Read in the Digest:

- Popularity of crypto-related apps skyrockets after the Super Bowl.

- Cardano’s TVL gains 1,000%, Cardano ETP debuts on Frankfurt exchange, double hacker rewards for spotting vulnerabilities.

- Ethereum receives $21 million from institutional investors to end 9-week outflows.

- BlockFi to pay $100 million to the SEC for offering unregistered securities.

Popularity of Crypto-Related Apps Skyrockets After the Super Bowl

The Super Bowl undoubtedly ranks as one of the most watched sporting events globally, with over 96 million viewers worldwide tuning in for the big game. Taking advantage of the Super Bowl LVI frenzy, some of the biggest names in cryptocurrency booked ad slots to run during the commercial breaks.

The Los Angeles Rams were not the only winners of 2022’s edition as crypto-related apps recorded quantum-scale leaps in their popularity on app stores.

Coinbase, which ran a 60 seconds advert, leaped from 186th place to 2nd in terms of downloads in the App Store, and ranks number 1 among finance apps.

Crypto.com, which also released an advert, is now the 13th most popular app in the finance category. FTX similarly jumped to 31st in the finance categor, while eToro has also moved significantly up the rankings, placing as the 69th most popular app, just behind Binance.

Flipsider:

- The world’s largest crypto exchange, Binance, chose to take a different route, warning the crypto-curious to be wary when investing investing because because of celebrities.

Why You Should Care

Crypto brands took to the Super Bowl to advertise themselves on one of the world’s biggest stages in a bid to increase the popularity and adoption of crypto assets.

Cardano’s TVL Gains 1,000%, Cardano ETP Debuts on Frankfurt Exchange; Double Hacker Rewards for Spotting Vulnerabilities

