Have you gone down the Bitcoin rabbit hole and now want to upgrade your privacy and security? Here’s how and where to buy BTC with no verification.

Privacy matters, it is a fundamental human right, and once you go down the Bitcoin rabbit hole, you realize how important it is to sacrifice a little convenience for better protection of your wealth and identity.

This article will guide you through the best practices and tools to buy BTC anonymously while developing a case for more privacy and security through documentation of emblematic events and the importance of protecting personal data.

To facilitate the path to more anonymity, we’ve structured this article into three distinct sections:

This guide has a shared focus on privacy and security, as the two go hand in hand. If you are a victim of a KYC info hack, you will rely on your security setup to keep your Bitcoin secure.

Although the advice provided in this article is well researched and well founded. We ask that you take the information contained therein as guidance and not as a directive. Nothing that we can write can ever be a substitute to doing your own research.

Section 1: Why does privacy matter?

With the advent of the internet, our privacy has faced profound challenges since our personal information is often at the mercy of malicious actors. It is our duty, and in our interest, to make sure that we take all available steps to protect our data.

You don’t need to live under an authoritarian government to risk being persecuted, distressed by the tax authority, or suffering wealth confiscation. Know your customer (KYC) and anti-money laundering (AML) regulations transcend the nature of a government when our data is stored in online databases that are constantly exposed to hackers.

Databases have been and will be hacked, allowing organized crime to steal our data. Identity appropriation, credit card cloning, and bank details theft are only a few risks we constantly encounter. Another reason to avoid KYC-compliant platforms is that they could be in a position to have to reveal personal data to authorities in certain circumstances, such as in the case of the Celsius bankruptcy filing.

When you own a unique asset like Bitcoin and expose your data, you risk compromising your wealth, which might mean everything to you and your family. Furthermore, the data can be cross-referenced with other hacked databases (such as Facebook or Linkedin) to create a complete profile of a potential victim (email, name, address, BTC, etc.).

The yet short history of the cryptocurrency industry has uncovered many hacks, even breaching companies’ systems that claimed to be extremely safe.

Then, you should assume that no exchange or platform is secure enough, and take full responsibility for adopting the proper measures to protect your wealth. Nobody else will do it for you if you don’t do it.

Buying Bitcoin anonymously is less frightening and burdensome than you might think, and it’s completely legitimate other than your fundamental right. If you think you’re breaking the law or doing something unethical, you could not be farther away from the truth.

Is Bitcoin anonymous?

No, Bitcoin is not anonymous, but it greatly depends on your use. While Bitcoin represents monetary freedom, it’s also an open ledger, meaning that all transactions verified and added to the blockchain are visible to everyone.

The ledger doesn’t contain any owner’s data, such as a name and address. However, an increasing number of analytics companies are running their own nodes in an effort to capture data such as your IP address. From there, the road to identifying you is short.

Bitcoin therefore is proving very advantageous to law enforcement, which can be a good thing when capturing bad actors or recovering stolen Bitcoin, like in the case of the Bitfinex hackers. However, with the justification that authorities need to tackle money laundering, terrorism, and illicit operations, such a surveillant system may impact the smaller genuine retail investor heavily.

Bitcoin privacy is increasing via upgrades such as Taproot, Taro, and ZK-Snarks. While Bitcoin is becoming more private, the onus remains on individuals to keep their coins safe and private by avoiding KYC and AML procedures.

What are KYC & AML

Know Your Customer or KYC is simply identity verification of a client carried out by a financial institution to comply with government regulations. It may vary depending on the jurisdiction; however, most identification methods are similar across the board, and these include:

- A valid ID card;

- name;

- email address;

- telephone number;

- utility bills to prove a home address.

Traders must accept exchanges’ stricter KYC procedures if they want to transact higher volumes. Such procedures include:

- A user’s photo;

- a selfie holding a piece of paper displaying further information;

- a video where you follow basic instructions to provide a 3d view of your head.

