In December 2021, the world’s largest crypto exchange, Binance, announced the introduction of a new Binance Coin (BNB) Auto-Burn protocol to provide more “transparency and predictability” to its community.

The Auto Burn protocol automatically calculates how much BNB should be burnt based on BNB’s average dollar-denominated price during the quarter and the number of blocks produced on the Binance Smart Chain (BSC) in that period.

Although the Auto Burn protocol replaced the normal quarterly BNB burn, there is a second burn mechanism on the BSC, which involves the real-time burning of a percentage of BNB gas fees on the chain.

Auto Burn Used to Destroy

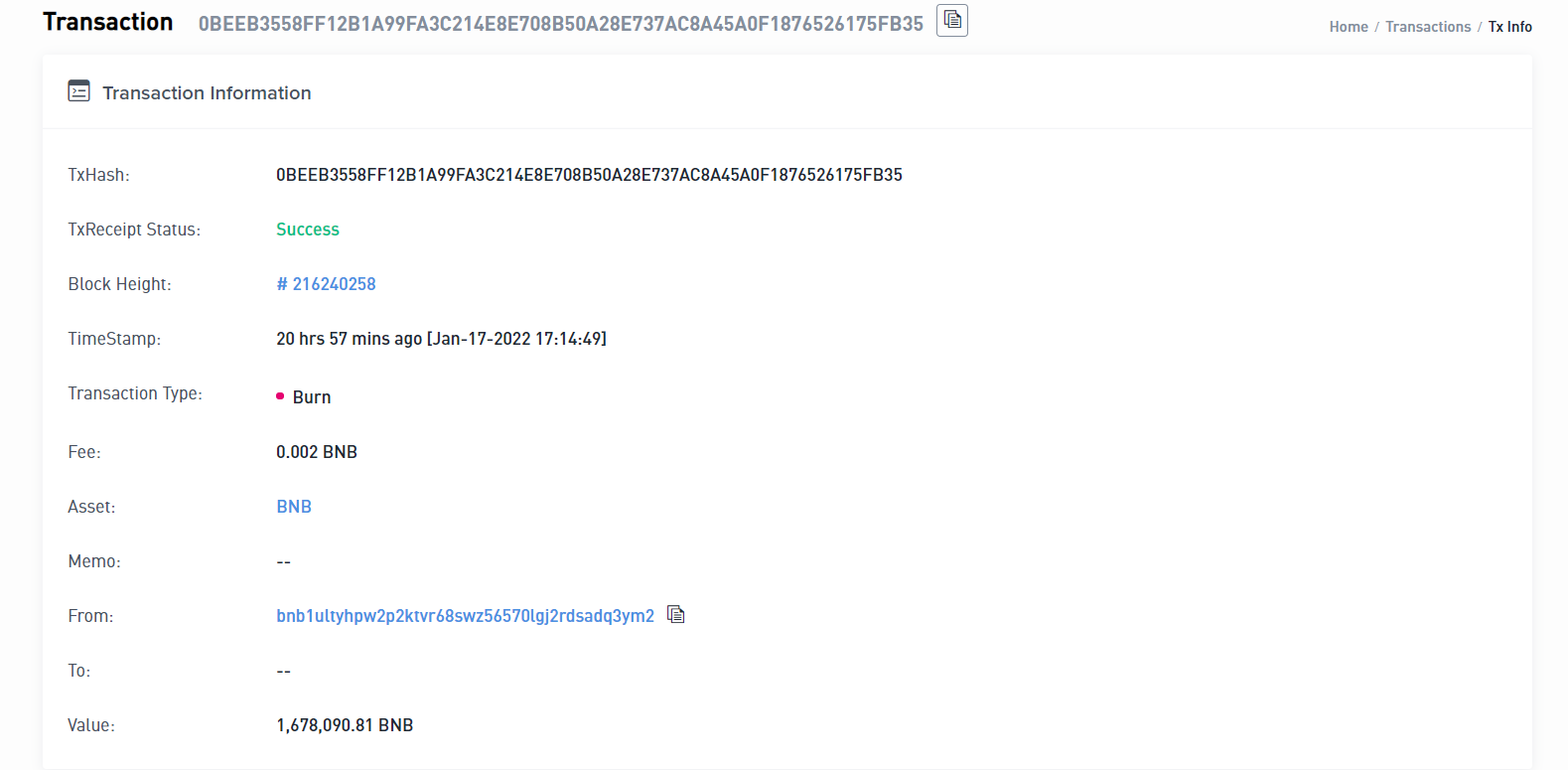

In its first quarterly BNB Auto-Burn (or the 18th quarterly burn), Binance has announced that 1.684 million BNB (worth approximately $792 million) has been removed from circulation. The burn represents an amount equal to 0.84% of Binance’s initial supply.

The 18th BNB Quarterly Burn. Source: Binance Chain Explorer

According to the announcement, 6296.305493 BNB was burned as a part of its Pioneer Burn Program. In addition, Binance has reassured users that 50% of its initial 200 million BNB will be burnt.

On the Flipside

- The effect of deflation has been minimal on the Binance Coin (BNB), which is 32.40% below the all-time high of $690.93.

Why You Should Care

With a fixed supply, token burns aim to make BNB a deflationary asset and could possibly increase the store of value appeal of the Binance Coin.