Macroeconomic crises developing in Pakistan, Taiwan and China underscore the flaws in macroeconomics and the need for Bitcoin.

“Fed Watch” is a macroeconomic podcast, true to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining current events in macroeconomics from across the globe, with an emphasis on central banks and currencies.

In this episode of “Fed Watch,” CK and I went through several charts, giving market updates on bitcoin, the dollar (DXY) and the Hong Kong dollar. Next, we examined the deteriorating situation in Pakistan, and asked the question, is it the next Sri Lanka? Lastly, we discussed the Taiwan/China situation and I read several important snippets, one from Chinese foriegn minister Wang Yi and the other from think tank expert Wang Wen.

Audio listeners can follow along with the

I’ll add that a strong dollar is not bearish for bitcoin. Perhaps, initially, a strong dollar is correlated to lower bitcoin, but after the dollar has stabilized in a higher range, that is when bitcoin has traditionally rallied.

Below is a screenshot from the Hong Kong Monetary Authority’s website. Each month, it releases statistics on its foreign currency reserves, which it uses to stabilize its peg. Last week, I speculated that maintaining the Hong Kong dollar (HKD) peg was rapidly draining its reserves. However, according to this press release, it only used slightly more than 1% of its reserves in July to maintain the peg. That means the HKD is likely able to keep the peg (if it wants to) for several years.

Pakistan On The Brink

The developing situation in Pakistan has a lot of things in common with the recent collapse in Sri Lanka. In the podcast, I pointed to i5w involvement with the World Economic Forum (WEF). Pakistan has received hundreds of millions of dollars in funding to revamp its agricultural sector and add national parks.

Another similarity between Pakistan and Sri Lanka is the important role that Chinese funding has played in the last decade. Sri Lanka lost control of its major port because it couldn’t pay back Chinese loans, and now Pakistan is saddled with approximately $20 billion in high-interest loans to China and Chinese companies.

Pakistan has only two months left in the budget, and is desperately courting new lenders. The Chinese have turned it down, the Arab States are thinking twice, the only place to turn is back to the IMF. And that means harsh austerity.

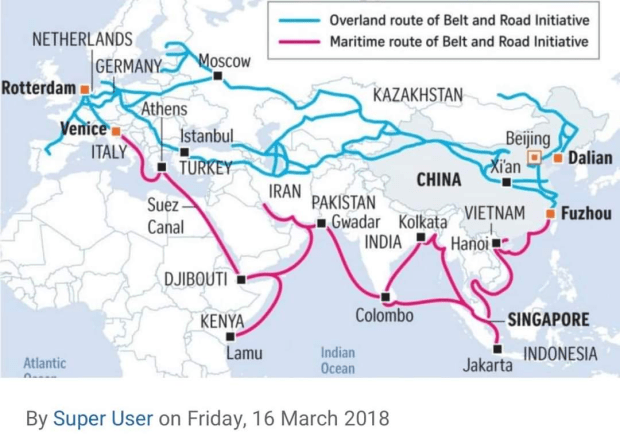

Perhaps, not surprising, that both Sri Lanka and Pakistan are important nodes in the Belt and Road Initiative (BRI).

As I’ve said on many occasions, the BRI is doomed to failure. China is attempting to make places and routes economically viable, where the long span of history hasn’t done so. No amount of money can overturn millenia of culture and eons of geography.

Well, once again, one of the important links in the BRI has been bankrupted by the Chinese central planners.

Taiwan/China Situation

I’ve been discussing the Pelosi situation and the Chinese response for days on my Telegram live streams.

In this episode of “Fed Watch,” I read some excerpts from a noted Chinese minister and a Chinese think tank expert. You can read Wang Yi’s full comments here. Suffice it to say for this article, he repeated “One China” many times, and called the U.S. the side trying to change the status quo. He also had very harsh words for Tsai Ing-wen, the sitting president of Taiwan. He said she “betrayed the ancestors.” In another translation, I heard Yi’s original comments also indicate that she betrayed her ancestors (and her race).

The next comments I read were from Wang Wen, executive dean of the Chongyang Institute for Financial Studies at Renmin University of China (RDCY) and the executive director of the China-U.S. People-To-People Exchange Research Center. You can read his comments and several others here. He tries to explain why China’s response was so weak, and that China should not provoke an armed conflict with the U.S. until it can “outperform the U.S. in terms of economic power, attain financial and military strength comparable to that of the U.S., and develop an overwhelming capacity to counter international sanctions.”

Sounds a long way off. I’ll simply advise the reader to not get caught up in fear-baiting rhetoric about Taiwan and China. They are disciples of Sun Tzu, who said, “appear strong when you are weak.” Wen also quoted Sun Tzu:

“A major military clash with the U.S. is not the goal of China’s foreign policy, nor is it the path to a better life for the common people. Recall what Sun Tzu wrote in ‘The Art Of War’: ‘Do not act unless there is something to gain 非利不动; do not use military force without the certainty of victory 非得不用; do not go to war unless the situation is critical 非危不战.’”

We wrapped up the podcast talking about the upcoming CPI data release and other things pertinent to bitcoin.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.