Major crypto exchanges prefer to remain anti-money laundering (AML) compliant as it helps them avoid being liable when a user gets away with committing a crime because they failed to do due diligence.

The information you provide to buy KYC’d Bitcoin may be used in the following ways:

- to trace your transactions and balances through Chainanalysis;

- identify the wallet you engage and transact with;

- monitor how you buy Bitcoin;

- block you from using regulated services like in Canada;

- to confiscate your Bitcoin and make tax claims against you.

KYC is part of a more comprehensive regulatory measure identified as anti-money laundering (AML) to make it more difficult for a criminal or terrorist organization to hide its illicit activities.

However, such regulations defeat the purpose of Bitcoin because they preclude one of the fundamental concepts of cryptocurrency: decentralization.

By providing your data to a centralized entity like an exchange, the pursuit of decentralization and anonymity recedes while the security of your asset is at risk. Even though most cryptocurrency exchanges pledge to provide maximum protection through robust military-style standards, you should never assume they are flawless, and your data may be leaked.

Furthermore, you fall prey to analysis companies that could be in a position to supply your data to third parties and governments.

Is it possible to un-KYC yourself?

Once you submit KYC data, this remains on official record forever and cannot be removed. There are ways to mitigate the impact of such compliance, such as emptying your record by selling your Bitcoin and repurchasing it with no verification to start afresh.

However, this will trigger a taxable event if you sell for a profit unless you live in a Bitcoin-friendly jurisdiction that doesn’t tax crypto holdings. You can also accept that your existing Bitcoin is KYC’d and move on, knowing that in the future, you can buy it in a KYC-free manner.

If you want to sell your Bitcoin and repurchase it anonymously, please keep reading to learn how you can avoid KYC.

Frequently Asked Questions

1. How can I buy Bitcoin without verification?

In-person using cash, decentralized peer-to-peer exchanges, and selected ATMs are all good ways to buy Bitcoin without verification. This guide will help you find the most suitable ways to do it.

2. Can I buy Bitcoin with a debit card with no verification?

Debit Cards are typically an extension of your bank account, which would be fully compliant with KYC. It is possible to add a few extra layers of obfuscation through money transfer services which you can read about below.

Pre-paid or virtual debit cards for online purchases offer softer verification requirements than a typical bank card. However, they are never entirely anonymous since they are reloadable.

3. Can I buy Bitcoin with a credit card with no verification?

Similar to debit cards, soft-KYC pre-paid and virtual credit card options exist. Many payment circuits like Visa and Mastercard offer prepaid credit card payments through automated services like Ezzocard or Blur.

4. Is Bitcoin more traceable than cash?

Yes. Bitcoin is more traceable than cash. Besides appearing in an open ledger available for everyone to see, Bitcoin addresses are “pseudonymous,” meaning they don’t automatically reveal their owner’s identity. If it is used on an exchange that implements KYC, it may be easily linked to a real-world identity depriving privacy.

5. How can Bitcoin be tracked?

Unlike common belief, Bitcoin transactions are highly traceable because they are stored in a public, transparent blockchain, a distributed ledger visible to everyone. Block explorers that track every blockchain transaction are becoming increasingly sophisticated, making Bitcoin addresses, block numbers, and transaction hashes easier to trace.

When coupled with wallet explorers, such tools make it possible to draw connections between addresses and the wallets used to hold Bitcoin.

Section 2: Steps to protect your privacy

Buying Bitcoin anonymously can be challenging, but it’s possible if we buy with cash in person or through a KYC-free ATM. We can also choose KYC-free or soft-KYC exchanges, especially if they support mixers –we’ll go through more on this later.

Unfortunately, the convenience of buying Bitcoin through centralized KYC-compliant exchanges and Fintech comes with a price, and that’s your privacy. However, if you are ready to trade convenience for more privacy, there are ways to go about it, and we’ll go through what they are.

