Investing shouldn’t be a light-hearted decision, but it sounds more complicated than it is. In traditional finance, some brokers guide investors through the process, making it a more straightforward experience.

With Bitcoin, there can be no intermediaries, and there should not be in the true spirit of the cryptocurrency. However, the Bitcoin offering is varied, and users can decide to invest in BTC individually with no third parties involved or by engaging a broker like an exchange or a fintech company to do the job for them.

Bitcoin Magazine is here to provide a beginner with the proper tools to make their first BTC purchase or help experienced Bitcoin users switch to more principled platforms in line with Bitcoin philosophy.

What is Bitcoin?

Bitcoin is the first decentralized and peer-to-peer cryptocurrency created by anonymous Satoshi Nakamoto in 2008.

It is decentralized and peer-to-peer because it relies on an open global network of nodes that communicate with each other to validate transactions without the need for a central authority like a bank or a financial institution.

Over the years, it has grown exponentially to become the most secure network, virtually impossible to break, and suited to allow its users to take complete control and responsibility for their own money. If you take good care of your Bitcoin, nobody can take it away from you, censor you, or manipulate your holdings. You can learn more about it in our in-depth guide about Bitcoin and how it works.

Frequently Asked Questions

Can I buy 1 Bitcoin?

You can buy any amount of Bitcoin, even as little as $1. Bitcoin is divisible, and satoshis are the smallest denomination of bitcoin. One satoshi is equivalent to 100 millionth of a bitcoin.

What’s the minimum amount I should Invest?

From an investment point of view, it is advisable to start allocating at least $10 to optimize the payment of transaction fees. If you’re planning to grow your capital gradually, you can look into ‘dollar cost averaging,’ allocating small amounts every day, week, or month.

What’s the safest way to buy Bitcoin?

The most popular exchanges like Coinbase are usually considered safe to buy Bitcoin. However, no matter where you buy it, remember to secure it immediately after purchase and take it into your own custody by removing it from exchanges subject to hacking, censoring transactions, or preventing withdrawals.

Where is the best place to buy Bitcoin?

This article will help you understand what the best-suited service for you is. It can be an app, an exchange, or a broker; however, the best place may depend on the amount you want to buy, your location, and how much you value privacy over convenience.

Key Considerations Before You Buy

Holding Bitcoin vs. an IOU

There’s a famous Bitcoin community mantra saying, “not your keys, not your coins.” What does that mean?

Bitcoin is a type of money different from traditional coins; when you own it, you actually hold a private key that gives you access to the asset. It allows you to store it securely and use it, send or receive it. By controlling the private key, you’re the only owner of Bitcoin, and nobody else can access it.

If you transact Bitcoin through an exchange or lending service, they more often hold the private key and act like a bank that keeps your money relatively safe. They can prevent you from withdrawing your own money or inducting censorship on your private key access. If your service provider is hacked, you can lose your Bitcoin.

Whether you’re looking to buy Bitcoin to make a profit or hodl it for a long time, you should consider protecting it so that it cannot be confiscated or stolen away from you.

Keeping your asset on online platforms effectively equals having an “I owe you” (IOU), not the Bitcoin itself. This is why IOU is a good idea if you plan to trade Bitcoin, but as soon as your asset becomes substantial, you should remove it from the third-party service and place it in a non-custodial wallet that only you can access.

Volatility

Bitcoin is still a relatively young asset with just over a decade. Like every new asset, it is subject to volatility, which is considered a feature, not a bug, among the Bitcoin community. Many bitcoiners take advantage of the volatility to sell the asset when it climbs in value and buy back when it crashes to grow their stack. Bitcoin traders use volatility to make money during price swings.

Ardent bitcoiners would say you should hodl Bitcoin for over two cycles (typically over eight years) because volatility still points to the upside over the long term. You could still generate attractive returns in between cycles if you embrace it.

Privacy

Bitcoin’s transactions are anonymous, so no name, address, email, or sign-in forms are necessary to use BTC; however, they are linked to specific public addresses that are indeed shared and open for everyone to watch.

Those addresses will forever display the transactions executed through them; therefore, it’s easy for everyone to know how much Bitcoin has been sold, bought, moved, and used through one specific address.

