Read in the Digest

- Kazakhstan or the Fed: Which is Behind the Crypto Market Sell-Off?

- Aave Launches Institutional DeFi Pools, Ethereum Could Lose DeFi Dominance – JPMorgan

- NFT Gamers Are Causing a Spike in Polygon Network Gas Fee

- NASCAR Rejects ‘Let’s Go Brandon’ LGBcoin Sponsorship

- Whales Move $176 Million DOGE, Musk Hit 69 Million Followers on Twitter

Kazakhstan or the Fed: Which is Behind the Crypto Market Sell-Off?

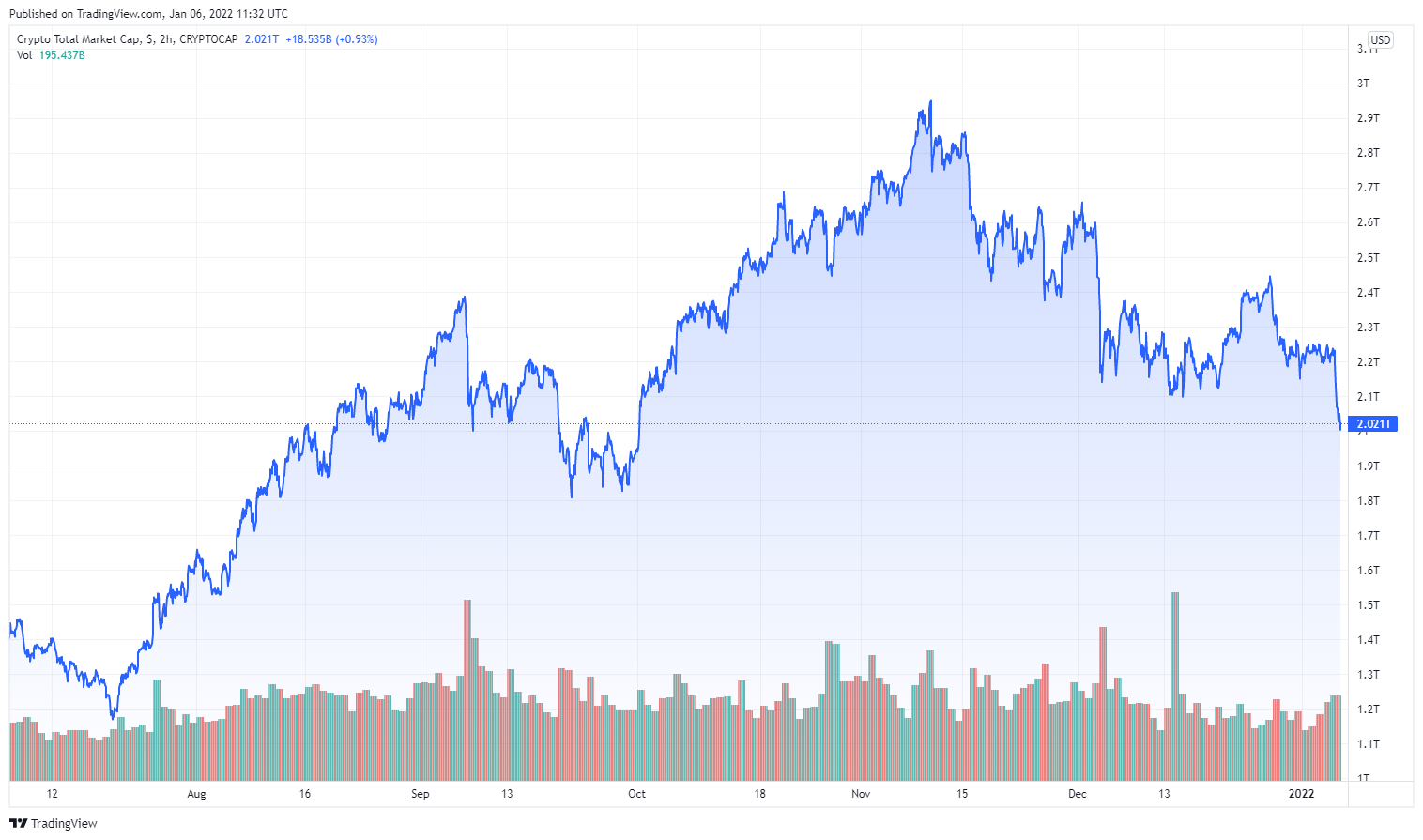

In a repeat of the first week of December, the cryptos have been hit by a major flash crash, with the market shedding more than 12% of its overall value, reaching its lowest point since September 2021.

The total market cap over the last 6 months. Source: TradingView

The slump began with the stock markets after notes from the Federal Reserve’s December FOMC session re-confirmed plans to hike its rates. The impact was soon felt in the crypto market, with Bitcoin slipping under $43k.