Such methods shouldn’t be intimidating and only require some of your time to dig down some privacy and security steps, from online protection to transaction safety. You won’t need to utilize all the options detailed below, but adopting some of them will go a long way to give you more peace of mind.

It goes without saying that few things in life are unassailable. Any number of the following solutions can be compromised in the future, so best practice would be to understand what each option solves and to combine those that make most sense to keep your identity private.

A guiding principle

If you want to keep your coins private, the first step is to never reveal to people that you own Bitcoin, especially how much you hold, as this will make you a target for malicious actors.

Connecting to the internet

Use a dedicated computer or phone

You should always assume your Bitcoin is at risk online and could be compromised by hackers who could exploit vulnerabilities. You must prevent these vulnerabilities and avoid mixing your general internet use with your Bitcoin wallets and activities.

We always think we are smarter than hackers, but scams, primarily through phishing, get increasingly sophisticated, so it’s better to provide max privacy and security to avoid all chances. A Bitcoin-only dedicated machine is the best way to avoid being tricked into scams using malicious websites and programs.

When choosing your Bitcoin-dedicated machine, it would be helpful to keep the following advice in mind:

- The worst operating system is Windows because its security is notoriously weak and more exposed to keyloggers, viruses, etc.;

- It’s better to use either IOS or Linux as their security standards are better than windows;

- The best OS is TAILS (The Amnesic Incognito Live System), a security-focused Linux distribution of free and open software that connects to the Internet exclusively through the anonymity network Tor.

- Bonus: Encrypt your computer and/or phone with PGP encryption to increase security so that any sensitive information that you may or may not hold on these devices cannot be recovered by anyone without the key that you privately hold.

Web browsers

While Chrome is by far the most popular browser in the world, there are alternative browsers that are more respectful of privacy. In 2020, Mozilla emulated a 2009-2011 study from security expert Dr. Lukasz Olejnik using 52,000 Firefox users. Mozilla’s study confirmed Olejnik’s earlier findings that companies such as Google and Facebook are able to track people based on their browsing histories using a method known as re-identification.

Admittedly, it’s unlikely that this is a risk that will affect too many people. Nevertheless, using an alternative browser to Chrome is a simple solution.

- Tor Browser is a favorite of Edward Snowden. Tor sets the standard for avoiding fingerprinting. It prevents unauthorized snooping with the help of its hidden relay servers and encrypts your traffic three times for three different decentralized nodes.

- Mozilla Firefox is quite secure. It offers a private browsing mode, including pop-up blocking, malware and phishing protection, and tracking. It has also borrowed Tor techniques to block browser fingerprinting.

- Epic is a powerful privacy-centric web browser that uses DuckDuckGo as its default search engine. Its mission is to deliver “extreme privacy” and does so by blocking cookies, ads, and data-tracking web analytics systems. It also doesn’t allow plugins, doesn’t use auto-suggest or spell-checks, or other such enhancements.

- Brave is a free and open-source Chromium-based web browser that claims to be blocking ads, fingerprinting, scripts, and ad trackers by default. However, it has been reported to be misusing affiliate links for profit, besides actually storing your data if you opt for their rewards program. By being rewarded, you are actually selling your data to them.

- Impervious.ai is a newly released Peer-to-Peer web browser that uses Decentralized Identifiers (DIDs) to allow users to cryptographically control their identity and designate how they’d like to exchange data online. They promote encrypted messaging, video calls, and document sharing. It utilizes both peer relays and the Bitcoin Lightning Network to establish real-time, cryptographically-secure data transmission channels.

Bonus tip: Resist the urge to install browser plugins on these browsers, as they invariably reduce your privacy.

Block web trackers

Web tracking websites collect, store and share information about visitors’ online activities. Potentially a web tracker could link two purchases belonging to the same user to the Bitcoin blockchain’s transactions, thereby identifying an entire cluster of addresses and transactions.

Blocking web trackers is possible through the following providers, which are a great way of navigating online more securely and privately.