This inconvenience is avoidable by changing the public address every time you want to use Bitcoin. Most wallets do this automatically, making your money more difficult to trace.

You can take further measures to enhance security and anonymity and explore them in our article on How to buy Bitcoin anonymously.

Personal responsibility

We are used to delegating responsibility for our money to third parties like a bank or a financial institution so that we don’t have to worry about where to keep it safe. However, we mentioned earlier that this comes with trade-offs, as your money is under the control of another entity, and you may lose it.

One of Bitcoin’s main features is personal responsibility, which is challenging but rewarding. It’s challenging because you must use strict practical precautions to keep it safe at all times. If you don’t, you may lose your money, and nobody can give it back to you.

Being decentralized and entirely independent from the control of a third party, Bitcoin has no typical structure of an organization. Therefore, there is no contact center to call if you lose your money or have an issue with your transfer.

You must learn how to manage it yourself. However, a lot of help is available through social media channels, books, websites, and Bitcoin Magazine, so you won’t find it hard to get your way around it quickly and efficiently, even if you’re not a techie user.

It becomes very rewarding because you attain the feeling of owning the asset entirely, and nobody can take it away from you.

Taxes

Bitcoin is not exempt from taxation. Generally, if you hodl Bitcoin long-term, no income or capital gains tax is involved. You might incur a tax event when you sell or use it to purchase goods.

Before you go ahead and buy it, you should consider checking the tax implication in your country, which may differ from another jurisdiction.

How to Buy Bitcoin

The days you could buy Bitcoin only on Mt Gox (the first exchange) have long gone. Today, the offering is so abundant that you are spoiled for choice. From fintech companies to simple exchanges, you can choose to buy Bitcoin anonymously or not at any time.

Exchanges are the most common method of buying Bitcoin, so we have itemized the basic steps required to start making your first Bitcoin purchase. They may differ in terms of offerings and services, but the registration and purchasing processes are very similar across the board.

A list of exchanges and other purchasing methods will follow.

How to buy Bitcoin on an exchange:

1. Registration. You will be required to register and open an account with the service provider. Name, surname, email address, and date of birth will usually be enough to gain access to the exchange. You will undergo a different verification process depending on the services you want to use.

For example, stricter KYC is demanded in case of higher tiers intended for more significant purchases. In that case, a selfie with your credit card or passport displayed next to you will likely be requested by the exchange. A lot also depends on the exchange’s jurisdiction you are joining, as some countries require very little to no KYC at all.

2. Pre-purchase money transfer. Once you’re verified, you’re ready to go and buy Bitcoin. You can transfer money to the exchange using your credit/debit card for fast execution; however, this option will cost you very high fees.

If you are not in a rush to buy Bitcoin, you will incur lower fees to transfer money via a bank transfer, though the operation might take a few days to complete. Buy Bitcoin. Every exchange will offer you different options to buy bitcoin. You can set up any of the following types of orders:

3. Buy Bitcoin. Every exchange will offer you different options to buy bitcoin. You can set up any of the following types of orders:

- Instant order: an instant order to buy or sell at the requested price; if unavailable, a requote will occur.

- Market order: an immediate order to ‘buy’ or ‘sell’ at the current price in the market.

- Limit order: an order to buy or sell at a specific price or higher at any time in the future. It is an order visible to the market through the order book.

- Stop Order: an order to buy or sell when a stop price is met. Unlike the limit order is not visible to the market until the price is matched; then, it becomes a visible market order. like , or . Hardware wallets operate offline and are recognized as cold storage, assuring you that online hacks are virtually impossible.

4. Secure your bitcoin. Once your Bitcoin holding becomes substantial, it is recommended that you secure it in a hardware wallet like Trezor, Ledger or Opendime. Hardware wallets operate offline and are recognized as cold storage, assuring you that online hacks are virtually impossible.

There are plenty of ways to buy Bitcoin other than exchanges. In the early days, it was common to buy Bitcoin in person. However, the cryptocurrency’s value was negligible then, and such a method would not be recommended today. Keep reading to explore the multiple options available if you want to buy on exchanges or other services.

