Following three consecutive sessions of declines, BTC was fast approaching its support level of $40,000 on Friday, as markets prepared for February’s nonfarm payrolls report. This came as ETH also fell lower, and is approaching its own floor of $2,500 in the process.

Bitcoin

BTC bulls have been few and far between over the last few days, as the world’s largest cryptocurrency faced growing pressure from bears.

This pressure came following Tuesday’s climb to the resistance level of $45,000, which then triggered an onslaught of short sellers, who entered the market.

As of writing, BTC is down almost 6% on the day, and is currently trading at $40,845.52, with the 14-day RSI tracking at 49.5.

Looking at the chart, BTC now appears to be heading for support, which is located at $40,056, with the RSI heading for its own floor at 47.

The mid-term moving average of 25-days (blue) also seems to have once again changed course, with momentum now shifting downwards.

As of now, this bearish pressure seems as though it will inevitably take prices to the floor. However, once there, market uncertainty could potentially kick in.

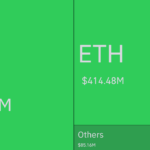

Ethereum

Similar to bitcoin, ETH is also down for a third straight day, with the price of the world’s second-largest crypto down 7% as of writing.

Earlier in today’s session, ETH/USD hit intraday high of $2,891.03, however these gains were short lived, and ethereum is now trading at $2,702.07.

This is marginally higher than today’s low of $2,680.50, however as Friday’s session matures, many expect further drops in price.

The floor of $2,550 seems to be the target of bears, which have been firmly present since prices were trading at the $3,000 resistance point.

Price strength has now also moved into oversold territory, with the 14-day RSI tracking at 44.8. From the looks of it, though, the 39 level could be a realistic floor.

Could we see prices fall further heading into the weekend? Leave your thoughts in the comments below.