- uBlock Origin, a free and open-source browser extension for content filtering, including ad-blocking;

- Adblock Plus, a software that blocks and filters ads;

- Ghostery is a free, open-source privacy and security-related browser extension and mobile application.

Use a VPN

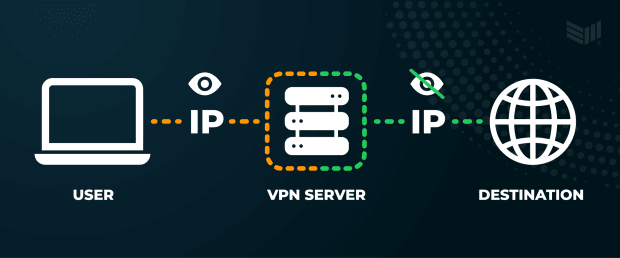

Virtual private networks (VPNs) are services that protect your internet connection and privacy online. They typically create encrypted tunnels for your data, protect your online identity by hiding your IP address, and allow you to use public Wi-Fi hotspots safely.

Some prominent VPN services are NordVPN, Proton, and ExpressVPN. It’s enough to subscribe to their services to enjoy more privacy online. Costs are usually between $3.99 and $6.99 per month.

Use TOR

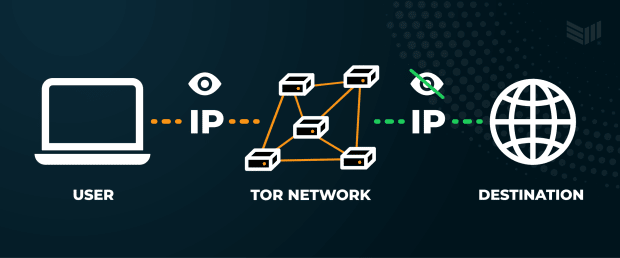

The onion router (TOR) is a globally distributed network of individual volunteer servers used to ensure anonymous communication. Its decentralization makes it difficult to detect its encrypted connections.

The difference with a VPN is their operation method. While TOR encrypts and makes your online traffic private through a decentralized network, VPN encrypts and routes your connection using a network of servers maintained by a centralized entity.

They both enhance your online security and privacy; however, TOR is similar to Bitcoin by not having a single point of failure, while VPN has all the characteristics of a centralized entity. TOR’s decentralization will be more effective if more people run their own TOR node; therefore, besides running your Bitcoin node, it would be beneficial for the system to run your own TOR node too.

Run a full node

Running your own node protects your Bitcoin wallet from disclosing information about your transactions. You might wonder why since your Bitcoin wallet should be private, especially a non-custodial one.

Random public nodes verify your Bitcoin transactions if you don’t run your own node. A random node operator could be a surveillance company that could access your IP address (that can be used to identify you) and all of your Bitcoin wallet balance, exposing it to governments or hackers’ potential interference if it gets leaked.

It then becomes clear why running your own node will protect you from third parties, like block explorers, that could leak your information. As computer scientist Nick Szabo defined them, such “trusted third parties are security holes” that should be removed for more privacy and security by running your own node.

A node run through TOR, a VPN, or both in tandem, attains further enhanced protection. Therefore, using them is highly recommended.

Setting up your own node is relatively simple and beneficial to the overall network robustness.

Here are a few options available to run your own node securely:

- Bitcoin core is the open-source software that connects a user to the Bitcoin peer-to-peer network to download and fully validate blocks and transactions;

- DIY options give you the maximum self-sovereign Bitcoin you could ever have. Running your DIY node can be achieved with a few hundred dollars of hardware and will offer you that ultimate privacy and security you deserve as a Bitcoin enthusiast. Raspiblitz, Start9, Umbrel, and Voltage are a few node providers that you can use for your DIY node;

- Plug n Play any of the node providers listed above, including Nodl, RaspiBlitz, and The Bitcoin Machine, and you’re ready to go. All you have to do is acquire the relevant hardware and plug it in, and it really is that simple. You are only two steps away from your best privacy and security practices.

