While bitcoin’s price might be “down,” the metrics that indicate the growth of Bitcoin are on a true course to the positive.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the Infantry before transitioning to the Finance Corps.

Will Clemente paints a darker picture, yet my conclusion is still the same. If I remember correctly, Bitcoin was still secure two years ago and was able to avoid attack and exploitation. As miners fall off the network, difficulty should adjust downwards over the coming weeks, making it more profitable for those who are able to hang in there. It’s a self-correcting system.

Bitcoin is not just secured by a wall of pure energy through the miners. It is also secured by a massive army of scarce and expensive computing equipment; The equipment is scarce as well.

Even if you miraculously had the electric infrastructure to attack the network, good luck getting your hands on the computing power. I think we’ll be just fine.

Even with the recent downturn in hash rate, the macro trend is still up and to the right. As Nico from Simply Bitcoin likes to say, incentives are stronger than coercion. Incentives take time to play out. Don’t let the short-term noise scare you out of your position.

Stop Feeding The Whales

“We few, we happy few, we band of brothers; For he to-day that [HODLs their stack] with me Shall be my brother” — King Henry V on Bitcoin, circa 1599

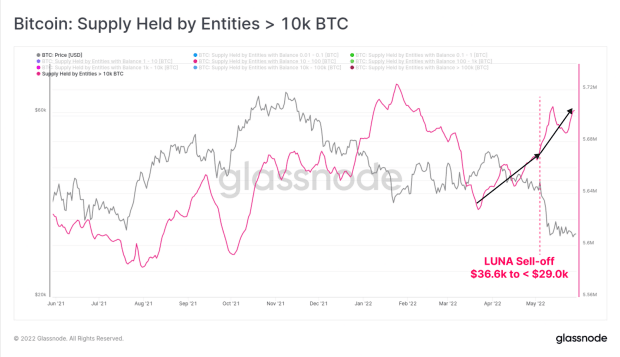

Stop feeding the whales. As traders and tourists panic sell and get their stacks liquidated, the whales are beginning to feast. What do they know that you don’t? They’re watching adoption grow nearly every day.

Warren Buffet says to be fearful when others are greedy, to be greedy when others are fearful. How about this: dollar-cost average and be greedy regardless of what other people think or feel. (Maybe a little extra greedy when everyone is freaking out, like right now).

Never forget the constant devaluation of your dollars. Stake your claim of absolutely scarce digital real estate before the big boys start to really figure it out. I know that’s what I’ll be doing. When in doubt, keep calm, zoom out and stack sats.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.