The Santa Fe Institute has a history of studying complex adaptive systems. Bitcoin has a deep connection to complexity theory and thermodynamic theory.

This is an opinion editorial by Spencer Nichols, a contributor at Bitcoin Magazine.

“Continuous growth and the consequent ever-increasing acceleration of the pace of life have profound consequences for the entire planet… This is surely not sustainable, and, if nothing changes, we are heading for a major crash and a potential collapse of the entire socioeconomic fabric. The challenges are clear: Can we return to an analog of a more ‘ecological’ phase from which we evolved and be satisfied with some version of sublinear scaling and its attendant natural limiting, or no-growth, stable configuration? Is this even possible?” — Geoffrey West, “Scale”

Geoffrey West Ph.D., former president of the renowned Santa Fe Institute (SFI) and founder of the High Energy Physics group at Los Alamos National Lab, recently appeared on “The ‘What is Money?’ Show” (TWIMS), hosted by Robert Breedlove, to talk about his mathematical framework describing how different types of networks, (including biological and social networks), scale their growth over time. West and Breedlove covered the former’s bestselling book “Scale: The Universal Laws Of Growth, Innovation, Sustainability, And The Pace Of Life In Organisms, Cities, Economies And Companies.” In their conversation, they discussed what thermodynamics may teach us about the network structure of those phenomena, and included some discussion of Bitcoin, of course. In his book, West uses the lens of a biological organism’s metabolic rate and applies the concept to understand the metabolic rate of human social networks — namely cities, economies and companies — and their overall temporal sustainability in the context of the limits of thermodynamics and network adaptation. In doing so, he weaves together biology, physics and information science to analyze humanity’s current economic trajectory and what this might imply for our collective future amid the staggering amount of social and technological change we have already begun to witness.

SFI, where West currently serves as an advisor, is a privately funded, interdisciplinary research group spanning the domains of physics, chemistry, ecology, biology, computation and economics. The institute emphasizes the study of complex adaptive systems, or systems with many interrelated components which generate emergent macrosystemic properties inevident when considering each component in isolation.

Theoretical biologist Stuart Kauffman, one of the first SFI resident researchers, defines a complex system as, “A system with many parts and many processes where the parts and the processes can interact with one another, out of that emerges a crystallization of organized parts and processes that then do something useful.”

Examples of complex phenomena include economies, ecosystems and societies as well as the global climate. These types of systems are often addressed with the tools of non-equilibrium thermodynamics. It is essentially the study of non-linear dissipation of heat within complex thermodynamic systems as the network adapts to environmental conditions via feedback mechanisms, known as non-equilibrium systems. A significant pioneer in the field is Ilya Prigogine, who won the Nobel Prize in Chemistry in 1977 for his work on non-equilibrium thermodynamics for developing “a theory about dissipative structures, which maintains that long before a state of equilibrium is reached in irreversible processes, orderly and stable systems can arise from more disordered systems.”

While SFI’s work is grounded in quantitative methods and the hard sciences, it endeavors to synthesize novel perspectives regardless of their seeming disparity. The institute seeks to understand the underlying “shared patterns in complex physical, biological, social, cultural, technological and even possible astrobiological worlds.” The American novelist Cormac McCarthy (“No Country for Old Men”) offers a description of life at SFI:

“Scientific work at SFI is always pushing creativity to its practical limits. We always court a high-risk of failure. Above all, we have more fun than should be legal.

“We are absolutely relentless in hammering down the boundaries created by academic disciplines and by institutional structures. If you know more than anybody else about a subject, we want to talk to you. We don’t care what the subject is.

“We are beyond relentless in seeking out the best people in every discipline. We will get you here no matter what, and we will give you the space and the resources that you need.

“We don’t care how young you are.

“We have in general avoided becoming involved in matters of policy, but if you are working on a program that involves sustainability, or the environment, or human welfare, and you think we have something you could use, pick up the phone.

“The educational opportunities that we offer — especially for young people — are simply not available elsewhere. Period. And lastly, occasionally we find that an invited guest is insane. This generally cheers us all up; we know we are on the right track.”

