According to Ethereum tracking website, UltraSound.money, a total of $1.079 billion of Ethereum (ETH) fees were burned during the month of January. A “fee burn” is an automated “self-destruct” mechanism which permanently removes a percentage of ETH-based fees, which used to be paid to miners as reward for their “Proof of Work” protocol as they validated transactions on the Ethereum blockchain.

The fee burn started August 5, 2021 as a key first step toward upgrading the Ethereum network to a more efficient “Proof of Stake” consensus model, following the activation of EIP-1559. The burn feature is an intentional effort to reduce the overall circulating supply of Ethereum as a way to make that particular coin increasingly valuable, using basic supply and demand principles.

Following the deployment of the first phase of the EIP-1559, a portion of the ETH fees is taken out of circulation for every transaction that occurs on the Ethereum network. While sending and receiving ETH does not usually cost too much in transaction fees – also called gas fees – more time consuming and high-bandwidth tasks such as minting NFTs have much higher gas fees.

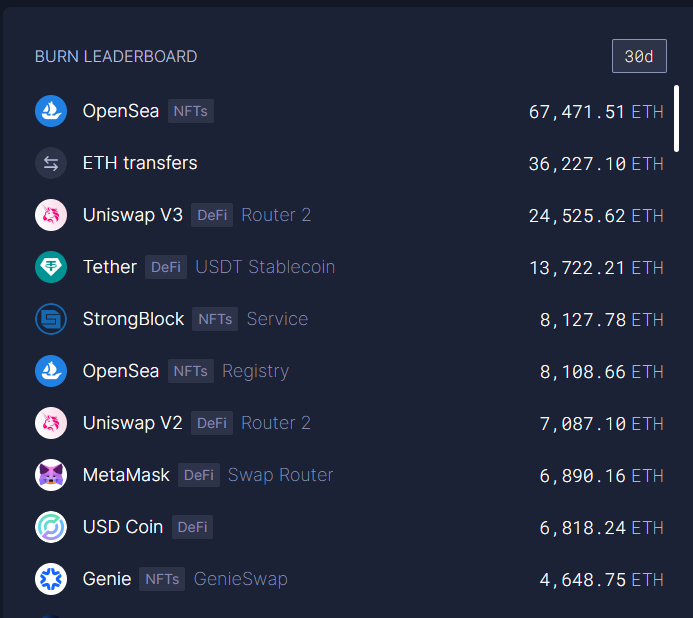

It’s hard to imagine, but the more than $1 billion in burned Ethereum last month was totally comprised of transactional gas fees, which means a lot of transactions took place and the overwhelming majority of those transactions took place on OpenSea. The UltraSound.money dashboard below ranks the top-10 sites that burned Ethereum last month. Top-ranked NFT marketplace OpenSea is setting the pace, burning 67,471 ETH with a value of more than $182.6 million U.S.

The reason why OpenSea burned more than $182 million in Ethereum in January, was because it set an all-time record of NFT sales surpassing $5 billion in revenue last month. Those January sales demolished the prior single-monthly record for OpenSea of $3.4 billion set last August.

For now, Ethereum is still an inflationary blockchain as its current issuance of new coins is 5.4 million ETH per year, which is more than its annual burned amount of 3.5 million coins. However, that will change once Ethereum’s migration to its “Proof of Stake” consensus model is finalized by Q3 of this year. Until then we’ll take every deflationary break we can get.