Bitcoin doesn’t try to change our nature. It works with nature; it’s part of nature. It is the combination of ancient wisdom and scientific knowledge.

This is an opinion editorial by Leon Wankum, one of the first financial economics students to write a thesis about Bitcoin in 2015.

As I walk through the ruins of Machu Picchu, an Incan citadel built in the heights of the Andes Mountains in Peru and dating back to sometime around 1450, I see the magnificent remains of buildings and structures erected by a civilization long gone. To this day, we cannot explain how the Inca built it or what its exact use was. Historians know the Inca used Machu Picchu as a sacred site to house around 700 high priests. A place full of magical mysteries, Machu Picchu is known for its intricate ashlar walls that fuse huge stones together without mortar and for buildings that incorporate astronomical alignments.

Machu Picchu is part of a series of humanity’s greatest achievements, which we do not fully understand how they were built, such as the pyramids in Cairo; the pyramids in Teotihuacán, Mexico; and Coricancha in Cusco, Peru. How were the Inca able to carry and then align large stones up a 2,430-meter mountain, which would be difficult even with the most modern tools?

What we do know is that the Inca lived in harmony with nature. They participated in an agricultural society that used the forces of nature to build cities and sacred sites that still stand today. The philosophy of life in the Andes was based on benefiting from nature without destroying it. According to Juan Carlos Machicado Figueroa in “When the Stones Speak,” samples of this way of life are seen in different archeological sites, from the early cultures to the complexity of Incan society. Generally speaking, scholars are obsessed by the idea of resolving the question of how the Inca managed to construct their buildings and have forgotten to understand why and what thinking was behind these constructions.

We should ask ourselves, “What can we learn from these ancient cultures?” Technology needs to work in harmony with nature and so do we.

Just as the Inca worked in harmony with nature to create magnificent forts and sacred sites, Bitcoin exists in harmony with nature to create sound money from energy. Sound money is money that is not subject to sudden increases or decreases in value, assisted by self-correcting mechanisms inherent in a free market system.

Contrary to popular belief, money is not a product of the state; it is a natural product of our environment. On a metaphysical level, money is energy. We use our time and our energy to make money. So, money is a store of our energy, a store of value. Energy is plentiful and should be accessible to all. Any kind of centralized system — like a central bank trying to manipulate money — creates an imbalance that is not natural.

Traditional centralized banking systems like the Federal Reserve are subject to boards and government institutions controlling the supply and distribution of money. In contrast, bitcoin is entirely produced collectively by the network, at a rate which was defined when the system was created and known to the public, to paraphrase Andreas Antonopoulos in “Mastering Bitcoin.”

Bitcoin is an open monetary system, accessible to everyone.

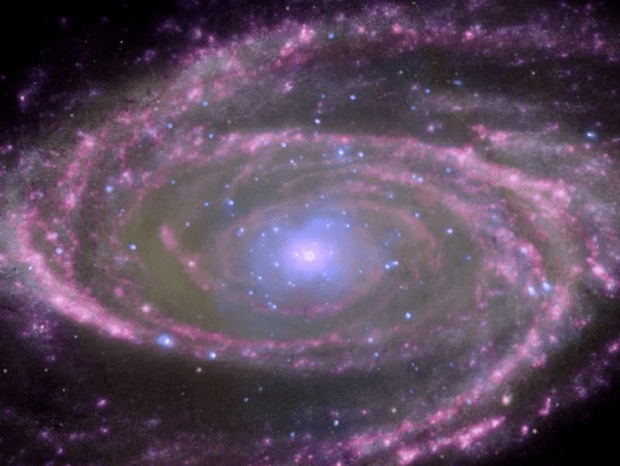

For the Inca, gold was not valuable because of its purchasing power but because of its energy. It was representative of the sun, the life force of the Earth. Like the sun — which serves as the energy source for all life on Earth — Bitcoin serves as an inclusive financial system in which everyone can participate. Bitcoin is the first successful attempt to create digital property that can be sent securely to someone else without the risk of third-party obstruction. Again referencing Antonopoulos, as of today, no one has been able to disturb the mining process or figure out a way to mine bitcoin without using the required Bitcoin software with its internal security and self-reliant value system. It is money backed by mathematical proof.

Despite what the mainstream media tells us, bitcoin using energy for its production process is not bad for the environment; it is a natural process. The fact that mining uses energy makes bitcoin money because money is energy. The law of conservation of energy, also known as the first law of thermodynamics, states that the energy of a closed system must remain constant: It can neither increase nor decrease without external influence. The universe itself is a closed system, so the total amount of energy in existence has always been the same. However, the forms that energy takes are constantly changing. Energy is never wasted; it is used. Like a child eats food in order to grow, humanity uses energy to move forward. Miners use electrons and produce bitcoin. They are literally creating digital gold out of energy.

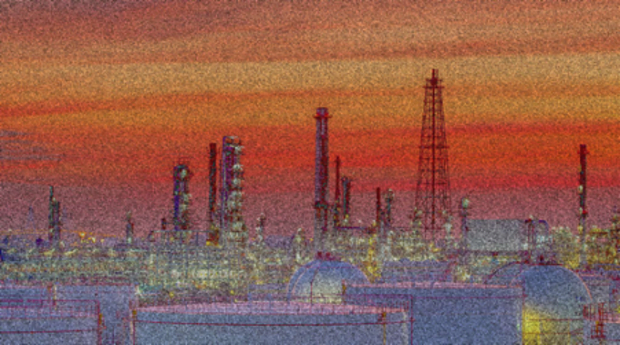

In fact, Bitcoin will enable humanity to use energy more efficiently, make progress, create wealth and foster a healthier relationship with our environment. There are estimates that up to 30% of the energy produced is wasted through losses in generation, transmission and distribution. Bitcoin miners are trying to capture this energy, because they need to find cheap energy in order to lower their cost structure. For example, companies like Great American Mining use excess gas released from oil production to mine bitcoin.

