February has brought a breath of fresh air for crypto investors who weathered the storm that was January, Bitcoin’s worst outing since 2018. Over the weekend, the crypto market enjoyed its biggest rally since November 2021.

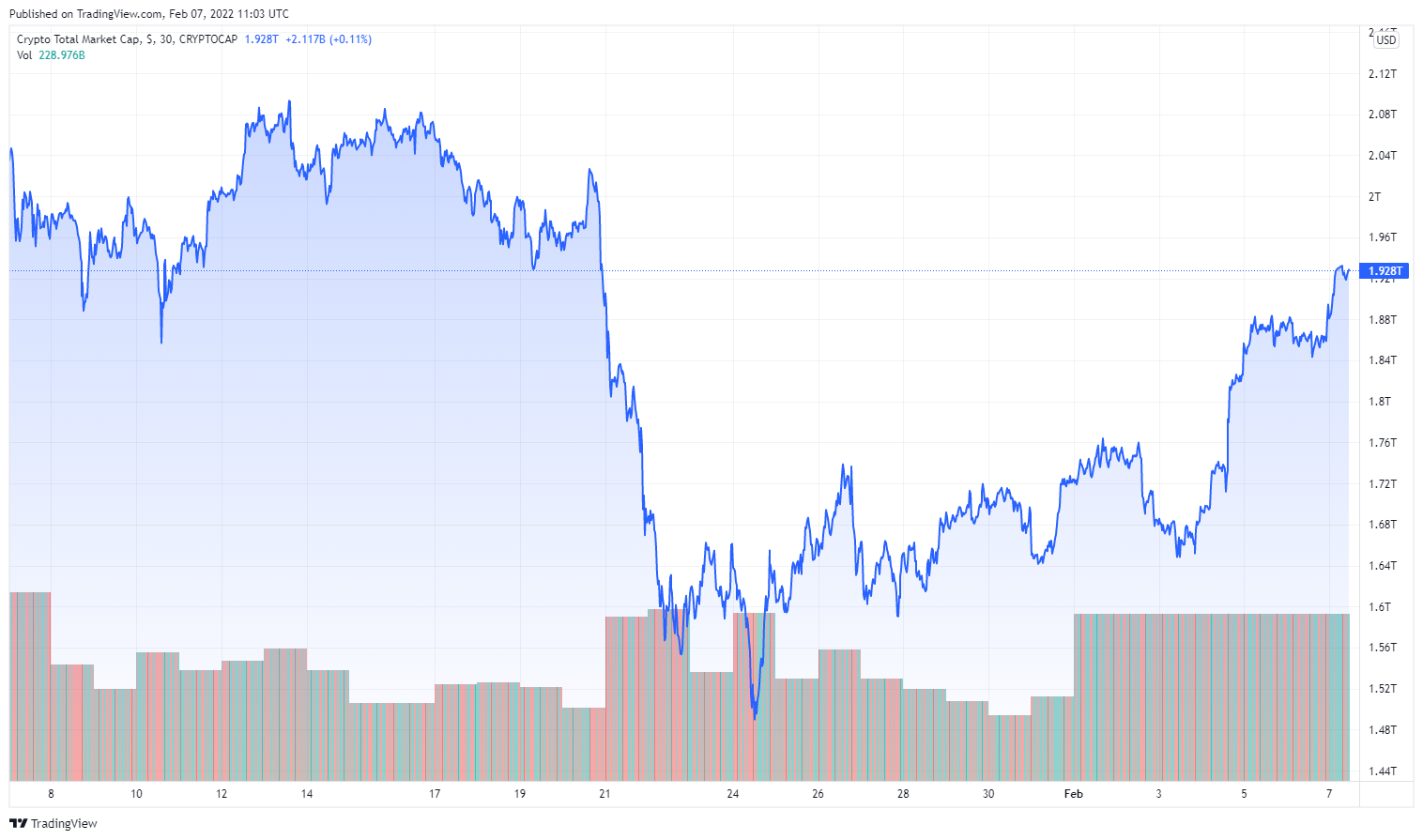

The rally saw the global crypto market cap gain over $200 billion to briefly grace the $2 trillion mark for the first time since January 20th. On Friday morning, the global crypto market was capped at $1.73 trillion, but now holds $1.928 trillion as of this writing.

The one-month chart of the global crypto market. Source: Tradingview

Relief for Bitcoin and Ethereum

Bitcoin led the charge, amassing 15% gains since Friday, February 4th. Bitcoin opened for trade on Friday at $37,149, but is now trading at $42,680, at press time.

The price chart for Bitcoin (BTC) since Friday. Source: Tradingview

The rally also saw Ethereum trade at above the $3,000 mark for the first time in more than two weeks. Opening February 4th valued at $2,681, Ethereum is, at the time of writing, trading at $3,080, having gained more than 15% in value over the last three days.

