Healing symptoms of widespread societal issues without fixing the underlying cause will lead to more of the same and doesn’t actually solve anything.

Logan Bolinger is a lawyer and the author of a free weekly newsletter about the intersection of Bitcoin, macroeconomics, geopolitics and law.

Part Two: The Big “This” That Bitcoin Fixes

“Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.” – Groucho Marx

In Part One of this series, I wrote about the first major breakthrough for me on my journey from being a fervent Bernie Sanders supporter to a committed Bitcoiner, which involved confronting the idea of trust in politics and wondering how Bitcoin’s trustlessness could be leveraged toward a positive political end via its potential to constrain lawmakers.

Now I want to talk about the second major breakthrough I experienced on this journey. I want to start by suggesting something that is going to sound, at first blush, plainly antithetical to some in the Bitcoin community, but which I think might resonate with those who have emigrated to or have arrived at a belief in Bitcoin from a more left-leaning political starting place (like, say, the Bernie Sanders/progressive orbit or the liberal arts ecosystem): Progressives and Bitcoiners both identify and acknowledge a similar slate of problems with the status quo.

Progressives would highlight and emphasize wealth inequality, unequal financial access, monopolies, an overpowerful cadre of tech companies, excess corporate power, exploitative (and discriminatory) big banks and, generally speaking, too much influence being wielded by a small group of individuals and corporations as major issues. This list is obviously non-exhaustive, but I think it’s a fair representation of major concerns.

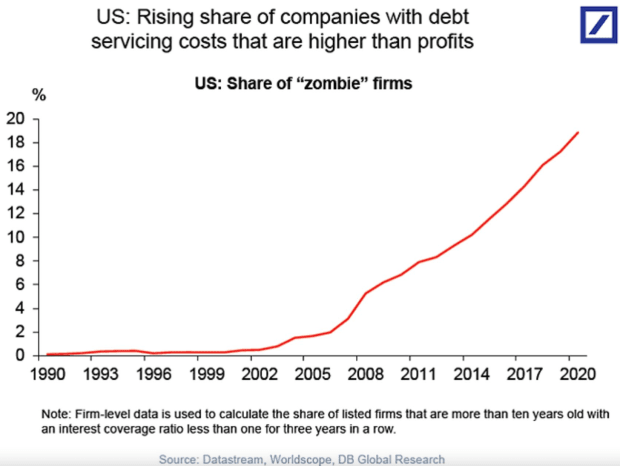

The majority of Bitcoiners would agree with most, if not all, of these criticisms, and would probably add the pursuit of GDP (gross domestic product) growth at all costs and ubiquitous malinvestment, both of which are necessitated and sustained by the current fiat system, to the list.

Progressives and Bitcoiners differ radically, however, on the exact location of the source of these problems, as well as on the appropriate solutions to these problems.

These divergent views are analogous to two doctors examining a patient and agreeing upon the symptoms, but disagreeing on the cure. I want to tug on this medical/corporeal metaphor a little more to draw out some additional points because it’s illustrative of Bitcoin’s unique and transformative promise.

Imagine our monetary system as a body. This body lives hard and fast and begins to exhibit symptoms of ill health. Two doctors examine this body and propose two starkly different remedies. Doctor A suggests giving the patient some medicine, which is to say a targeted pharmacological intervention, and sending her on her way. Then Doctor B suggests that the root cause of the symptoms are deeper and recommends fundamental lifestyle changes. This doctor endorses regular exercise, clean eating, drinking less alcohol, spending more time outside and the like. The patient opts for the easy prescriptions of Doctor A.

It doesn’t take long for the patient to return to see these two doctors with new and worsening symptoms. It turns out the medicine has had side effects, which now need to be addressed. Doctor A suggests additional pills to address these side effects, while Doctor B continues to recommend wholesale lifestyle changes to fundamentally address the root cause of the patient’s condition.

You can see where this is going. Reactively addressing symptoms without ever treating the underlying issue or worse, misdiagnosing/mislocating the underlying issue, results in a sicker patient with more problems.

Bringing it back to Bitcoiners and progressives, Bitcoiners locate the source of many problems at the monetary level. The money is no longer sound and this is the provenance of many of the subsequent societal symptoms. Bitcoiners can trace this problem to a precise point in time, 1971, the point at which money effectively became debt and currency formally became unbacked. From there, problems emerged, multiplied and compounded. For this reason, Bitcoiners propose fixing the money in order to begin healing the litany of consequent societal maladies.

On the other hand, progressives coalesce around different causal narratives. Sometimes it’s the billionaires, sometimes it’s capitalism itself, sometimes it’s corporations, sometimes it’s Mark Zuckerberg, etc. Sometimes the narrative just devolves or settles into an amorphous, all-encompassing oppressor/oppressed framework in which every human relationship or sphere of human action can be (and is) categorized by and via this binary. In this environment, scoring rhetorical points too often takes precedence over formulating thoughtful, considerate solutions. Instead, proposed solutions almost always involve shoveling more dollars at various parties.

