Looking at different metrics can help determine bitcoin’s place in the traditional market cycle and how macroeconomics can impact the bitcoin price.

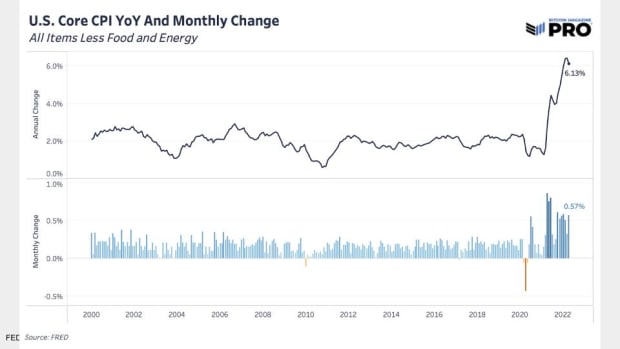

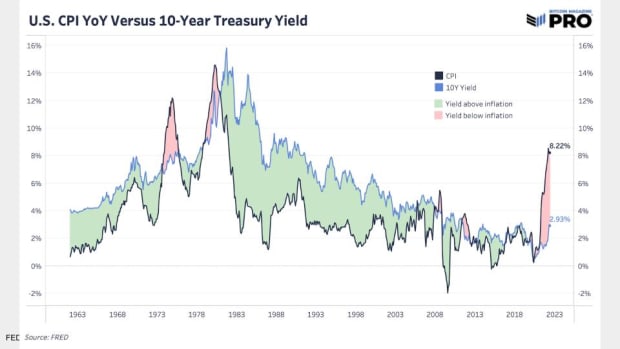

newsletters is they not only look at the bitcoin market but also how macro could be affecting bitcoin. The next two charts are about CPI and interest rates. LeClair does a great job breaking these down during the podcast.

I ask LeClair about his thinking on the Federal Reserve monetary policy, and he focuses his analysis around real interest rates. He says real rates will have to stay negative in order to erode the massive global debt burden. Therefore, if the Fed hikes even to 3.5%, for real rates to stay negative the CPI will have to stay above that.

Next up is CK’s favorite indicator, the Mayer Multiple, or the 200-day moving average price divided by current price. When the price is below the 200-day moving average, this ratio is below 1, and has historically been a good way to time the market.

One of the most dense informational charts on Bitcoin Magazine Pro is up next, and that is Reserve Risk.

“The Reserve Risk chart basically weighs Hodler conviction, whether strong or weak, with price.”

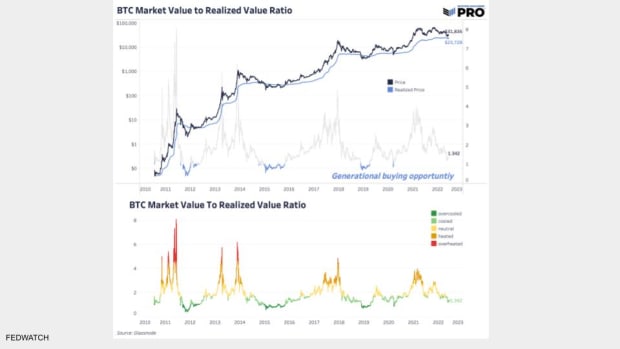

Our last chart for the day is Realized Price, and this is LeClair’s favorite. It is a great way to strip out much of the noise and volatility of the bitcoin price and concentrate on the trend.

“One of the cool things about the transparency of this network is, we can see when every single bitcoin has ever moved, or was ever mined. We can also [assign each UTXO a price of when it last moved] to come with what we call Realized Price. […] We can see when everyone is underwater on average.” – LeClair

Bitcoin Regulation from Senator Lummis

At the end of the show we wrap up with a discussion on the recently proposed draft legislation, by Senator Lummis, that outlines a new framework for bitcoin and what the bill calls “digital assets.” In fact, they don’t use the terms bitcoin, Ethereum, blockchain or even cryptocurrency in the draft at all.

Suffice it to say, we tease out some opinions from LeClair and go back and forth with the livestream crew, but you’ll have to listen to get that whole insightful discussion! We dive into the effects on the bitcoin market, exchanges and a future bitcoin spot ETF!

That does it for this week. Thanks to the readers and listeners. If you enjoy this content please subscribe, review and share!

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.