Another reason for the drop could be traced to the mining of Bitcoin in Kazakhstan. Following growing protests sparked by fuel costs in Kazakhstan, the government cut off the country’s internet access.

As it did, more than 18% of the world’s Bitcoin hashrate disappeared, with some theorizing this to be the cause of Bitcoin’s drop. As of the time of writing, the country currently has more than 100 mining businesses registered.

Flipsider:

- The criticism that Bitcoin cannot become a store of value because of its volatility has once again been raised.

Aave Launches Institutional DeFi Pools, Ethereum Could Lose DeFi Dominance – JPMorgan

As the interest of institutional investors increases in decentralized finance, Aave is looking to welcome them with a permissioned DeFi pool Aave Arc. Aave described Arc as “a DeFi liquidity market designed to be compliant with AML regulations.”

Aave Arc will allow institutional investors to participate in DeFi securely as liquidity providers and borrowers. Working with the asset manager, Fireblocks, Aave Arc will get 30 new institutions participating in the ecosystem from launch.

Flipsider:

- Aave Arc is gaining popularity and dominance as the first chain to support DeFi.

- While Ethereum dominates two-third of the DeFi sector, JPMorgan believes it could lose this dominance

- According to JPMorgan, the late launch of sharding – an essential feature for Ethereum’s improved scalability – could mean the pioneer of DeFi play catchup in an industry with several competitors offering better

Why You Should Care

Aave is pushing for mainstream adoption for decentralized finance, as it looks to accelerate DeFi into a $1 trillion industry.

NFT Gamers Are Causing a Spike in Polygon Network Gas Fee

Ethereum layer-2 scaling solution, Polygon is experiencing a spike in its gas fees – a problem that has long plagued Ethereum. Like with Ethereum, the gas fees have jumped because of network congestion caused by Sunflower Flowers.

Sunflower Flowers is a play-to-earn NFT game that incentivizes gamers to compete fiercely to farm as many token rewards as possible. Launched at the end of December, the game now has over 385,000 players and is the most active dApp on Polygon.

The quick rise of the game has caused Polygon gas fees to jump by more than 16x – from about 30 Gwei to more than 700 Gwei. The surge in gas fees has caused Double Protocol, an NFT rental protocol, to postpone the release of its Alpha Pass.

Flipsider:

- According to security analyst Thomas Kerbl, the incentivized farming game may have attracted a “ton of bots trying to extract value.”

NASCAR Rejects ‘Let’s Go Brandon’ LGBcoin Sponsorship

Crypto involvement in the sports industry was one of the major trends we saw take flight in 2021. On December 30th, LGBcoin.io, a newly created meme coin, announced a sponsorship deal with fast-rising NASCAR driver Brandon Brown.

The partnership was to see Brandon Brown don his livery etched with the logo and wordmark of LGBcoin for all 33 races of the NXS season. However, top officials at NASCAR have rejected the sponsorship deal.

The sponsorship was nixed because of the “Let’s go, Brandon” — a veiled insult to President Biden finding increased popularity among some Republican supporters.

As per a previous meeting, NASCAR clarified that “no form of derogatory and vulgar euphemism would be allowed on any paint scheme or sponsorship.” Brandon’s newly painted Brown-LGBcoin car was scheduled to debut next month.

Flipsider:

- LGBcoin detached itself from any attack on President Biden. The crypto’s website clarifies that it’s “not inherently political.”

Why You Should Care

Brandon’s sponsorship is another example of NASCAR cutting off anything regarded as highly political.

Whales Move $176 Million DOGE, Musk Hit 69 Million Followers on Twitter

Since Elon Musk announced Tesla would accept DOGE, the crypto has seen a rise in whale activities. The recent torrent of whale movement saw over 1 billion DOGE (worth $176 million) moved in the last 24 hours.

According to the whale transaction tracker, DogeWhaleAlert, Robinhood was used in most of the whale transactions. Musk’s praise for Dogecoin was once again displayed as one whale paid $3.12 in fees for a $6,844,529 transaction.

The founder of Tesla and SpaceX, Elon Musk, who has become an integral part of the cryptoverse and the world’s richest man, has hit another milestone. On January 6, the official Twitter account of Elon Musk hit 69 million followers.

Musk, who is an avid supporter of Dogecoin, now has the 14th largest social media following in the world. Musk had previously joked about quitting his job to become a full-time social media influencer – now he has the means.

Flipsider:

- While Dogecoin’s support increases, the value of DOGE wanes – having lost 75% of its value in the last eight months

Why You Should Care

While gaining popularity as a meme coin, Dogecoin continues to prove its worth in transaction processing.