The three day price chart for Ethereum (ETH). Source: Tradingview

Dogecoin and Shiba Inu (SHIB), Ripple’s XRP Exhibits Massive Comeback

While each of the top 50 Altcoins are trading in the green once more, with the exception of THETA, meme coins remained the stars of the show as the market rallied.

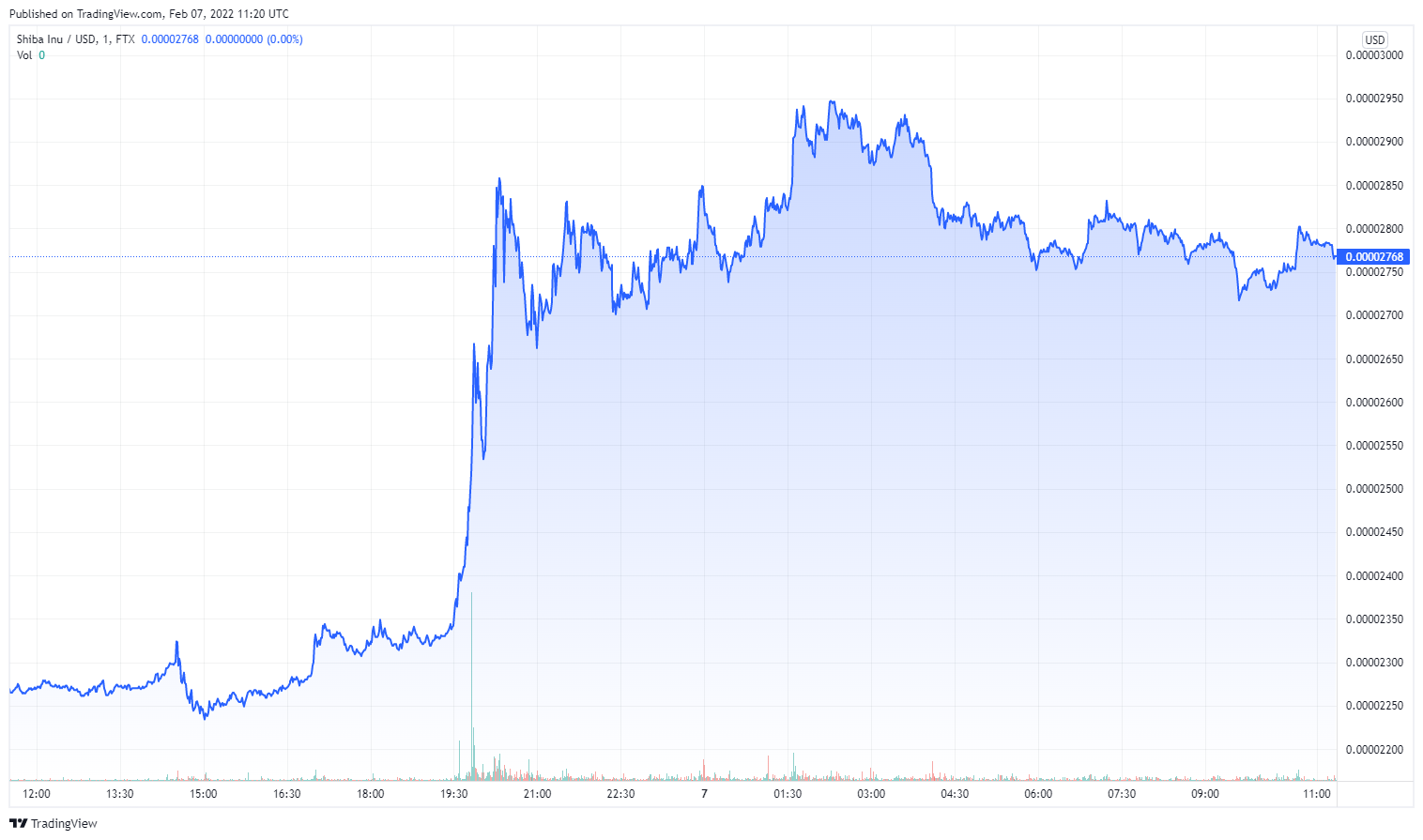

Over the last 24 hours, Shiba Inu (SHIB) has gained in valueby more than 22% to hit $0.00002768, outstripping Dogecoin which gained 7% across the same period.

The 24 hour price chart for Shiba Inu (SHIB). Source: Tradingview

Over the last 24 hours, XRP has gained 15% in value, and is now trading at $0.7655 – its highest price since January 18th.

On the Flipside

- Despite becoming a $2 trillion industry, some traditional traders and pundits still believe that cryptocurrencies are a bubble waiting to burst.

Why You Should Care

This latest crypto rally has been a much-needed breath of life for investors, and has helped the markets move out of extreme fear, and back into the neutral zone on the Fear and Greed Index.