Where to Buy Bitcoin

Exchanges

Starting with exchanges, here are a few marketplaces where you can begin building your Bitcoin portfolio. The main difference between exchanges and other fintech services is that these offer investment vehicles that are not available in exchanges, mainly used for buying and selling digital assets only.

Bitcoin only exchanges

Listed below is a list of a mix of centralized and decentralized exchanges that are recommended to buy or sell Bitcoin only. They should be the preferred method to buy Bitcoin as they better support and safeguard the Bitcoin network.

1. River is a US-based Bitcoin-only custodial exchange that claims to be very easy and secure to use while offering plenty of good educational material to understand Bitcoin.

River charges fees based on how much Bitcoin you buy, starting from 1.20% but offers no fees for recurring buys. River stores all bitcoins offline and in secure cold storage. River also offers customers to buy Bitcoin miners.

2. Swan is River’s main competitor in the USA and claims to be the most secure platform to buy Bitcoin. Swan provides similar services to River, with the main difference being in the fees: Swan’s are 0.99% while River’s start at 1.2%. They offer recurring daily, weekly, or monthly purchases, which they made enticing due to a very competitive USD/BTC conversion rate.

3. CoinCorner is a Bitcoin exchange based in the Isle of Man, Great Britain. They have over 2 million users across over 45 countries they serve. Deposits and withdrawals are only available in GBP and Euro. They have fixed transaction fees based on the amount processed.

Deposits are free in the UK and Europe however, they have a fixed fee of £25 for every other region. Withdrawals cost 1GBP and 1EUR, depending on the currency used. There’s no fee for depositing or withdrawing Bitcoin.

4. Bull Bitcoin is a longstanding Bitcoin-only exchange established in 2013 and appears to be a very simple service to use from the start. There are no frills on the opening page, and every essential information you need to know about the service is displayed right away. You can also use Bull Bitcoin to pay your bills online with Bitcoin.

They are widely appreciated for their efficient customer support and have tiered-based transaction fees starting from 0.5% for $100CAD to $1000CAD, up to 1.25% for amounts transacted over $10,000CAD.

5. Robosats is a peer-to-peer Bitcoin exchange ideal for onboarding new users as it’s easy and quick to use. It requires no KYC since it’s based on pseudonymous avatars that allow customers to trade Bitcoin over the Lightning Network using the TOR browser only.

Users can also easily swap on-chain Bitcoin for Lightning liquidity. Established in early 2022, the non-custodial exchange has a lot of room for improvement, but it is set to provide the prototype of a Bitcoin-only exchange based on privacy and security.

6. Hodl Hodl is another peer-to-peer Bitcoin exchange that also offers peer-to-peer lending services. It’s a non-custodial platform that requires no KYC or AML procedures. The exchange accepts almost all fiat currencies and many payment methods to start trading, including cash in person and bank transfers.

It works simply: a contract is generated, and Hodl Hodl creates a unique multi-sig escrow. The seller deposits Bitcoin directly from his wallet and agrees on a payment method with the buyer. The seller releases Bitcoin from multisig escrow directly to the buyer’s wallet.

7. Paxful is a Bitcoin exchange and digital wallet where customers can also use various digital currencies like Tether, Ethereum, and Monero to buy Bitcoin. Other than the typical bank transfers, Paxful offers a wide range of payment methods, including gift cards and airline tickets.

8. Relai is based in Switzerland and is Europe’s most accessible bitcoin-only investment app. It enables instant Bitcoin purchases through SEPA payment integration, and customers can set up a weekly or monthly savings plan for as little as 10 EUR. Bitcoiners appreciate it because it requires no deposit, registration, or strict KYC procedure. It’s the perfect app for beginners who want to buy and hodl Bitcoin because it’s easy to use and provides a hassle-free experience.

9. Bisq is a decentralized peer-to-peer bitcoin exchange that allows anyone to buy and sell bitcoin in exchange for fiat currencies and other cryptocurrencies. It is not a company but free software that requires no centrally-controlled servers and has no single points of failure.

Bisq does not require personal information or a linked bank account to use the platform, making it the perfect choice for those who want to preserve their privacy.

Cryptocurrency exchanges

Mainstream crypto exchanges provide trading and other services for the myriad of altcoins available in the market. They are not recommended for users who want to have a Bitcoin-only experience and do not want to be distracted by the ‘altcoin casino’ that can allure customers to fall prey to projects of dubious nature.

