Investing in Bitcoin companies is a viable path for generating BTC and will lead to heavier emphasis on sats flowing back to investors.

In my 2021 end-of-year essay, I shared my path to Bitcoin, the vision for Ten31, and my views about investing in Bitcoin infrastructure. Despite Bitcoin irrefutably being the most secure network with the longest history, the most decentralization, largest “market cap,” and best brand (among other factors) there is very clearly an imbalance in capital disproportionately allocated to “crypto” and underweight in the Bitcoin ecosystem. This creates tremendous asymmetry for investing in Bitcoin companies, which has not yet been appreciated by most and remains one of the most overlooked and best-kept secrets in the industry at present. Following my previous essay, I wanted to share further thoughts on the opportunity I see in investing in Bitcoin infrastructure and how a Bitcoin-oriented world will impact investing going forward.

The Economic Case For Investing In Bitcoin Infrastructure

To see value, you need to think differently …

What is the key to being a great investor? Is sound investment judgment an innate capability, or can you learn it? In my 15 years as a professional investor, I’ve found that investment judgment develops over time. You must have personal honesty and discipline. You must know when you should say “no” and be willing to do it. You should learn not just from the deals you do but also from those you don’t. But above all else, what I have found key to investing well is independent thought. That is, being yourself and challenging the norm, and seeing value where others do not. In my experience this usually comes from one of three sources:

- Getting there first / being early (“unearthing value others have not”)

- Having proprietary information / insights: not just unique information but also unique capabilities to capitalize on the information and insights you have (“the ability to crystallize value others cannot”)

- Thinking differently: having the same data but a different view, or a greater understanding of that information, or seeing value (or risk) in it where others do not (“recognizing value where others do not”)

Ten31’s strategy is to invest in and support great Bitcoin companies, and we have the benefit of all three sources of alpha above. As it stands, most professional investors aren’t yet thinking about investing in Bitcoin companies because the broader market (even those interested in “crypto” or “blockchain”) generally still does not understand bitcoin. That’s what creates the huge upside in the BTC/USD price (which will ultimately be captured as information, and general understanding of bitcoin becomes more distributed), but this pricing upside also often underlies the impulse to only hold the asset and not consider investing in the “picks and shovels” around it. I’ve found the hesitation among bitcoin believers to invest in Bitcoin equities most often stems from (i) a desire to wait until future price gains on bitcoin are realized (in a sense, a future FOMO), (ii) a disbelief that investing in Bitcoin equities can outperform bitcoin, or (iii) risk aversion.

Bitcoin is the safest asset and most pristine collateral on the planet (1 BTC = 1 BTC), so I understand the third group above who may prefer to only hold bitcoin out of risk aversion (every individual should decide their risk tolerance and orient their asset portfolio accordingly). I have less sympathy for the first two perspectives, (i) those waiting for a higher bitcoin price (i.e. future FOMO) and (ii) those who don’t think investing in Bitcoin companies can outperform bitcoin (i.e., Bitcoin equity skeptics), for several reasons.

First, both of these points of view implicitly suggest that an allocation to Bitcoin infrastructure is an “either/or” relative to holding bitcoin. Unless you have 100% exposure to bitcoin and hold no other assets or investments (in which case, well done), those arguments are misplaced, as an investment in Bitcoin infrastructure should be evaluated in context to all other allocations within a portfolio, including traditional markets (public markets, real estate, PE/VC, etc.). The measuring stick shouldn’t strictly be against bitcoin.

My second argument is that investments in Bitcoin companies can in fact outperform bitcoin. If deployed carefully and selectively, successful investments in early-stage Bitcoin companies have 100x-plus return potential over a shorter time frame, unlikely to be matched by bitcoin over the same horizon (even if we all believe the appreciation potential for holding bitcoin remains hugely significant over the longer term). Investments in Bitcoin companies that earn and build bitcoin on their balance sheet (at effectively below market prices) also offer the opportunity to outperform bitcoin (for example, think of a bitcoin miner). As more companies successfully offer products and services desired by holders of bitcoin, these companies will eventually be paid in bitcoin, and bitcoin will accrue to their bottom line and strengthen their balance sheet (indirectly becoming “bitcoin miners” … more on this below). In this way Bitcoin companies can in effect become leveraged plays on bitcoin.

