As the Terra stablecoin becomes depegged from the U.S. dollar, the biggest buyer of bitcoin in recent months could become its biggest forced seller.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox,

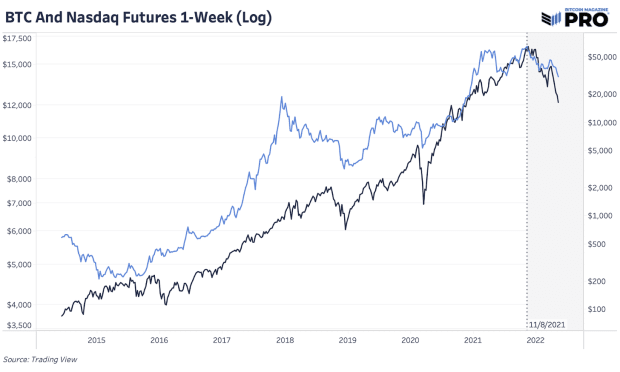

Now the main risk to the market is that the biggest buyer of bitcoin over the last couple months will now become the market’s biggest forced seller. The market expectations and potential selling have certainly played a role in bitcoin’s historic selloff today, but it comes at the same time that broader equity markets have been selling off in tandem. Bitcoin’s correlation to broader equity indexes and tech stocks is at historic highs and is following the same market dynamics since November 2021.

As a result of the rise in global interest rates, 40-year high inflation, deteriorating growth and a macro credit sell-off and unwinding unfolding, we’ve been highlighting these dynamics and the larger market risks at hand for months.