1. Binance is the largest cryptocurrency exchange in the world in terms of the daily trading volume. Its license to operate in cryptocurrency differs according to the jurisdiction; for example, in the US, it has a more limited operational activity than in other countries.

It allows customers to trade over 350 cryptocurrencies, but customer satisfaction is not very high due to poor customer service and difficulty sometimes in withdrawing funds. It offers 0 trading fees on selected BTC spot trading pairs and better fees when using its native BNB in a trading pair.

2. Coinbase is an easy-to-use cryptocurrency trading and investing platform with over 98 million users and $256 billion in assets. It offers its customers the ability to buy, sell, and exchange Bitcoin and over 100 other cryptocurrencies.

It provides other services like earning crypto through educational programs; however, its fees are pretty high on average compared to other exchanges. It’s often been criticized for its poor customer service and downtime during high usage traffic.

3. Kraken is one of the prominent cryptocurrency exchanges. It offers a versatile platform for individual investors and large trading firms.

Its advanced trading system and tools, including several types of stop-losses, leverage, and margin-based trading, place Kraken among the leaders in cryptocurrency exchanges.

The US-based exchange offers relatively low BTC withdrawal fees and a wide range of educational content.

4. Bitstamp is one of the oldest cryptocurrency exchange platforms, established in 2011 in Luxembourg. It allows trading and exchange between major cryptocurrencies and fiat currencies, and it targets more experienced traders in contrast with Coinbase, which is more geared toward beginners. It offers competitive fees ranging from 0.00% to 0.40% and is especially appreciated for its dedicated in-app customer support.

5. Gemini is a web- and mobile-based cryptocurrency exchange founded in 2014 by brothers Cameron and Tyler Winklevoss. It allows its customers to buy, sell, trade, and securely store Bitcoin and other cryptocurrencies. Its native stablecoin, the Gemini dollar, is tied to the US dollar.

Gemini has an easy-to-use tiered service with different interfaces and fee structures dedicated to beginner retail investors and more experienced traders.

Brokers

Brokers are intermediaries between the crypto markets and investors and facilitate buying and selling of cryptocurrencies like Bitcoin. Many brokers specializing in traditional investments like stocks, bonds, and mutual funds now also offer cryptocurrency trading through their platforms.

These can be desktop-based, app-based, or both. They offer services like copy-trading and a wide range of derivatives like futures, options, and swaps. Investors should always consider factors like broker location, withdrawal and deposit limits, trading fees, and security before choosing a suitable service.

Some cryptocurrency exchanges act as brokers too, by offering services like derivatives and leveraged trading. Here are some of the most popular Bitcoin brokers:

1. FTX is a centralized cryptocurrency exchange (CEX) specializing in derivatives and leveraged products. It is based in the Bahamas and supports the most commonly traded cryptocurrencies. US residents have to use FTX US to buy and sell Bitcoin.

While FTX and FTX US share the same management teams, they have separate capital structures, and the US division has fewer coin and token offerings.

2. eToro offers commission-free cryptocurrency trading; however, it charges a spread markup based on the cryptocurrency being traded.

One of the most popular features offered by eToro is its social trading platform with its CopyTrader service, which allows you to copy the trades of the platform’s top traders.

eToro allows users to also trade traditional investments like stocks and ETFs making it a versatile platform.

3. TradeStation is a US stockbroker founded in 1982 that started offering cryptocurrency services in May 2019 with the launch of the TradeStation Crypto platform. It provides commission-based pricing based on the trader’s account balance and whether the order is marketable. Pricing ranges between 0.05 and 0.03 percent of the trader’s order. Traders can also buy and sell Bitcoin futures through the crypto platform.

4. Webull is a commission-free trading app that includes trading cryptocurrencies other than stocks and ETFs. It requires no deposits, but, like many other brokers, it will charge a spread markup on either side of a trade. The platform provides a great all-around option to diversify a trader’s portfolio easily.