No matter which method or hardware you choose to run your own node, we can never stress enough how important it is to undertake this process. Verifying your own balance and transactions, other than contributing to the expansion and security of the Bitcoin network, will accrue the sense of freedom and self-sovereign Bitcoin was created for.

Registering on platforms

Avoid services that require you to register with your easily identifiable KYC information, like your name, address, email, and phone number.

Bypass email verification

It is possible to register an anonymous email address, not tied to your personal information and is preferably dedicated to the process of buying Bitcoin only. This will stop you from being exposed to other users, possible phishing emails, and, overall, being recognized.

Services like Protonmail and Tutanota were created to preserve your privacy and security; therefore, you should consider adopting such tools.

Bypass phone verification

Just like for emails, you could obtain a phone number that’s not tied to your identity. The following practices and tools will help you achieve it:

- Buy a burner phone, a cheap mobile phone designed for temporary use, after which it may be dumped. Burners are purchased with prepaid minutes and without a contract.

- Buy an anonymous sim such as one provided by silent.link that you can pay with Bitcoin without any KYC info.

- Use online sim verification services such as Text Verified, and Receive SMS to bypass verification. These services can be useful for one-off purchases and are liable to fail for multiple verifications.

Sending fiat money

Unless you use other cryptocurrencies to buy Bitcoin or exchange it for goods and services, you’ll need fiat money to execute the purchase. Sending money online typically leaves a clear trace of your personal information, including your name and address, the amount transacted, the date and time, and your bank account details.

These details move from your bank account to the exchange or broker you use for the transaction. If this is your preferred method of buying Bitcoin, you can still avoid leaving an irreversible trace, and listed below are some ways to go about it.

Use Prepaid cards

You can circumvent the tracking of your money linked to your data by purchasing pre-paid cards, such as gift cards, that many KYC-free platforms accept.

If you have the chance to buy prepaid cards from your local store in cash instead of your debit/credit card, you’ll reach the ultimate level of anonymity for such a method.

- Prepaid Bitcoin vouchers are a fast-rising way of buying Bitcoin because they are simple and require no KYC. Popular prepaid Bitcoin vouchers are Azteco and 1ForYou. Bitcoinbons is another provider available across 4,000 tobacconists and petrol stations in Austria.

- Prepaid debit cards are usually linked to a bank account and a verifiable individual. However, it’s possible to get prepaid debit cards in some countries that don’t require identifying information. Virtual debit cards are quickly expanding as KYC-free payment methods. Local Bitcoins & Paxful are Bitcoin exchanges that accept prepaid debit cards.

- Prepaid gift cards – Prepaid gift cards can be used to buy Bitcoin on many exchanges. Paxful accepts most of them, including Flexevoucher, Amazon Gift Cards, Steam Wallet Gift Cards, PlayStation Network, and XBOX Gift Cards, to name a few. Hodl Hodl also provides many gift card options, while Robosats accepts Amazon eGift cards. Gift cards would preferably be purchased using cash.

Money transfer services

While most Bitcoin exchanges approve of the same payment methods in most countries, including gift cards and prepaid cards, depending on your jurisdiction, you might have to resort to sending a wire or using one of the following services anonymously:

- With Moneygram, for instance, you can use an email account with a masked name and address and a prepaid or virtual credit card, which are safe ways to avoid revealing your data.

- Paypal Business and Premier accounts allow you to create an account using fictitious personal information to send fast payments. Simply add your recipient’s email address to your list of payees, and you are ready to send money online anonymously.

After purchase

Labeling

Addresses and transactions are inherently connected in the Bitcoin blockchain, making it relatively easy to extract private information. To avoid privacy leaks, coin control and labeling become necessary for more anonymous transactions.

Just like physical coins in your day-to-day fiat cash wallet, when you spend your Bitcoin, you select your wallet’s coins to spend, known as Unspent Transaction Outputs (UTXO).

