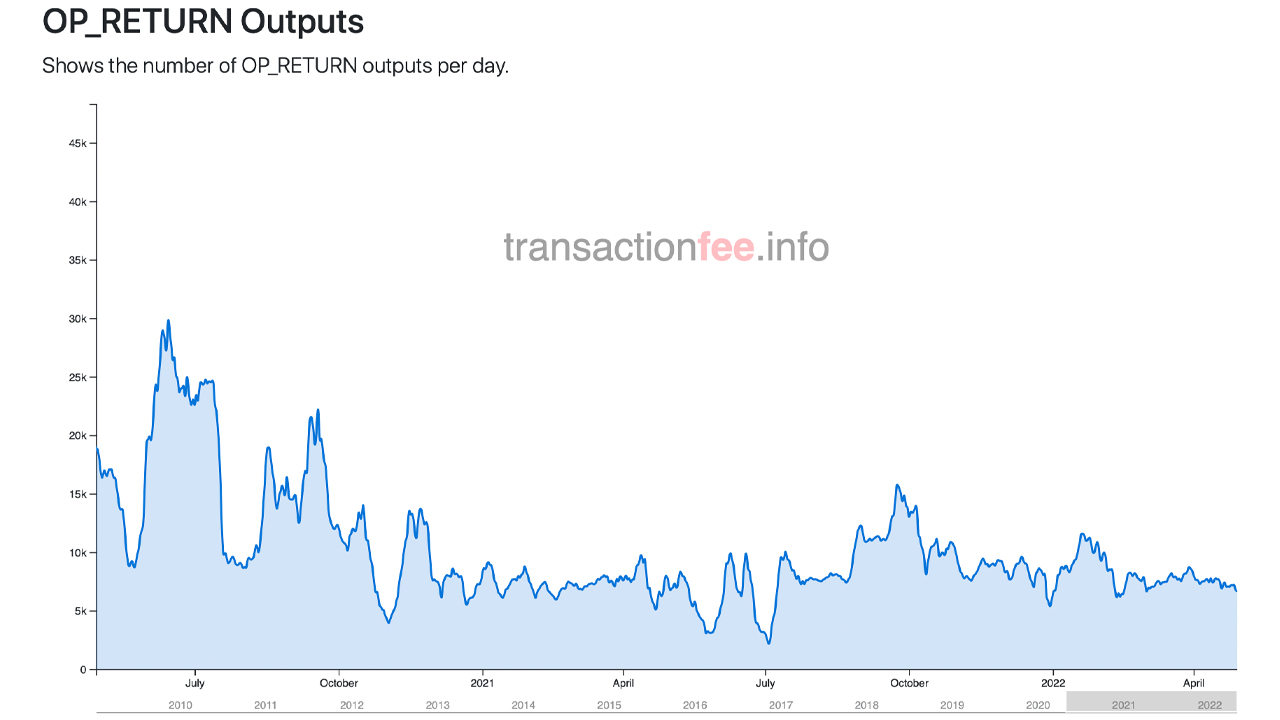

Three years ago there were a lot of discussions concerning data embedded in bitcoin transactions and the block size space consumed by these OP_Return transactions. However, in recent times, the use of OP_Return transactions has dropped a great deal and the trend has lowered network fees to some degree.

OP_Return Transaction Domination Slows Significantly Alleviating Bitcoin Network Fees

Bitcoin transfer fees have dropped quite a bit over the last nine months since July 1, 2021. At that time, the average transaction fee to send bitcoin (BTC) was above $10 per transaction. Statistics show that at the end of April 2022, the average fee to send BTC is 0.000042 BTC or $1.62 per transfer. This month a report published by the lead at Galaxy Digital Research, Alex Thorn, explains there are a number of reasons why onchain transactions have been cheaper.

Thorn’s report explains there are a number of reasons why fees are lower including the use of transaction batching, increased Segregated Witness (Segwit) adoption, and Lightning Network usage. Another trend Thorn’s report covers is the fact that OP_Return transactions have declined. The researcher notes how after 2018, following the launch of Veriblock, the use of storing arbitrary data on the Bitcoin blockchain spiked.

In recent times, however, OP_Return transactions stemming from the likes of Veriblock and Tether via Omni are down. The Galaxy Digital Research study explains how most tethers have moved off the Omni Layer network that uses OP_Return transactions to alternative chains. While Thorn’s report briefly mentioned the spike in OP_Returns after Veriblock it doesn’t mention how controversial storing arbitrary data on the Bitcoin blockchain was at the time.

Essentially, an OP_Return is used to mark a transaction output and users can mark roughly 80 bytes of null_data to the Bitcoin blockchain in a given transaction. By using Bitcoin’s script and null_data, a great number of entities have used it to write messages on the blockchain and record important data. At the end of 2013 and into 2014, OP_Return use started to become more popular and controversial. Still, before 2017, research shows that OP_Return transactions only accounted for less than 2% of transactions.

Current daily data shows that OP_Returns have dropped in recent times and it is very different than when Veriblock captured 57% of Bitcoin’s OP_Return outputs in 2019. Bitcoin proponents were very concerned at the time about people and organizations storing arbitrary data on the Bitcoin blockchain. One paper published on December 11, 2020, discusses “dominating” OP_Return outputs in a paper called “The Impact of Omni and Veriblock on Bitcoin.”

Besides Veriblock, between 2018 and December 2019, the top publishers of OP_Return transactions stemmed from Omni/Tether, Factom, Komodo, Blockstore, po.et, Chainx, and RSK. Nowadays, while many of these projects still exist, they are not producing as many OP_Return transactions as they were in the past. Of course, there’s a chance the use of OP_Return outputs dominating BTC transactions could happen again. While reports like Thorn’s study and current data show OP_Return transactions have lowered, there’s no clear explanation for why this has happened.

What do you think about the decline in Bitcoin OP_Return transactions in recent times? Let us know what you think about this subject in the comments section below.