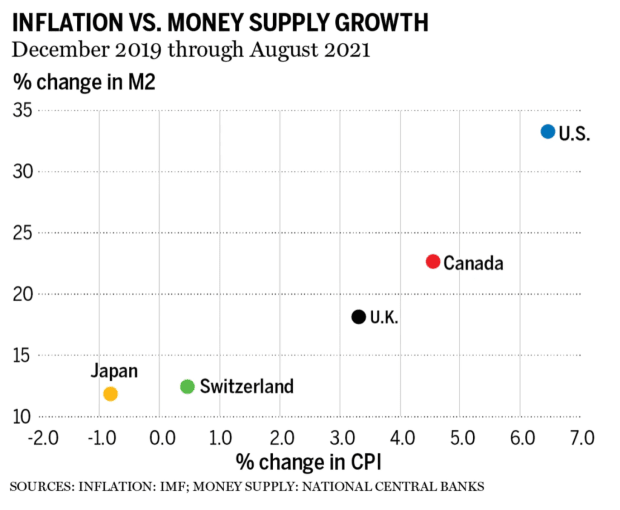

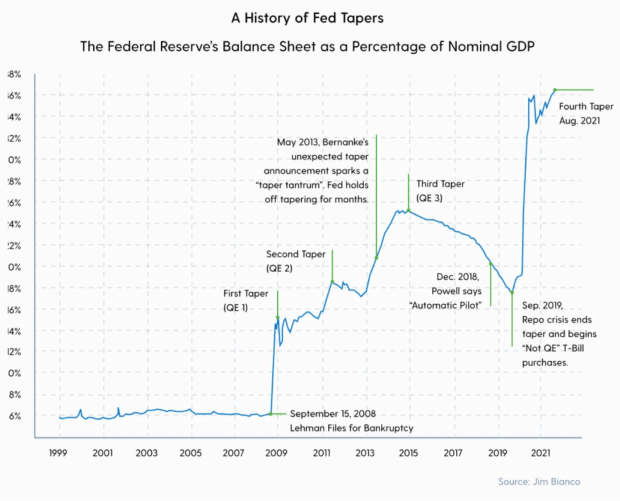

Before I discovered Bitcoin, I was a devoted advocate of spending however much money was necessary to “fix” problems like wealth inequality, excess corporate power, inequitable access to services, etc. This, I came to learn, only temporarily relieves the pain, while leaving intact the monetary system that causes the pain in the first place. We can see this today with inflation. We pumped the economy full of liquidity and handed out stimulus checks. Sounds great, right? Almost two years later and, wouldn’t you know it, that money did have to come from somewhere after all. And by increasing the money supply so dramatically to undertake these (largely) well-intentioned interventions, we ensured the inflation we are now experiencing. The brunt of which is borne by the same wage-earning savers for whom the stimulus was meant to aid.

Furthermore, the Federal Reserve Board is now in the position of raising rates in a slowing growth environment in order to curb this inflation, which will itself likely cause a recession — continuing to harm wage-earning savers. When the pain reaches a tipping point, the Fed will step back in again with a new painkiller of liquidity, devalue the currency even more, further enriching the wealthy asset holders, while further punishing the wage-earning savers. We will continue this vicious cycle, failing to solve any of the problems we were seeking to address. Fiat solutions cannot solve fundamentally fiat problems.

In other words, we’ll just continue to treat the symptoms until they become too numerous and ultimately, terminal.

As an aside, I find it interesting that the Western world, with its globally unique conception of pain and its painkiller medical culture (as opposed to a more holistic Eastern approach of locating and addressing the source of pain) opts to treat its monetary system the same way. The government treats the money the way Big Pharma treats health and gets similar results.

But anyway, treating the symptoms of a diseased monetary system without addressing the cause has the perverse effect of merely delaying more severe and potentially terminal future symptoms, while exacerbating the existing symptoms in the meantime.

If I had not found Bitcoin, I’m not sure I ever would have understood this. And I suspect there’s a reason for that. Learning about Bitcoin incentivizes financial and economic literacy, which is neither widely taught nor widely distributed. I don’t think it strains credulity to suggest that many of the folks in Congress charged with making these important decisions about fiscal spending, the budget, and government debt are similarly underinformed about the downstream consequences of popular interventional ideas, a situation that is compounded by an overarching interest in winning re-election. Promising to hand out more money, regardless of where that money comes from and regardless of any grave future consequences it may produce, is a much easier political sell to constituents than the pursuit of financial discipline. The former is a painkiller that temporarily masks its root causes. The latter is a painful withdrawal that, once undertaken and completed, offers hope for more lasting long-term health.

I was a Bernie supporter because I wanted to address a litany of societal problems. I am now a Bitcoiner because I know that deca-billionaires, dominant corporations, “late-stage capitalism” and Mark Zuckerberg — though certainly objectionable — are not the causes of these problems. They are the symptoms of a broken money. And attempting to solve for these discrete symptoms will only result in systemic contortions that allow other symptoms to metastasize. It’s whack-a-mole problem-solving.

Put simply, Bitcoin made me realize that it is impossible to solve the problems caused by fiat money within the fiat framework. It is, in fact, impossible to have a fiat system in which these problems can be avoided. Which is why true solutions, the “big structural changes” that progressives like Elizabeth Warren tout and demand, require a rebuilding of the system itself upon a better foundation, which means fixing the money.

Bitcoin’s promise is the prospect of fixing this. And anyone who is serious about addressing all the issues progressives and Bitcoiners agree upon must confront the root cause of a wholly, irreparably broken money at the base layer of society.

This is a guest post by Logan Bolinger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.