Assuming your coins get tracked down by observers when you spend or receive them, labeling might come in handy as it will help you decide to whom to send the selected Bitcoin and from whom you receive it.

By recognizing them through labels, you can avoid re-using them by keeping them private from entities or individuals and using new coins so they cannot be tracked down.

Coin Mixing / Joining

In the ‘Run a full node’ section, we mentioned the importance of verifying your own transactions to keep your coins private. If you don’t run your node, your wallet and IP addresses are exposed to the potential surveillance of a random node that could leak your data.

This is where coin mixing and joining come to the rescue. With cash, if user A pays user B with a ten-dollar bill, user B has no idea where that bill came from. With Bitcoin, coins are more easily traceable, a bit like revealing on a bill the names of all previous users and the amounts transacted.

Coin Mixers

Coin mixers are software and service solutions that allow users to mix their coins with others, disguising the ties between their addresses and real-world identity, thereby preserving their privacy.

This concept is straightforward: users send coins to the mixer, and the mixer sends different coins back – usually minus a mixing fee.

When mixers are centralized services, they are inevitably vulnerable and present flaws as being a single point of failure they are exposed to malicious attacks. Trust is another weakness, as the services must be trusted to send the coins back and not steal them from the user.

Mixers must also be trusted to preserve your privacy, as they know exactly which coins were exchanged and could determine the transactions’ trail. The alternative solution to trusting centralized mixers is to use CoinJoin.

CoinJoin

CoinJoin provides anonymity to Bitcoin users when they transact with each other, obscuring the sources and destinations of the BTC used in transactions. This method works by combining several payments from different users into a single big transaction, mixing their UTXO in a pool, thus making it unclear who sent bitcoin to whom.

Bitcoin developer Gregory Maxwell first developed CoinJoin in 2013, and early examples included Dark Wallet, JoinMarket, and SharedCoins. Joinmarket is still a leading project that allows users to create wallets and send coinjoin within the same application.

Early decentralized solutions included Coinmux, Coinjumble, and CoinJoiner; however, none of these were widely used and, therefore, not very helpful since the concept makes sense only when there’s someone to join forces with.

Later efforts include Wasabi Wallet and Whirlpool from Samourai Wallet. Wasabi wallet and hardware wallet Trezor are combining efforts to offer coinjoin for users’ enhanced privacy and plan to offer a coinjoin mixing scheme next year.

PayJoin is an interesting coinjoin protocol that further obfuscates the ownership of UTXO during a coinjoin transaction mixing cycle where both the sender and the receiver coordinate to build a single Bitcoin transaction, thus masking the payment amount. Non-custodial Bitcoin and Lightning wallet Blue Wallet added support for Payjoin at the end of 2020 to further enhance its wallet users’ privacy.

Avoid Block Explorers

Block explorers are software that elaborates data from the blockchain to provide network statistics and allow users to look up specific addresses, transactions, or blocks through a simple search bar. They are also used to obtain more data for block analysis companies like Chainanalysis and can reveal how much Bitcoin you hold and your transaction history.

If you are running your own node, using block explorers is more private than using online versions.

Wallets

After purchase, transfer your Bitcoin to a non-custodial wallet for more privacy. Cold storage, or hardware wallets, are preferred as they operate offline, reducing the risk of malicious attacks.

Wallets are typically anonymous because no KYC procedures are required to open one unless they also function as exchanges. In that case, they might need some form of verification, and you might want to use it for day-to-day transactions while keeping a different one to store your stack more privately and securely. You should also connect your wallet to your own node for extra privacy and security.

HD Wallets are hierarchical deterministic (HD) wallets that prevent you from reusing an address you used in the past to receive bitcoin by generating multiple keys (addresses) from one single private key. Each of those keys can generate its own set of keys and so on to an infinite number of series. It’s advised to take advantage of this feature.

