Understanding the monetary system is foundational to seeing what’s wrong with the current system and to have a true grasp of Bitcoin and its importance.

“If you want to make an apple pie from scratch, you must first invent the universe.” – Carl Sagan

Among the first objections that arise for anyone who has just learned about Bitcoin is “this is too complicated to understand.” And it’s true; private keys, block times, difficulty adjustments, UTXOs, uncensorable CoinJoin transactions, hash-something — the learning curve is steep and, for most, the reasons to ascend it seem few and far between.

The first time I was introduced to Bitcoin in practice (not in theory — )

A Visa card in Apple Pay can “instantly” pay for things halfway across the world too. For international transfers, Wise or Revolut or a plethora of fintechs can move bank money across the world in seconds.

Tech is not the thing. Digital is not the value-add.

Of course, most Bitcoiners know that the Visa-Wise-Apple-Pay analogy is faulty. And my guy could have made Saifedean Ammous’ argument that bitcoin has salability across space, which my $5 bill lacks. But to understand much of what sets bitcoin apart you need to go well into the monetary plumbing weeds. What happens when we make a bank payment? What is money?

International transfers or bank-issued Visa cards require identification in a way bitcoin doesn’t; they don’t provide final settlement (payments can be revoked later); bank transfers are often deferred net settlements (though real-time gross settlement payments are rolled out in more and more central bank payment networks). Funds in Venmo or PayPal or other lower layers of the dollar banking system are permissioned, in the sense that any of the half-dozen entities required for a payment to be successful could block it — for innocent technical reasons or more malign control/authoritarian reasons.

Thinking that an effortless Venmo payment is akin to an on-chain bitcoin transfer because they look and “feel” the same, is a rather elementary error to make. They’re both digital; they both involve “money,” whatever that means; they both allow for transfer of value from one place to another. But in order to understand why they are different, you — like the Carl Sagan quote above — must first explain the whole monetary system: where it can go wrong, what it relies on, how new money enters into it, what banks do, which entities have the power to block, delay, inspect or charge fees for transactions, what you’re risking by passively holding a constantly depreciating currency.

To Gladstein’s credit, he has an understanding of the banking realities of the bottom billion that dwarfs any payment troubles that most Westerners have ever encountered. But the average nocoiner doesn’t. Which is why we routinely get news articles where some clever-by-half financial journalist lumps together bitcoin with stablecoins, with non-fungible tokens (NFTs) and central bank digital currencies (CBDCs). Or when the chairman of the Federal Reserve Board says that CBDCs make the need for bitcoin or stablecoins obsolete: they’re all the same, really — new, hip, digital ways of storing and moving what seems to be valuable things.

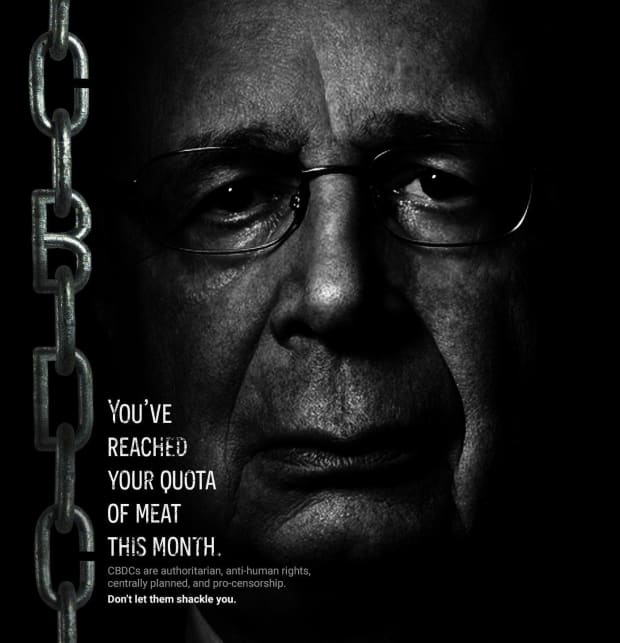

The Fed is here to help steward the dollar system, so once its own fancy-sounding technical solution is in place, there could be no need for private options. And “programmable money” sounds amazing — at least until the programming of the not-so-kind programmer stops you from purchasing what you require.

From Gita Gopinath at the IMF, we learn that the Russia-Ukraine debacle “would also spur the adoption of digital finance, from cryptocurrencies to stablecoins and central bank digital currencies.”

What about the conflict could possibly spur anything but bitcoin? Finance is already digital. Fiat bank money is already digital. The Fed adjusts the monetary base, digitally, through purchases and sales of assets via its New York Fed branch. The dollar is already discretionary and permissioned, controlled, regulated and surveilled. What does a central bank digital currency (CBDC) bring to the table?

If anything, it would make the politicization of banking-related problems on both sides of the Donetsk battlefield worse, with even more control by authoritarians who want to mandate what people may or may not do with “their” money. You don’t need a blockchain or a token to do 99% of what cryptocurrency projects attempt to do — and the ones that appear to do something useful, don’t do that better than Bitcoin.

Beyond the first few hours and days, before international transfers could comfortably arrive to Ukraine’s banks in bulk, there was nothing that “cryptocurrencies” broadly speaking could do for Ukraine; its problem was real, not monetary. Help fleeing refugees smuggle out their savings against a hostile banking system? Sure, bitcoin always excelled at that, but how would a CBDC, issued and governed by the National Bank of Ukraine fare? Or worse, Ripple, whose CEO proudly stated:

“To clear any confusion – RippleNet (while being able to do much more than just messaging a la SWIFT) abides by international law and OFAC sanctions. Period, full stop.”

Instead of being the permissionless, uncensorable, F-U money that bitcoin aspires to, its cryptocurrency “competitors” proudly uphold censorship and government sanctions:

“RippleNet, for example, has always been – and remains today – committed to NOT working with sanctioned banks or countries that are restricted counterparties. Ripple and our customers support and enforce OFAC laws and KYC/AML.”

Complying with authoritarian sanctions is the opposite of what freedom money does.

I repeat: Tech is not the thing. Digital is not the value-add.

The value-add of Bitcoin is the liberty and independence that comes with holding your own money outright — unencumbered by a bank, a payment processor, a financial regulator or a tax man. It’s no longer being subject to the whimsical demands of your authoritarian ruler, democratically-elected or not. It’s to no longer suffer the asinine consequences of the monetary excesses that the dollar’s current stewards have so catastrophically botched.

Bitcoin is freedom money for a century of liberty. But to truly grasp why that is, you need to see what’s wrong with the system it attempts to overthrow.

Understanding how the fiat monetary system works is fundamental to understanding Bitcoin.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.