Some well-known scientists from SFI’s research community include Sean Carroll, Lee Smolin, Sara Walker, Leroy Cronin and current SFI President David Krakauer.

In an equally interdisciplinary pursuit, previous episodes of TWIMS have explored the qualities of money through a lens of Austrian economics and philosophical thought while also taking inspiration from physics and biological evolution. Past guests of the podcast have described Bitcoin as a form of cybernetic life (Michael Saylor), an augmentation of humanity’s psychotechnology (John Vervaeke, assistant professor of cognitive science) and a form of liquid biological fitness (Geoffrey Miller, professor of evolutionary psychology).

West’s scientific journey has taken him from high-energy particle physics to the study of biology and social systems at all scales. Surprisingly, given he studies social phenomena, West remarked that he has yet to develop a deep understanding of Bitcoin and cryptocurrency, more generally. To see SFI faculty engage with Bitcoin, albeit in an introductory manner, is highly significant given the institute’s stature in the fields of complexity science, collective computation and academia in general. West was SFI president from 2005-2009 and was listed among the “100 Most Influential” in the 2006 Time Magazine, so his endorsement of proof-of-work (or not) on TWIMS would provide significant fodder for popular discourse around Bitcoin and its environmental implications. While West did not offer any particular endorsement of Bitcoin, thankfully he did not offer any attributions to Dutch central bank employee Alex de Vries or the (thoroughly debunked) science™ espoused by Greenpeace either.

West detailed his previously held aversion to the study of money and even shared a story of his non-investment in bitcoin despite tips from friends and colleagues who recommended he do so over the years. Notably, despite his somewhat Keynesian, neoliberal economic viewpoint, West appeared open to exploring libertarian economic thinkers, including the likes of Murray Rothbard and Ayn Rand at the suggestion of Breedlove.

SFI has had its share of run-ins with prominent Bitcoiners in its history. Wences Casares delivered a talk at SFI in 2014 titled “Bitcoin is Gold 2.0.” The following year, tech-focused value investor Bill Miller purchased bitcoin at $200, citing SFI’s 2015 symposium. He co-authored “Money and Currency: Past, Present, and Future” with current President David Krakauer, referencing work as an influence in his decision to buy. Incidentally, Miller endowed the institute with a $50 million donation (its largest ever) in November 2018, to further the study of complex adaptive systems.

Miller reported, “My long affiliation with SFI has been among the most rewarding of my life, both personally and professionally.” Miller even referred to his namesake contribution as “the campus that bitcoin built.” Completed in late 2021, the first and only event hosted at the SFI Miller Campus thus far was titled, “The Thermodynamics of Natural and Artificial Distributed Computational Systems,” and its agenda noted a “focus on systems that:

- Are distributed with multiple spatially separated subsystems;

- Are not at thermodynamic equilibrium (and in general, not even in a stationary state);

- Have substantial thermodynamic costs of communication among the subsystems and substantial thermodynamic costs of the information processing within the subsystems.”

If that doesn’t sound like Bitcoin, I don’t know what does…

The agenda also states:

“The thermodynamics of computation is a long-standing interest in the physics, computer science, and biology communities, playing a major role in issues ranging from the design of artificial digital systems to the foundations of physics to theoretical neurobiology. The revolution in non-equilibrium statistical physics of the past two decades, sometimes summarized as ‘stochastic thermodynamics’, has provided a major advance in our ability to investigate this topic.”

SFI launched a new research theme in February 2022, concerning “emergent political economies” with current President David Krakauer noting that “Adam Smith needs to meet Complexity Economics.”

Relating it to the early days of the human genome project, Krakauer said, “The spirit of competition and cooperation between institutions will help us illuminate the elements of a complex system that is far greater than the sum of its parts.”

The implications of Bitcoin as a bottom-up economic system composed of self-organizing agents operating within an open, energy-based value communications protocol seems parsimonious with the study of emergent political economies that SFI appears to be pursuing. This lies in contrast to the top-down, centrally planned fiat system which arguably exhibits a lesser degree of collective intelligence when taking into account the economic calculation problem as it relates to central planning of the monetary system.