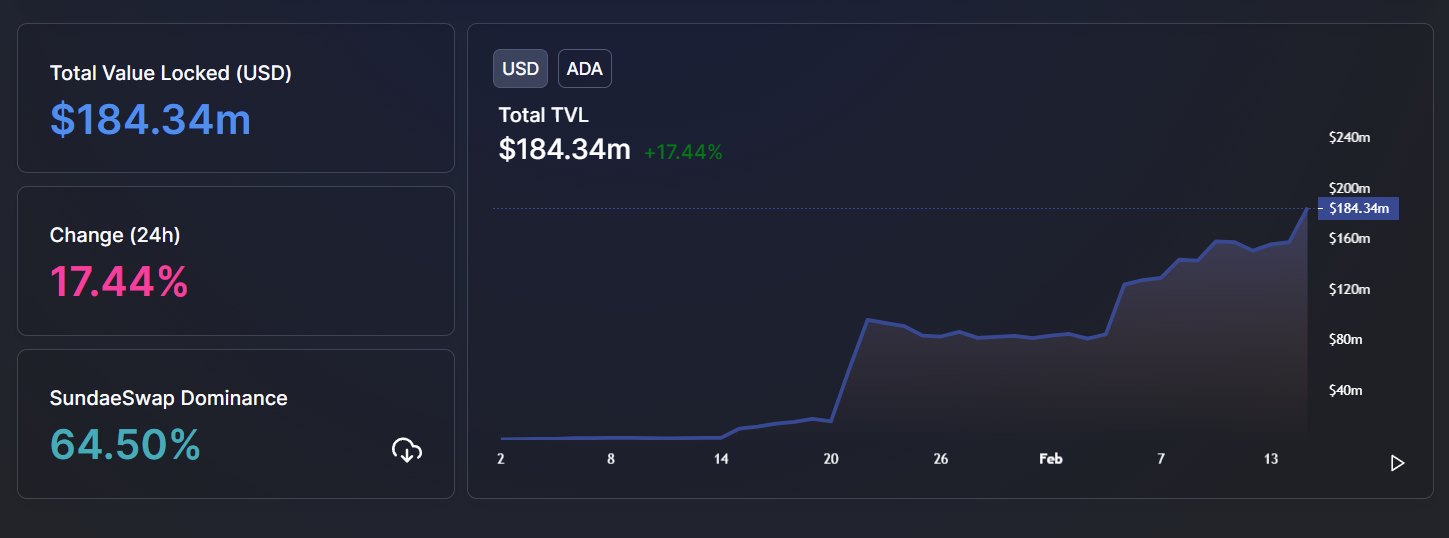

Following the implementation of smart contracts to the Cardano ecosystem through the Alonzo Hardfork, Cardano’s DeFi segment has steadily grown. Over the last 30 days, the total value locked (TVL) in Cardano’s chain has grown by 1,070%.

The Total Value Locked in the Cardano Chain. Source: DefiLlama

Having gained 17.4% over the last 24 hours, the TVL in Cardano now stands at $184.34 million as of this writing, making it the 27th biggest DeFi chain today. As its DeFi ecosystem grows, Valour, a subsidiary of DeFi Technologies, has introduced a Cardano exchange-traded product.

Valour launched the Cardano ETP alongside a Polkadot ETP on the Frankfurt stock exchange. With the ETPs, retail and institutional investors can gain exposure to the native DOT and ADA tokens as easily as buying shares from their bank or broker.

As its network grows, the Cardano Foundation has announced that it will be doubling rewards offered to hackers who unearth vulnerabilities in the network. The project, which will run from February 14th, 2022, to March 25th, 2022, aims to make Cardano more secure.

Flipsider:

- Despite its recent performance, which has pushed Cardano’s ADA up to $1.10, the coin lies far behind its all-time high of $3.10 set in September 2021.

Why You Should Care

The growth of Cardano’s network is backed by the focus the Cardano Foundation has paid toward steadily building and improving its network performance.

Ethereum Receives $21 Million from Institutional Investors to End 9-Week Outflows

Since hitting its peak in November, Ethereum along with the broader crypto market, embarked on a steady downswing. As the price of the Ether fell, institutional investors began withdrawing their funds from the second largest crypto.

The nine-week outflows experienced by Ethereum totaled a loss of $280 million. However, at the climax of this harsh period for Ethereum, investment product inflows from institutional investors have seen a resurgence.

In the week ending February 11th, Ethereum raked in $20.9 million from its total digital asset investment product inflows of $75.3 million. Ethereum’s inflow came in marginally behind Bitcoin, which attracted $25 million.

This represents 28% of the week’s total inflows into crypto investment. The recent inflow brings Ethereum’s total assets under management (AuM) to $13 billion as of the week ending February 11th.

Flipsider:

- While ETH has gained in value by 9% over the last 24 hours, analysts have advised caution as the asset could correct in the wake of the news from the U.S. Fed and Ukraine.

The 24 hour price chart for Ethereum (ETH). Source: Tradingview

Why You Should Care

The resurgence of institutional investors breaks a 2-month long outflow and will surely act as reassurance that investors see merit in the accumulation of Ethereum.

BlockFi to Pay $100 Million to the SEC for Offering Unregistered Securities

As part of the increasing crackdowns on crypto lending services, BlockFi announced on February 14th that it has agreed to pay a $100 million settlement to the U.S. Securities and Exchange Commission and 32 states.

The DeFi protocol, which is backed by American billionaire, entrepreneur, and venture capitalist, Peter Thiel, will pay $50 million to the SEC, and a further $50 million to the regulators of the affected states.

In November 2021, the SEC alleged that BlockFi, a crypto lending service, offered unregistered securities on its interest accounts, through which users could receive yields as high as 9.25% on Bitcoin, Ethereum, and Tether.

Flipsider:

- BlockFi is now looking to register with the SEC to offer a new crypto savings product called BlockFi Yield.

Why You Should Care

The settlement provides clarity for crypto firms operating in the realm of security offerings.