Oil drilling releases gas. Since the drilling takes place far from residential areas, the gas released has no other use than on-site. It is very difficult to store the gas and bring it to residential areas, so most of it gets burned. The burning of gas is called flaring. A gas combustion engine can be used in industrial facilities, such as petroleum refineries or chemical plants. Bitcoin mining is not dependent on residential areas; it can take place anywhere. Great American Mining takes advantage of this by capturing the released gas, which would otherwise be burned and polluted, to mine bitcoin. Showing how mining can solve the so-called energy crisis.

Additionally, a study published by the Bitcoin Mining Council estimates that 58.5% of the global mining sector is powered by renewable energy, as renewable energy is among the cheapest energy sources. This makes their use very attractive for miners, who in turn help to make the use of renewable energy more efficient.

Technology is first adopted by the people who need it most. El Salvador became the first country to adopt bitcoin as legal tender on September 7, 2021. The Central African Republic followed in 2022. Both countries are on continents that have been plundered for their natural resources. War-torn places caught in a vicious cycle of trauma, war and suffering.

The financial institutions created by the international community under U.S. leadership to provide aid to developing countries — such as the International Monetary Fund and the World Bank — have failed. They have enslaved the developing world by putting them in debt, instead of giving them the opportunity to develop further. Creating debt obligations is a soft form of imperialism. It doesn’t help; it makes everything worse.

Those benefiting from the current financial system are trying to fight Bitcoin. The establishment being resistant to change is a recurring phenomenon throughout history. In 1633, the Catholic Church imprisoned Galileo Galilei for fear of losing power for his correct argument that the planets revolve around the sun and that the sun is the center of the universe, not the Earth. The Catholic Church believed that the Bible said that all other planets revolve around the Earth and to defy this belief was considered an act of heresy. Back then, a person could be prosecuted (and even executed) for disobeying religious teachings. Similarly today, governments and central banks are trying to fight Bitcoin because it threatens their position of power. It is not in these institutions’ interest that an open monetary network exists outside of their control, so they demonize it and claim it’s bad for the environment, although the opposite is true.

Since President Richard Nixon announced that the United States would end the convertibility of the U.S. dollar into gold on August 15, 1971, central banks began operating a fiat-money-based system with floating exchange rates and no currency standard. The term “fiat money” comes from Latin and means “let it be done.” Fiat is a type of money that is not backed by a commodity, such as gold, and derives its value entirely from government decrees. It is a debt-based system in which central banks create and lend out fiat money, solely for the promise of the recipient to repay in return.

Any central bank in the developing world that adopts bitcoin has a chance to compete with the world’s most powerful central banks by acquiring bitcoin, a debt-free asset. This challenges the global power dynamic. As a decentralized, open monetary network, Bitcoin enables everyone who uses it to become independent.

Mass adoption of bitcoin will take time. It could take centuries, but it will happen.

As Robert Breedlove points out, Bitcoin is software, software is code and code is information. Information wants to spread. The Bible has survived many empires, so Bitcoin has the potential to outlive any individuals, parties and groups that try to fight it. As long as there is one computer running the Bitcoin protocol, Bitcoin won’t die. We have effectively created this new life form that will outlast us all (and probably humanity).

Bitcoin is hope because it allows everyone in the world to store value, regardless of gender, race, location or age, and it allows people to save for the future. This results in positive second-order effects. The inflationary fiat system that we live in today incentivizes short-term thinking. Money that we earn today will lose value in the future, so we spend it on things we don’t need. We are incentivized to consume constantly, to waste the world’s resources and to make bad decisions because we don’t care about the future. Bitcoin is different. It’s disinflationary. It encourages long-term thinking. As Bitcoiners, we are more aware of the value of our money because it increases in value. Why should I spend my bitcoin on a car today when I can use it to buy a house in the future?

People are taking on more responsibilities and they can see a better future on the horizon because there is a greater sense of freedom due to the qualities of Bitcoin and what it allows. Once you adopt bitcoin, you pursue work that you find meaningful. You establish more meaningful relationships and live a more meaningful life. These second-order effects apply to the individual and humanity as a whole because Bitcoin is an open network that anyone can use.

Can we even imagine a united humanity? Probably not, but Bitcoin makes us dream. Imagine if we could build on each other instead of taking from one another. If one eats, we all eat. When you work, when you make an effort, we all benefit. This is the power of an open network, controlled by no one but open to all. With Bitcoin there is no “us and them,” there is an “I” from which a universal “we” emerges.

Many cryptocurrency companies are trying to capitalize on the human need for harmony with false promises, but these efforts are only made to enrich certain individuals. Bitcoin is here to enrich humanity. It’s about the intention. Alone we can go fast, but together we can go far.

Bitcoin doesn’t try to change our nature. It works with nature; it’s part of nature. It is the combination of ancient wisdom and scientific knowledge. A bridge between old and new — the future.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.