This model for valuing bitcoin can help us understand its growth potential by using political, economic, social, technology, legal and environmental factors.

This is an opinion editorial by Vishvas Garg, a Ph.D. in pharmacoeconomics, epidemiology, pharmaceutical policy and outcomes research from the University of New Mexico.

Compared to the total world population of over 7.7 billion people, bitcoin is owned in less than 150 million wallets today. While this does not mean one wallet translates to one person, it is safe to assume that the vast majority of the world population still doesn’t own any bitcoin at this time.

Block and Wakefield Research conducted a survey of 14 countries and reported that education is the key to bitcoin adoption. People with higher levels of knowledge about Bitcoin were found to be more optimistic about its future. Furthermore, lack of knowledge was found to be the top reason for people not buying the asset.

Bitcoin is a revolutionary force, but to significantly grow its rate of adoption, the knowledge and perception of Bitcoin needs to improve. This can be done by establishing an evidence-based value proposition of bitcoin. Having an evidence-based value proposition for bitcoin available can also enable major investments from various institutions: private, public or government.

To help understand the importance of such a value proposition of bitcoin, let’s use the example of a white paper published by Ark Invest and Block (then Square). This paper has shown that bitcoin is key to an abundant, clean energy future, as it could enable deployment of substantially more solar and wind energy capacity. What if we can leverage the findings of this research to understand the acceleration of the transition to renewable energy and assess what quantifiable value bitcoin can deliver for society, consumers, merchants, policymakers and financial institutions?

An evidence-based case can be made with:

- Policymakers: Why bitcoin adoption should be part of the carbon elimination strategy with key stakeholders such as the United Nations Framework Convention on Climate Change.

- Consumers: How owning bitcoin and supporting bitcoin mining are doing their part in the fight against climate change.

- Merchants: How small, medium and large businesses can help fight climate change through bitcoin adoption.

- Society: How the bitcoin-led transition to renewable energy can create a sustainable planet while providing prosperity through creation of new jobs.

- Financial institutions: Why any good ESG-type index should have bitcoin investments as a key criteria for inclusion.

In another instance, as I briefly discussed in my recently published article, I believe bitcoin can deliver high-quality, equitable healthcare in an affordable manner to everyone. In upcoming articles, I will share more details on this proposal.

To further enable the global adoption of bitcoin, a framework is needed that can be used to quantify its value proposition. One state-of-the-art framework to quantify the value of bitcoin that is currently available is Ark Invest’s model. This framework is an excellent approach to calculate the price and performance of bitcoin through the fundamental analysis of its network and adoption. However, as Cathie Wood — who I believe is the Benjamin Graham of the modern era — may kindly agree with me, sometimes price and network adoption may lag the long-term value of any asset. This may be especially true for a generational innovation like bitcoin that involves network effects.

The Ark Invest bitcoin valuation framework is highly complementary to the proposal suggested in this article. One way to understand this concept is to compare the Ark Invest framework to Benjamin Graham’s framework for securities from “The Intelligent Investor.” For one to fully understand the growth potential of Bitcoin, particularly due to its network effects, a comprehensive qualitative and quantitative thinking framework is warranted that can be leveraged to capture the full long-term value proposition of bitcoin.

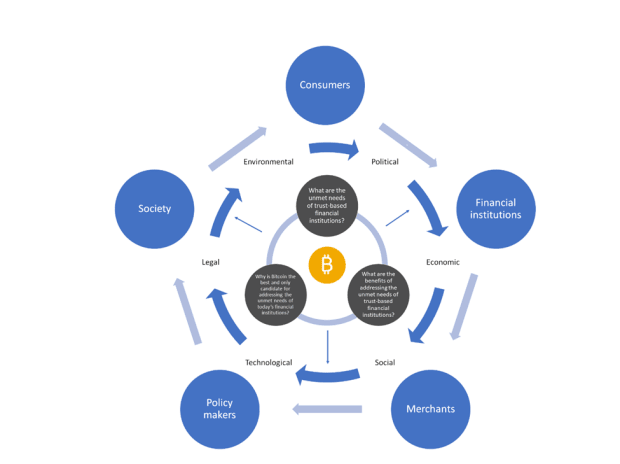

Based on this comprehensive qualitative and quantitative thinking, a framework of three concentric circles that comprehensively captures the full long-term value proposition of bitcoin is proposed below. See the first figure for more information.

The first and the innermost concentric circle is the core of this framework. This core is based on the following three big questions:

- What is the unmet need? This is the purpose of bitcoin.

- What are the benefits of fulfilling the unmet need? This is the benefit of bitcoin.

- Why is Bitcoin the best and only candidate to fulfill the unmet need? This is the potential of bitcoin.

The middle concentric circle is constituted by the PESTLE (political, economic, social, technology, legal and environment) factors from Mike Morrison’s “Strategic Business Diagnostic Tools.” Originally, the PESTLE framework was proposed to understand the impact of external factors on an organization. However, the proposed framework calls for the inverse — to seek the answers to the three questions posed in the innermost circle in the context of the PESTLE factors.

The outermost concentric circle represents the direct and indirect stakeholders that can be impacted by bitcoin adoption or lack thereof. Depending on the stakeholder under assessment, the answers to the three questions posed in the context of the PESTLE factors may differ. For example, in understanding the economic benefits of addressing the unmet needs of today’s trust-based financial institutions, the answer may be different for the society or consumers versus the financial institutions themselves.

I know that Jack Dorsey wouldn’t want me to do this, but given the instrumental impact his ideas had on shaping my own, I would like to kindly propose that this framework be called the “Blockhead Three Circles (BTC) Value Framework.”

How Can This Framework Be Used?

This framework can be leveraged to assess the total long-term net benefit of bitcoin, qualitatively or quantitatively, for all direct and indirect key stakeholders, including consumers, merchants, policymakers, financial institutions and society.

Such assessments will positively impact the knowledge and perception of bitcoin, which in turn, can help drive its adoption globally.

What Are The Next Steps?

There are three major next steps:

- Finalize the structure of the proposed BTC Value Framework: Anyone who would like to give feedback and inputs into this framework is welcome to provide their input directly to my Twitter. I will post a link to this article on my profile upon publication.

- Build an open-source model based on the BTC Value Framework: One way to benefit from the framework proposed in the current article is to build a model based on it that can help generate evidence to support the value of bitcoin adoption. I call upon the fellow Bitcoin community to support the development of this model. This model should be built using the “bitcoin standard” and be freely accessible to anyone in this world.

- Accelerate evidence generation to assess the value of bitcoin: As of today, the research studies evaluating the value of bitcoin are still scarce. Especially if we review the existing literature through the lens of the proposed BTC Value Framework, it becomes clear how major the gaps are in the value proposition of bitcoin. Given this, a long-term, open-source, coordinated effort for the development of bitcoin’s value proposition is warranted. This effort should be as open-source and inclusive as the technical development of bitcoin itself. Such an effort will create a new high bar for scientific research across any discipline.

This is a guest post by Vishvas Garg. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.