Thirdly, and perhaps just as powerful and very much overlooked, investing in Bitcoin companies can enhance your bitcoin portfolio by offering returns which are disentangled from near-term price swings of bitcoin, balancing out the underlying volatility of the asset. An early-stage Bitcoin company with product market fit and/or customer traction might be achieving significant equity growth over a period when the bitcoin price temporarily stagnates or even declines due to broader market factors. Given the significant secular tailwinds expected over the coming decade as adoption continues, investing in early-stage Bitcoin companies can capture these benefits, regardless of shorter-term bitcoin price volatility. For example, BTC/USD is up roughly 35% over the last six months, 15% over the last 12 months, 350% over the last 18 months, and 400% over the last 24 months. In Ten31’s Low Time Preference Funds, we have investments in Bitcoin companies that have outperformed each of these metrics over the same shorter-term time frames. While in many cases the value of private, illiquid company stock doesn’t move over these shorter periods (updated mark-to-markets are typically done in conjunction with subsequent fundraising activity), the point is that once valuations are updated upon such an event, it can crystallize returns in excess of bitcoin over the same period.

And finally, as I described in my last essay, there is also a flywheel from investing in Bitcoin infrastructure. Investments in the Bitcoin ecosystem strengthen the network, driving increased adoption and value of the asset, which in turn attracts additional capital and supports further investment in infrastructure in a virtuous circle. There are natural synergies from holding bitcoin and investing in the network, and the result is an overall improved risk/return profile versus holding bitcoin on a standalone basis. Therefore, rather than an “either/or” with holding bitcoin and investing in Bitcoin infrastructure, the conclusion is that one should both hold bitcoin AND invest in Bitcoin companies. We were all convinced at one point to own bitcoin, and the next logical step should be to “get off zero” in terms of allocating capital to Bitcoin equities.

Tying back my concepts of independent thought to investing in the Bitcoin ecosystem, I believe Ten31 captures all three sources of alpha previously mentioned:

- We are early: the capital misallocation is significant – most still are not allocating capital to Bitcoin infrastructure

- We have unique insights and capabilities: Ten31’s network and execution capabilities allow us to access investment opportunities other funds cannot (including top-tier VCs and cryptocurrency funds), as well as offer unmatched value to the Bitcoin companies to support their growth and long-term value creation. We bring an institutional background and blue-chip investing pedigree, combined with a deep understanding of bitcoin and a strong team with broad reach, to align ourselves with Bitcoin companies and support the ecosystem over the long term

- We see value where others in the space do not: as above, the rationale for investing in the ecosystem is clear, but not yet appreciated by most:

Investing Under A Bitcoin Standard – A Shift To Sats Flow Investing

As we’ve seen over the last couple of decades under a fiat standard, very often the profile for a venture investment has been to burn cash and pursue growth at all costs, with no need or ambition to consider profitability or cash flow (the profitability dial can theoretically be turned later, or perhaps an exit can be realized before ever reaching profitability). A world of infinite liquidity can prime the pump with fresh capital to rinse and repeat this process over and over again.

As we transition to a more Bitcoin-oriented world, the importance of profitability and sound business models will increase, and there will be a greater emphasis on returns on invested capital (measured in bitcoin terms). That is not to say that venture-backed Bitcoin companies won’t also burn cash initially while experiencing hyper growth; likely most will initially, but the drive to achieve profitability more quickly will be greater and the allocation of scarce capital resources based on those ambitions will be more disciplined than before. That’s because Bitcoin companies are backed by Bitcoiners, and the common goal among every Bitcoiner is to obtain more bitcoin. Under a Bitcoin standard, earning bitcoin today will generally require less work than earning the equivalent amount of bitcoin in the future. Said another way, for the same amount of work you will earn less bitcoin in the future. This will emphasize the opportunity cost of foregoing bitcoin today for the prospect of bitcoin tomorrow (which will be harder to earn). When the objective is to accumulate as much of the 21 million fixed supply as possible, this will become a forcing function on a company’s mindset for evaluating investments in growth. Return on investment (“ROI”)-based analyses will become more common, even in the earlier-stage venture world (e.g., “what is the expected bitcoin yield we could expect in profits from this investment?”).

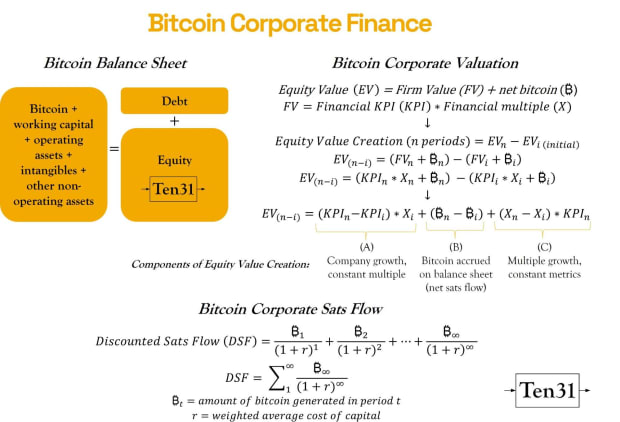

Not only will entrepreneurs start to think in terms of how much bitcoin can be generated from allocation of its resources, but investors will also begin to think more in bitcoin terms when evaluating the risk/return of investment opportunities. Let’s take a look at some simple corporate finance and valuation concepts, applied to bitcoin.