Multi-signature (Multisig) wallets provide extra security by requiring more than one signature (key) to authorize a Bitcoin transaction and dividing up responsibility for the possession of bitcoins. You should always use a multisig with your own node to avoid KYC trade-offs with popular Casa & Unchained Capital apps, for instance.

Seeds are probably the most critical component of your wallet experience as they should always be stored safely, for example, in a well-hidden piece of paper, in encrypted methods, or on a steel plate.

Section 3: Where to buy Bitcoin Anonymously

You now have a few best practices available to enhance your security and privacy when buying Bitcoin, and you can employ them with the following methods for more anonymity. Not all privacy steps are necessary for each of these methods. You can use your judgment and capabilities to adopt at least a few to give you more peace of mind.

Buy locally (in person)

Buying locally and in person used to be more common when the value of Bitcoin was much lower than today, and people took risks associated with trusting the buyer or the seller.

However, if the counterpart is someone you trust reasonably, it’d still represent an excellent way to buy Bitcoin. It’s even better if the transaction is done with cash, as only the other entity would know about the operation, reducing the risk of being tracked down by authorities or malicious actors to near zero.

Buy locally (physical stores)

Besides online, Bitcoin can also be acquired in physical stores, usually a foreign exchange store with a little kiosk with Bitcoin-dedicated buyers and sellers. Many require some form of ID, but that typically depends on the country’s store location.

This is an excellent option to buy Bitcoin with a KYC-free process; however, buyers should be aware of the risk of being physically seen and therefore associated with Bitcoin by criminals.

Here are a few locations around the world where Bitcoin can be bought with no verification required:

- The Bitcoin Store has 3 locations in Croatia – Split, Zagreb & Rijeka– where you can buy 15,000 HRK (approx 2,000 euros/dollars) without using an ID, so long as you are over 18.

- The House of Nakamoto is located in Vienna, Austria. The maximum purchase allowed without ID is €250.

- LibertyX is America’s first and largest network of Bitcoin ATMs, cashiers, and kiosks. Depending on the location, you can buy up to $1,400/week (rolling seven days) with only a phone number.

ATMs / BTMs

Automated teller machines (ATMs) where you can buy bitcoin are also called Bitcoin teller machines (BTMs). ATMs are known for withdrawing fiat currencies from bank accounts. In contrast, BTMs use blockchain to execute transactions that send the cryptocurrency to the user’s wallet through a QR code.

Buying Bitcoin with an ATM is quick and often KYC-free. However, the transaction fees are high, from 8 to 20%, due to the high maintenance costs of the hardware.

There are currently around 39,000 ATMs spread across 79 countries. The USA is where they are primarily distributed; however, they are rising fast everywhere. If you visit Coin ATM Radar, you can find an ATM near you, including the types of KYC requirements.

Crypto exchanges & apps

Exchanges are typically the most convenient and easiest way for people to buy Bitcoin, and they can be either centralized (CEXs) or decentralized (DEXs). Buying Bitcoin on exchanges is convenient, but that convenience often comes with a price, your privacy, and security.

Decentralized (DEX)

Using DEXs is usually recommended to protect your privacy due to their decentralized nature and fewer KYC requirements. Using specific payment methods to receive your funds is still necessary to maintain complete privacy, as sending directly from your KYC’d bank account obviously leaves a transaction trail.

- Bisq is a decentralized peer-to-peer exchange that allows anyone to buy and sell bitcoin in exchange for fiat currencies and other cryptocurrencies. It is free software with no centrally-controlled servers and no single points of failure. It offers different types of payments, including face-to-face and cash, making it an ideal KYC-free solution.

- Robosats is a peer-to-peer Bitcoin non-custodial exchange ideal for onboarding new users as it’s easy and quick to use. It requires no KYC since it’s based on pseudonymous avatars that allow customers to trade Bitcoin over the Lightning Network using the TOR browser only.