Payment Apps

1. Robinhood is a web- and mobile-based fintech platform that offers no-fee trading.

It is another versatile company that allows users to invest in and trade stocks, ETFs, options, and American depositary receipts (ADRs) other than specific cryptocurrencies based on users’ geographic location. It is very user-friendly; however, it doesn’t allow to transfer crypto assets off the platform, which means investors don’t own their Bitcoin private keys.

2. CashApp is a peer-to-peer payment system that allows users to purchase and sell Bitcoin and stocks. Unlike Robinhood, the platform enables investors to transfer their Bitcoin to their wallet, although withdrawals are limited to $2,000 daily or $5,000 within any seven days. Cash App sets a fee depending on price volatility and market trading volume, which is disclosed at the time of purchase.

3. Paypal launched its crypto service in late 2020, offering customers the ability to buy, hold, and sell Bitcoin and other cryptocurrencies. As of July 2022, the company started allowing users to move their cryptocurrencies to other wallets, as the feature was the most demanded since they began offering crypto services. Users can buy up to $20,000 weekly but no more than $50,000 during any one-year period.

Fees include an estimated 0.5% trading fee that varies depending on market conditions and a tiered transaction fee depending on the amount of Bitcoin purchased, ranging from 0.5% for purchases below $25 and 2.3% for amounts between $25 and $100.

4. Peach is a peer-to-peer mobile app that allows customers to buy and sell Bitcoin. The service is still in beta mode, and there’s a waiting list to join it; however, it is one of the few Bitcoin p2p marketplaces on a mobile application for the European market.

5. Revolut was one of the first European fintech apps to offer cryptocurrency trading, although with a temporary license. In 2022 it won full authorization to provide its cryptocurrency services across Europe and the UK. The app is straightforward to use and supports the trading of cryptocurrencies at competitive exchange rates, having access to the largest liquidity pool in Europe. Its premium customers can also transfer their Bitcoin to their wallets.

6. Venmo is an American peer-to-peer mobile payment service owned by Paypal since 2012. The platform allowed the buying and selling of Bitcoin and other few cryptocurrencies in April 2021 and has a similar fee structure to Paypal, with an estimated 0.5% trading price and a tiered transaction fee ranging from 0.5% for purchases below $25 to 2.3% for trades between $25 and $100.

ATMs

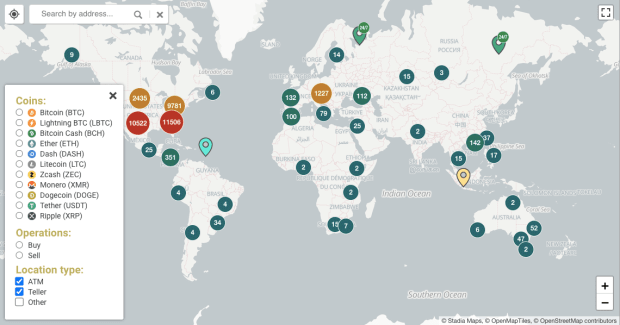

There are currently over 39,000 Bitcoin automated teller machines (ATMs) worldwide, and their number has increased fast since 2017, when only 1,000 were recorded globally.

The largest ATM producer is San Diego (CA) based Genesis Coin, with 15,364 machines installed globally.

ATMs have become an easy, fast and efficient way of buying Bitcoin with a credit/debit card and cash. Most ATMs don’t store users’ KYC information, bank details, or private keys, making it a good choice for those who want to preserve their privacy.

Their major drawback is the high transaction fees which can be as high as 20% (or more), depending on the ATM and the type of transaction being processed. The pricey transactions are mainly due to the high cost of running and maintaining the physical machine.

Read our comprehensive guide to understand how to use a Bitcoin ATM

Source: Coinatmradar.com

Summary

With increasing popularity, Bitcoin is expected to grow its user base and technological potential in the next few years. You might want to be part of this innovative monetary system, and acquiring some of it would be the first step to encouraging and expanding its network.

The key takeaways to getting involved and having a smooth buying experience are the following:

- Plan how much you want to purchase Bitcoin and how regularly you want to buy it;

- Pick a service that is suitable for your geographical location, level of technological skills, transaction fees, security, and privacy;

- Register and place your order with a credit/debit card or a bank transfer;

- Secure your asset in a non-custodial wallet that only gives you access to the private key.