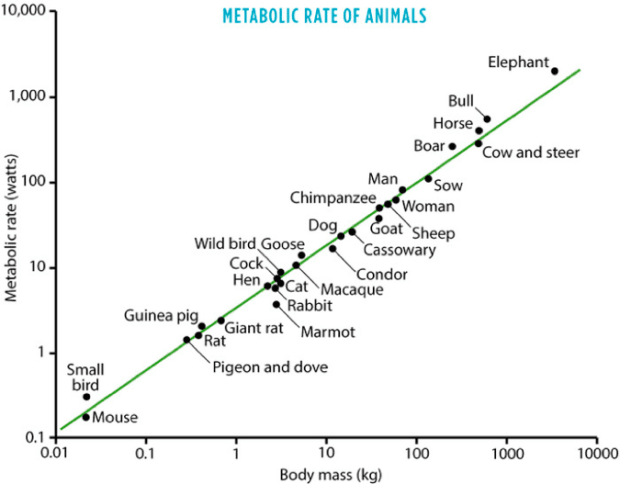

Moving back to West’s appearance on TWIMS, he and Breedlove engaged in a wide-ranging dialogue on the fractal structure of biological networks, connections between Austrian economics and complexity science, as well as what insights from biology and high-energy particle physics might suggest about the network structure of complex adaptive systems generically in the context of thermodynamic sustainability. West addressed these themes as they relate to network power-law scaling. Simply put, power-law scaling observes the relationship between factors as a thermodynamic system changes in scale, with one factor in exponential relationship to the other. What West and his collaborators discovered is that one can generalize a biological system’s implied patterns of growth over time using a quarter-power scaling interpretation (hence power-law scaling), revealing surprisingly regular scaling factors across all manner of diverse biological organisms.

Exemplifying these scaling laws in nature is the observation that on average, as a mammal doubles in weight, its metabolic rate scales with an exponent of three-quarters (^¾). This exponent, being less than one, implies an economy of scale (referred to by West as “sublinear scaling”) of metabolic rate with network size. This efficiency is shown by the fact that larger mammals live longer lives due to the fact they become more metabolically efficient as they scale, using less energy per cell added as they grow. (See: Kleiber’s Law from biology.)

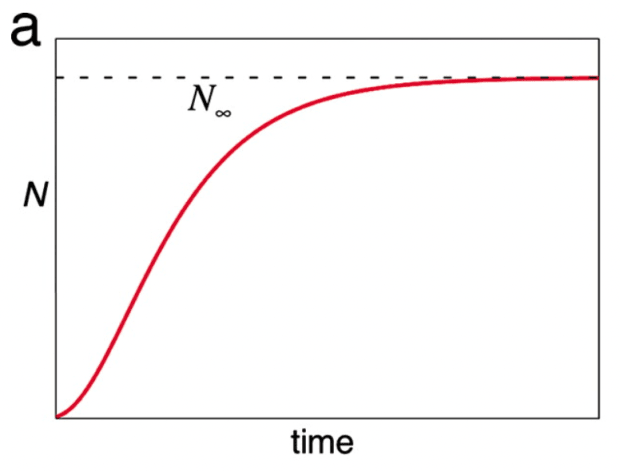

In reality, mammals only grow so large, with growth ultimately leveling off (sigmoidal growth). This implies that growth driven by economies of scale eventually results in the cessation of growth (N) and a stable carrying capacity, shown below by a flattening of the curve in the upper-right. This is why we as humans (on average) do not continue growing in size past a certain point of our development.

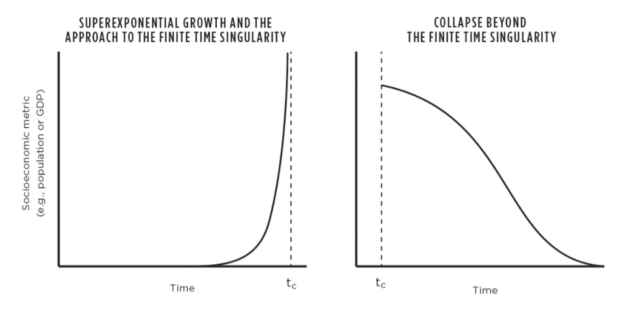

Conversely, in human social networks, per-capita artifacts like gross domestic product, disease, number of patents and the number of social interactions approximately increase with an exponent of around 1.15 (exponent greater than one) as the network doubles in size. This is an example of returns to scale, or “superlinear scaling.”

