With indications of inflation appearing on the horizon, how can bitcoin serve as a safeguard against the impact?

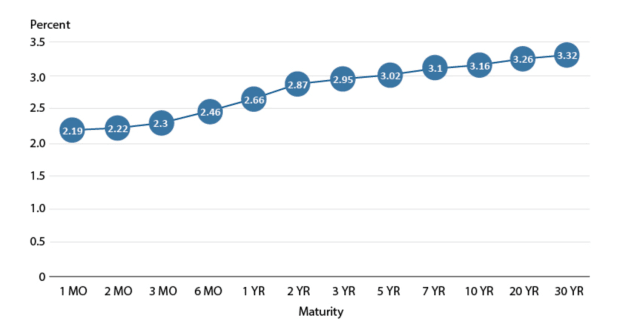

- What is the yield curve?

- What does it mean when it’s inverted?

- What is yield curve control (YCC)?

- And how does the eurodollar fit into all this?

Inspirational Tweet:

To identify the inflation hedge attributes of Bitcoin, it’s simple really. Because Bitcoin is governed by a mathematical formula (not a board of directors, CEO, or founder), the supply of bitcoin is absolutely limited to 21 million total.

Furthermore, with a truly decentralized network (the computers that collectively govern the Bitcoin algorithm, mining, and transaction settlements), settled transactions and total number of bitcoin to be minted will never change. Bitcoin is therefore immutable.

In other words, Bitcoin is safe.

Whether or not the price of bitcoin (BTC) is volatile in the short term does not matter as much as the fact that we know the value of the U.S. dollar continues to decline. And in the long term and in total, as the dollar declines, BTC appreciates. It is therefore a hedge against long-term inflation of not just the U.S. dollar, but any government-issued fiat currency.

The best part? Each single bitcoin is made up of 100 million “pennies” (actually the smallest unit of bitcoin – 0.00000001 btc – is called satoshis, or sats), and one can therefore buy as much or as little they can or want to in a single transaction.

$5 or $500 million: You name it, Bitcoin can handle it.

This is a guest post by James Lavish. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.