- Hodl Hodl is a peer-to-peer Bitcoin non-custodial exchange that offers p2p lending services. It requires no KYC or AML procedures and offers many payment options, including cash in-person, prepaid debit cards, and bank transfers. It works through a multisig escrow where the seller controls one of the keys and agrees to a payment method with the buyer. Once payment is received, the Bitcoin is released and sent to the buyer’s wallet.

- Paxful is a Bitcoin exchange and digital wallet that offers a wide range of payment methods, including gift cards, vouchers, and airline tickets. It usually does not require KYC verification; however, it had to introduce it at the end of 2020 for a select number of countries.

- Peach is a peer-to-peer mobile app only that allows customers to buy and sell Bitcoin using amazon gift cards too. The service is still in beta mode, and there’s a waiting list to join it; however, it is one of the few Bitcoin p2p marketplaces on a mobile application for the European market.

- Local coin swap is a KYC-free peer-to-peer non-custodial exchange that uses escrow protection for users who can buy and sell Bitcoin with several payment methods, including cash in-person, cash by mail, and gift cards for higher anonymity.

- Bitcoin.global is a p2p cryptocurrency exchange that requires no identity verification, no waiting times, and no additional charges, just an email address to get you started.

- Telegram, in April, revived an abandoned blockchain project called Wallet Bot that allowed users to buy Bitcoin. They have recently launched a peer-to-peer cryptocurrency exchange that users can join to send crypto via chat messages, with only a telephone number required for verification.

You can visit a complete list of p2p decentralized exchanges that require very little or no KYC on GitHub.

Centralized (CEX)

When you purchase Bitcoin on a centralized exchange, you expose your data to leaks and hacks and may be at risk. Not only is your online identity at risk, but your physical self is also challenged.

Depending on your jurisdiction, CEXs might still be an option to buy Bitcoin with little verification if they can resist strict KYC regulations. However, due to their nature, they might not be able to ensure soft- or no-KYC forever.

- Relai is based in Switzerland and is Europe’s most accessible bitcoin-only investment app. It enables instant Bitcoin purchases with no deposit, registration, or strict KYC procedure. The Relai app only provides non-custodial wallets, meaning its customers maintain control of their private keys at all times

- Bybit is a cryptocurrency exchange and a fintech platform that offers a p2p version that accepts over 300 payment methods, including cash in-person. It requires soft KYC procedures based on trading and withdrawal levels. Users can withdraw up to 2BTC with no verification required.

- Damecoins is a cryptocurrency exchange where users can buy Bitcoin with no verification and ID needed up to $50,000 transacted, except an email address to receive confirmation of purchases and account information. They also accept gift cards and bank transfers for transactions over $10,000 upon request.

Earn Bitcoin as income

The growing Bitcoin industry offers many opportunities to those who want to get a job that pays in BTC. You’ll still need to apply the security and privacy measures highlighted in this guide to receive Bitcoin anonymously. However, if you combine getting paid in BTC with moving to a crypto-friendly jurisdiction, you might be able to earn Bitcoin tax-free too.

Become a solo miner

Another way to acquire Bitcoin with no KYC is to start solo mining or mining at home. You can read about this subject in our extensive guides on Bitcoin mining and how to mine Bitcoin at home.

Operate a Lightning node

You can stack sats anonymously operating a Lightning node by charging fees to process transactions through your Lightning channels. Running a lightning node won’t earn you much Bitcoin at this point in time, but it would still be an excellent way to gain small amounts of BTC while saving on payment fees and helping secure and grow the network.

SUMMARY

Despite its reputation, Bitcoin is not entirely anonymous. Authorities want you to believe that it is a safe haven for criminals, money launderers, terrorists, and tax evaders; however, the reality is that it’s much more traceable than cash and digital payments due to its immutable and transparent open ledger.

It’s more convenient and cheaper to reveal your identity to buy Bitcoin; however, you should consider the trade-offs because more privacy might stop you from making costly mistakes in the long term.

Privacy takes work. But it’s worth it.