As an economy doubles in size, its quantity of social phenomena increases (on average) by 115%. This type of superlinear scaling in thermodynamic systems implies a pattern of growth called a “finite time singularity,” whereby as the network grows, social phenomena scale asymptotically, approaching an infinite quantity in a finite time.

According to West, finite time singularities are impossible in thermodynamic systems, and if not somehow avoided, they end in systemic collapse beyond the finite time singularity. West uses these as a model for understanding the growth and behavior of social networks within the context of thermodynamics, and considers what solutions may lie to this seemingly inbuilt structural-functional phenomena affecting our ability to scale society.

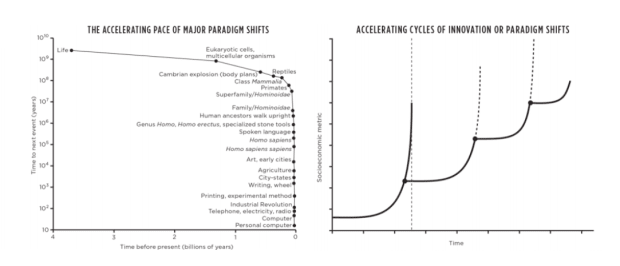

Network collapse under these types of superlinear conditions can only be offset or postponed by increasing innovation or human “adaptation” in the biological sense (shown below) to drive efficiency gains. This “resetting” of the innovation cycle recursively enables growth due to efficiency gain (Jevons Paradox), which then continues to feed the social metabolism of the economy in faster and faster cycles of innovation over time. Conversely, if this asymptotic rate of innovation fails to occur, the network ceases to function and a collapse beyond the finite time singularity ensues. West’s 2008 paper describes the phenomena of increasing pace of technological development in the context of cities:

“To sustain continued growth, major innovations or adaptations must arise at an accelerated rate. Not only does the pace of life increase with city size, but so also must the rate at which new major adaptations and innovations need to be introduced to sustain the city. These predicted successive accelerating cycles of faster than exponential growth [aka growth driven by superlinear scaling] are consistent with observations for the population of cities, waves of technological change, and the world population.”

This phenomena of built-in scaling patterns can help explain why social networks collapse, and while not discussed during West’s TWIMS appearance, I posit the phenomena could use due consideration with regards to the temporal sustainability of currency networks as they relate to thermodynamics and the limits of adaptation.

A fiat, debt-based financial system, which demands open-ended, continuous growth to service compounding interest on debt, appears inherently unsustainable in that open-ended growth of an economy drives super-linear scaling of social metrics. Because the growth of the system is unbounded, and social phenomena scale superlinearly, the monetary network must collapse at some point, due to the network effects of its super-exponential, social-metabolic rate. West writes in “Scale” to describe the seemingly unsustainable “accelerating treadmill” of technological change necessitated by these dynamics:

“Open-ended wealth and knowledge creation require the pace of life to increase with organization size and for individuals and institutions to adapt at a continually accelerating rate to avoid stagnation or potential crises. These conclusions very likely generalize to other social organizations, such as corporations and businesses, potentially explaining why continuous growth necessitates an accelerating treadmill of dynamical cycles of innovation.”

A way of tying together Bitcoin, complexity theory and deep thermodynamic sustainability that I find to be quite compelling is the idea of “monetary entropy” as outlined in an excellent Bitcoin Magazine article by Aaron Segal, titled “Bitcoin Information Theory: B.I.T.” Segal characterizes Bitcoin as the first monetary network suffering from zero terminal inflation of its money supply. In other words, Bitcoin has zero monetary entropy, such that any economic value stored in the network will not degrade from inflation, but rather will accrete value as humanity economizes and increases the creation and distribution of human wealth over time (the natural process of economic deflation). This incentivizes solvency and reflects a truly natural interest rate.