If an investor is making the economic decision of holding bitcoin today versus investing in the equity of a Bitcoin company, the investor should only do this if he/she has conviction the investment will yield more bitcoin, with some premium required based on the risk being taken and the cost of capital (i.e., the investment generates excess returns). Simplistically, an investor could value a business using a multiple-based approach (e.g., revenue- or earnings-based valuation) as a proxy for the bitcoin it can ultimately deliver to shareholders over the longer term. Alternatively, a business could be valued directly based on how much bitcoin it is estimated to produce in the future, discounted by its cost of capital in bitcoin (“discounted sats flow”).

These are familiar concepts to anyone who has taken corporate finance, but under a Bitcoin standard the relative level of importance of the different value drivers may shift. In an inflationary system, holders of assets win. With deflation, holders of money win. Under the simplistic multiple-based valuation approach above, equity value creation is driven by:

- Growth in the company (revenue or earnings, measured in sats) relative to its valuation multiple; plus

- The net additional bitcoin accrued on a company’s balance sheet (net sats flow); plus

- Any change in the valuation multiple of the business relative to its financial performance.

If future financial performance measured in sats (in the diagram above, KPIn) is harder to achieve in bitcoin terms in an absolute sense due to its deflationary nature (i.e., KPIn may grow less, if at all), it follows that the components (A) and (C) of equity value creation will also become more challenging in an absolute sense, and therefore component (B), the ability to generate sats flow, will become more important. Equity value creation, and by consequence investment success, will be more rooted in profitably generating sats.

In turn, this may lead to an increased emphasis on discounted sats flow (DSF) analysis. Following the same logic as above, if the amount of bitcoin earned in the future (₿t) is harder to achieve (and possibly declining over time), then the value of a company’s discounted sats flow will be more heavily weighted towards the present than in the previous paradigm, incentivizing the pursuit of a sound, sustainable and profitable business model more quickly, as compared to the growth-at-all-costs model incentivized by the fiat standard. Another likelihood under this line of thinking is that profitable Bitcoin companies which accrue bitcoin on their balance sheets will benefit from a lower cost of capital than those who don’t, further incentivizing sound business behavior. In calculating a company’s cost of capital, investors using DSF models will likely estimate a risk-free rate in bitcoin using an emerging bitcoin yield curve (see Nik Bhatia’s writing).

Qualitatively, it should seem obvious that Bitcoin will usher in a shift towards sats flow investing. In a fiat world of money printing, cash is not valued; artificially reduced interest rates mathematically favor growth investing, and cash flow investing has taken a back seat as a result. In a bitcoin world, if people start to value the monetary base unit more (sats), people will start to increasingly value the businesses that produce it. Ownership of sound money leads to ownership of sound equities and creation of sound business models.

As one last thought experiment, imagine a company that denominates its income statement in bitcoin, is profitable, and accrues bitcoin on its balance sheet. That sounds a lot like a bitcoin mining company. However, bitcoin mining companies are extremely capital intensive and fiercely competitive (anyone can plug in a miner and compete). In an open monetary network like Bitcoin, it is plausible that certain Bitcoin technology companies could establish early leadership positions in their respective fields with sustainable competitive advantages (sticky business models, technology infrastructure, network effect businesses, brand loyalty, etc.). Those companies would implicitly look a lot like bitcoin miners (generating a consistent stream of sats flows), except with a less capital-intensive business model (no constant replenishment of equipment) and with less competition than bitcoin miners. This is a very compelling financial profile and an underappreciated aspect of investing in the future leaders of the Bitcoin ecosystem, and we are pursuing these types of investments at Ten31. I have provided below a snapshot of the investment areas we are targeting, and we’ll provide more detail about how we view the investable landscape in a future piece.

Conclusions

- Investing in Bitcoin infrastructure is one of the most overlooked and bestkept secrets in the industry today, offering tremendous asymmetry

- An investment in Bitcoin infrastructure should be considered in conjunction with holding bitcoin (an “AND” not an “either/or”)

- As we move closer to a Bitcoin standard, we expect a gravitation towards more sound business models and a re-focus by companies and investors on sats flows

- As the Bitcoin distribution schedule continues to reduce the new supply of bitcoin available to the market over time, one of the most effective ways to earn bitcoin will be to have equity stakes in Bitcoin companies

- Companies with the talent to build bitcoin infrastructure and profitably produce bitcoin will be significantly more valued, and this will be appreciated more by investors over time

- There is going to be a longer-term increase in capital attracted to Bitcoin equities. Owning equity in the leading Bitcoin companies will become the future “scarce real estate.” It might make sense just to get some in case it catches on …

This is a guest post by Grant Gilliam. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.