turks saw the writing on the wall with their inflating lira and sought refuge in gold.

Since 2020, Turkish firms and retail investors have more than tripled their gold holdings to $36 billion. This is in addition to the gold that Turkish households hold at home which their government now estimates to be around 5,000 tons of gold worth between 250-350 billion dollars.

The rush to gold and dollars is to be expected, and lately, we’ve seen gold prices continue to spike in the Turkish market. However, one of the most interesting developments throughout this inflationary episode is that Turks are turning more and more towards bitcoin as a way to preserve their wealth against their currency’s debasement.

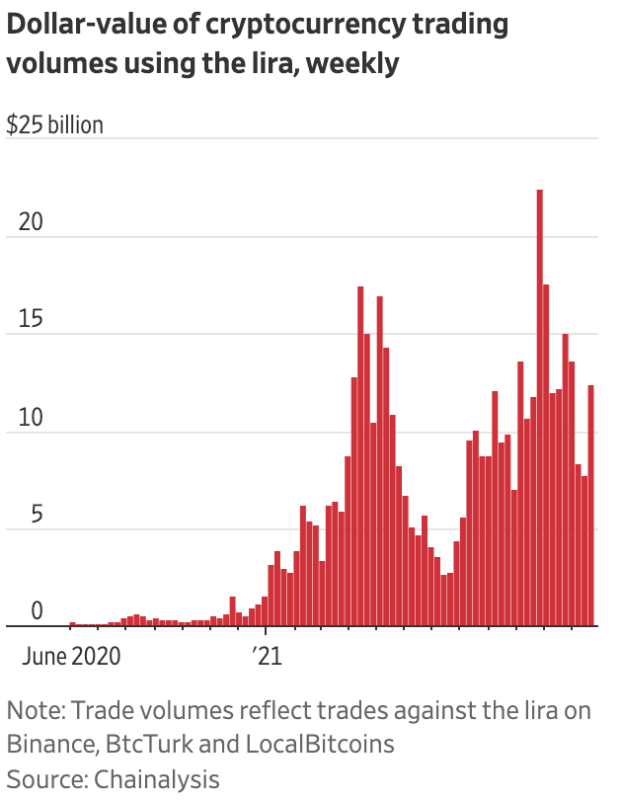

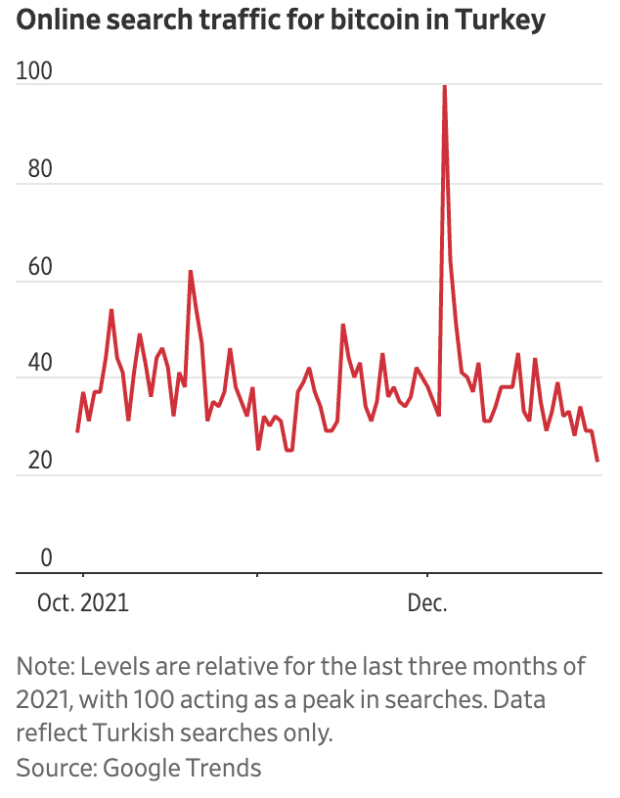

A report from the Wall Street Journal found that the dollar value of cryptocurrency trading volumes is up, and so too are online searches for “bitcoin.” Turks are beginning to embrace bitcoin and stablecoins, such as tether, as hedges against inflation in their time of need. Bitcoin is offering some people hope as they search for places to store their wealth outside the faltering Turkish banking system.

The Bitcoin Parachute

The fall of the Turkish lira is a prime example of why, 13 years ago, Satoshi invented Bitcoin. Embedded in the Bitcoin network genesis block, Satoshi sent a message that this creation was a possible solution to central banking and the easy money policies plaguing the world.

Today, we are seeing Satoshi’s vision be realized as Turks are starting to use bitcoin for its intended purpose — a non-governmental money that preserves wealth, and cannot be controlled or corrupted.

Before bitcoin, the people of Turkey would have had to resort to only using gold and dollars to protect themselves against their central bankers and government policies. Now a new solution exists that can be accessed by anyone with a smartphone and internet connection.

Unlike gold and the dollar, a Turkish individual does not need to trust a third party to gain access to this wealth-preserving asset. No longer do they need to have a bank account to protect themselves against inflation. On top of that, unlike gold and the dollar, bitcoin cannot be easily seized by authorities as we’ve seen countries do in the past during periods of financial crises.

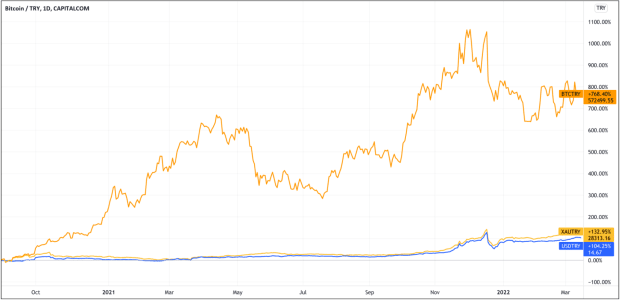

Bitcoin also has the added benefit of appreciating in value over time due to its inelastic supply and its network effect. Two years ago, if a Turkish citizen decided to save in bitcoin instead of gold, liras, or dollars, their purchasing power would have increased dramatically during a time period where the lira lost over 50% against the dollar.

For the last two years, bitcoin has outperformed the Turkish lira by 768.40% compared to the dollar (104.25%) and gold (132.95%):

As the lira has inflated, the good news is the people of Turkey understood how to protect themselves in part because older generations have suffered inflation like this before in the late 1990s. Turks have sought refuge from inflation in assets like real estate, equities, gold, dollars and, for the first time, bitcoin.

Back in November 2021, President Erdoğan famously declared war on bitcoin. The thought of a president declaring war against a decentralized digital ledger was comical, to say the least. Fast-forward to today, and it appears the Turkish president might already be waving the white flag in his war against bitcoin. After El Salvador President Nayib Bukelye visited with the Turkish President back in January, President Erdoğan advised the country’s ruling Justice and Development Party to closely examine bitcoin’s potential use and to organize an upcoming forum on the subject.

These recent developments give me hope for the people of Turkey. What lifts my spirits is knowing that bitcoin exists today as a parachute for them to escape their freefalling lira. Bitcoin is offering the people of Turkey a flicker of hope in dark times. It’s stories like the ones above that remind me of why I’ve dedicated every day of my life to making bitcoin more accessible to people all over the world suffering similar fates to those of the people of Turkey.

Today, I’m feeling optimistic. The sticker below, seen on the streets of Istanbul, says it better than I ever could:

Now that we’ve entered the age of Bitcoin, citizens all over the world have an alternative to turn to in order to protect their wealth against the detrimental effects of inflation.

This is a guest post by Sam Callahan from Swan Bitcoin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.