Conversely, fiat currencies incur monetary entropy due to their positive terminal inflation rate (aka increase in the money supply). Monetary entropy requires holders of the currency to perform more and more economic work over time for their capital to maintain its value. This is essentially the “Red Queen” problem in action, in reference to Lewis Carroll’s “Alice in Wonderland”: One must — economically speaking — run faster and faster just to stay in the same place.

From my reading of “Bitcoin Information Theory,” inflation seems to be antithetical to the principles of sustainability in that inflationary currencies necessitate open-ended exponential economic growth within finite temporal and physical constraints. As well, I posit that this embedded, continuous-growth obligation of a debt-based economy drives the system towards a finite time singularity due to super-linear scaling of social phenomena.

As predicted through West’s description of finite time singularities, infinite social quantities are impossible in real-world systems and ultimately cause the system to collapse. In an economic system with open-ended growth baked in, that collapse appears to be at the very least hastened by compounding monetary entropy.

A helpful way to mentally picture finite time singularities is Euler’s Disk. Imagine a spinning coin slowing to a stop. As the coin’s rotation slows, its rate of precession, or re-orientation of its rotational axis, approaches infinity and the coin comes to a standstill on its side. Again, physical systems don’t do well when encountering infinities, and an infinite rate of precession reflects the system coming to a halt in reality, i.e., the system collapses. If you equate precession to network adaptation, we can see why the Bitcoin network appears be an arbitrarily scalable monetary system in that it does not accrue monetary entropy, and thus does not necessitate an infinite rate of network adaptation (or precession, in the case of coin) via open-ended growth to continue functioning. As well, perhaps Bitcoin’s strict tether to thermodynamic work has implications for the rate at which humanity sows the seeds of its necessary growth and adaptation in the future.

In comparison to Bitcoin, agents within the fiat monetary system, an inflationary monetary network, are incentivized to accrue debt and draw forward future productive capital in order to finance present growth. With this, each network participant is reacting to high time-preference economic incentives embedded into their behavior. Inflation essentially induces a form of systemic risk accumulation via monetary leverage, all the while harvesting future economic capital.

This fiat monetary system (what Pierre Rochard calls the “high velocity trash economy”) decreases the value of future cash flows via inflation, whereas I would argue that true sustainability requires the opposite: a relative increase in the value of our collective future as time progresses via the natural deflationary process. This is illustrated by economist Garrett Hardin’s “Tragedy of the Commons” as it relates to pollution of globally shared resource pools like the ocean, fisheries, atmosphere and, in this case, the discount rate (aka the instrument to assess the value of future cash flows). Hardin’s theory seems to apply in the context of currency debasement, with Bitcoin essentially securely privatizing the creation of money, and thus generating incentive to protect the network’s value rather than to defect from cooperation, consequently preventing the accumulation of monetary entropy. By privatizing monetary creation, we avoid race-to-the-bottom dynamics around dilution of the time-value of money, truly a remarkable consideration given how many monetary systems have risen and fallen over the years, setting human progress back for who knows how many generations.

As humanity navigates the transition from a top-down, centrally planned fiat system to a bottom-up, decentralized and self-organizing one (where market actors discover the “natural” discount rate), it would be a boon for some of the world’s top scientists — those who are concerned with topics of entropy, network scaling and the deep aspects of thermodynamic sustainability, like West — to study Bitcoin’s potential higher-order, socio-environmental and technological effects. As well, SFI’s eye for interdisciplinary collaboration seems an excellent match given the Bitcoin rabbit hole’s endless depth and adjacence to the study of information theory, collective computation and distributed intelligence. Amid the aforementioned TWIMS appearance and an emergence of Bitcoin discussion in Santa Fe, public rhetoric and regulation concerning the socio-environmental impacts of proof-of-work consensus continue to ramp up. As such, it seems to be prime time for Geoffrey West and SFI to take the orange pill.

“I think the next century will be the century of complexity.” — Steven Hawking

This is a guest post by Spencer Nichols. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.