In the first week of February, the price of Bitcoin shot up to $45k from its horrific start to the year of $38k. For many investors February was being celebrated as the end of the “crypto winter.“

However, in reaction to macro-economic factors, and the increasing tensions surrounding the Russia-Ukraine crisis, the price of Bitcoin has plunged once more, collapsing through an important support zone.

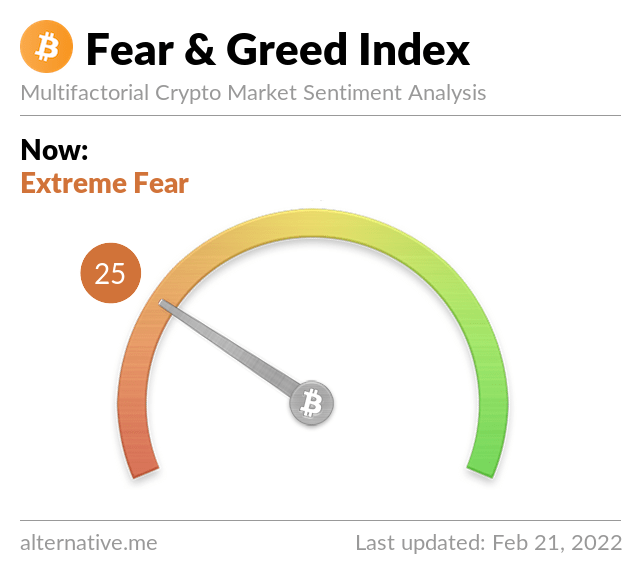

Market in Extreme Fear as Bitcoin Falls to $37,500

Unable to hold on to its $40k support level over the weekend, the world’s largest crypto, Bitcoin, plunged hard, falling to under $38k.

After losing 3% over the last 24 hours, Bitcoin is now trading at $37,500 as of this writing, its lowest point since February 4th. Bitcoin’s market cap is now at $710 billion, despite peaking at above $840 billion on February 9th.

The seven day price chart for Bitcoin (BTC). Source: Tradingview

Bitcoin’s sharp price dip has seen the world’s leading cryptocurrency fall to 25 points on the Bitcoin Fear and Greed Index, its lowest on the scale since February 4th, displaying that the market is currently in the extreme fear territory.

When Bitcoin soared to above $44k, banking giant JP Morgan estimated the “fair value” of Bitcoin at approximately $38,000 per coin. Now, two weeks later, the price of Bitcoin has fallen to precisely that valuation.

On the Flipside

- Ricardo Salinas Pliego, Mexico’s third-richest billionaire, has advised investors to buy Bitcoin now that it is low, and to forget about selling.

Why You Should Care

Vitalik Buterin, the co-founder of Ethereum, explains that the crypto winter could benefit the industry and reduce the number of short-term speculators despite the persisting price drop.