Much discussion has centered around the implications of decreasing fee revenue for bitcoin miners — why is it happening and what does it mean?

Introduction

Revenue for bitcoin miners from transaction fees is dropping to record lows, and fierce debates over the importance and long-term effects of this data are raging online. Current fee revenue represents barely 1% of total earnings for miners, a significant drop from the height of the latest bullish market cycle when, in February 2021 for example, fees were over 13% of monthly revenue. This data has been the subject of intense disagreement on Twitter as everyone from decentralized finance researchers to Bloomberg journalists to professional cryptocurrency traders weigh in on the doom (or lack thereof) signaled for bitcoin by low fee revenue.

This article provides an overview of the latest data on bitcoin fee revenue and answers the question of whether it matters in the short or long term that fee revenue as a percentage of total earnings is low and dropping.

Current Fee Revenue Data

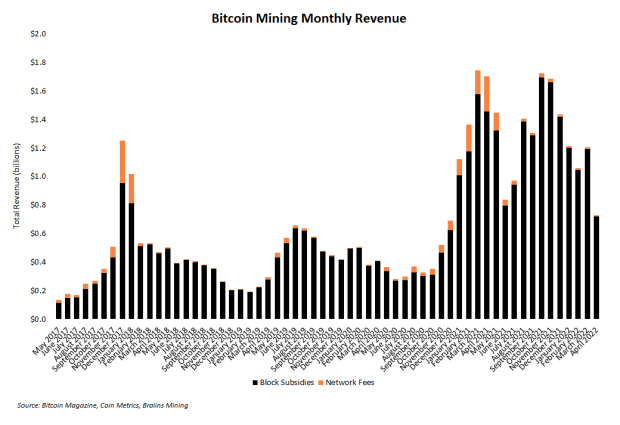

Even though the latest batch of heated debates about the significance of fee revenue have only appeared in the past few weeks, transaction fee revenue for miners has been relatively low for several consecutive months. The line chart below visualizes network fees as a percentage of monthly mining revenue. From early summer 2020 to spring 2021, fee revenue sustained a strong upward growth trajectory. Things quickly changed last summer though around the time China banned bitcoin mining. Fee revenue has yet to recover.

Current fee revenue levels are not unprecedented though. The above chart shows similar levels on a percentage basis throughout the bear market of 2018 and 2019.

And miners aren’t necessarily complaining. Every month since August 2021, their total monthly revenue has surpassed $1 billion, and April 2022 shows no signs of bucking that trend. The bar chart below shows total monthly revenue (subsidies and fees) paid to miners each month for the past five years. Fee revenue is represented in orange on top of each bar, and sizable fluctuations in the dollar amount of fees paid to miners are obvious.

But miners are still making money for securing the network and processing transactions. Sure, mining is getting more competitive as large and small miners alike continue adding more hash rate to the network. However, aggregate mining revenue is still substantial, thanks to the Bitcoin protocol’s mining subsidy, contributing to the already large stashes of coins plenty of miners have stockpiled.

Why Are Fees Down?

The first and most obvious question to ask about bitcoin fee revenue is: Why is it low?

For context, fees represent one of a two-part reward system for miners servicing the Bitcoin network. Fee revenue varies based on network usage, so when fewer people use Bitcoin, miners earn less fee revenue. The other part of mining payouts is the block subsidy, a fixed amount of bitcoin paid every block which is famously halved roughly every four years. Eventually (meaning, a couple centuries from now), the subsidy will drop to essentially zero, which leaves transaction fees as the only source of revenue for miners who secure Bitcoin.

Looking a couple hundred years into the future, the obvious potential problem is if the subsidy is gone and fee revenue is still low, miners don’t get paid and a key part of Bitcoin’s security incentives evaporates. This specific incentive is typically called Bitcoin’s security budget, which represents the total amount of money the network pays miners. Put differently, the security budget is how much every Bitcoin user, in aggregate, pays for mining as a basic service to keep the network running and secure from attacks.

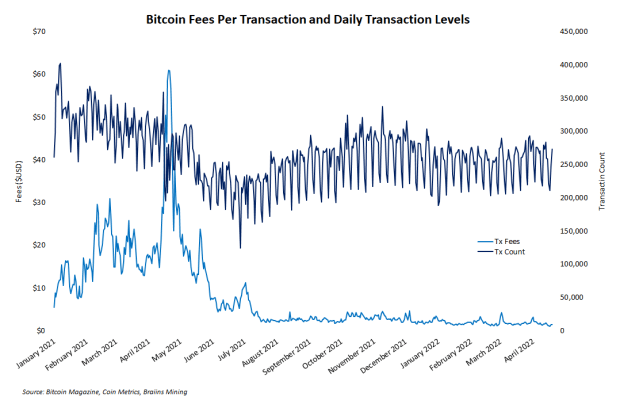

The line chart below visualizes some of the fee revenue data contextualized with daily transaction levels on Bitcoin. The precipitous drop in fee revenue is obvious, and at the same time, transaction levels are flat, at best, following a noticeable dip throughout most of 2021.

The simplest answer, therefore, to the question about why fees are low is because Bitcoin is being used less than it was before. So, why is Bitcoin used less? This question is harder to answer. Reasons for lower present use of Bitcoin range from increased Layer 2 use (e.g., Lightning Network or Liquid) to general boredom as price volatility continues dropping.

Is Low Fee Revenue A Problem?

In the short term, effects of low fee revenue mostly consist of sporadic Twitter drama as critics try to extrapolate today’s fee levels into predictions about Bitcoin’s sustainability decades and centuries from now.

Bitcoin is currently in the middle of only its fourth halving period with a subsidy payout of 6.25 BTC per block. The subsidy will still be above 1 BTC for two more halving periods and above 0.1 BTC for at least 20 more years. Even though regularly monitoring network health is important, alarmism over the current state of fee revenue is premature.

All the available fee data represents an unhelpfully small amount, when considering the future lifespan of the Bitcoin network. Fee revenue is also highly volatile, which makes fee revenue predictions even harder to accurately calculate. At the height of the latest bull market, fee revenue represented roughly 15% of total monthly mining revenue. Today, that level has dropped to barely 1%. Will those large fluctuations continue? No one knows for sure.

In short, current fee revenue gives no reason for panic, but ignoring this important data is also unjustified.

Will Fees Rebound?

The simplest and historically most reliable reason for fee revenue to rebound is another red-hot bullish market. But at a deeper level, the only way fees increase is if demand for Bitcoin block spaces also increases. Fees go up when people want to use Bitcoin. Options for cultivating this demand range from simply expanding adoption and daily use of bitcoin for payments to more controversial and complex efforts like building a decentralized finance ecosystem on the Bitcoin blockchain.

And it’s okay for future fee revenue to be an open question — for now. Nearly all of the doom and gloom broadcasted on social media about low Bitcoin fees is poorly substantiated given the small data set of historical fee revenue available to analysts and the sheer amount of time until the mining subsidy drops so low as to become irrelevant, making fees the only source of mining revenue.

If nothing else, Bitcoin has proven itself to be a reliant piece of technology. For the past decade, fee revenue has gone up and down. What fees will be 100 years from now is, quite simply, a wide-open question.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.